Bitcoin $119K Price Target: In 2025, the cryptocurrency market was highly volatile, and Bitcoin (BTC) exhibited interesting correlations with traditional commodity markets. Recent technical research suggests that Bitcoin’s price path may follow the same trends as past oil rallies, potentially pushing the world’s largest cryptocurrency closer to the significant $119,000 mark. This in-depth study examines the complex relationship between the Bitcoin and crude oil markets, as well as how changes in the energy sector may impact the value of cryptocurrencies.

Bitcoin-Oil Correlation Dynamic

Since Bitcoin gained popularity, the correlation between its price and the price of crude oil has undergone significant changes. Data reveals that there is no continuous correlation between Bitcoin and oil prices over time, and the relationship fluctuates significantly. However, recent market observations indicate that fluctuations in oil prices can have a significant impact on Bitcoin’s price, particularly when the market is highly volatile.

Energy costs are a significant part of Bitcoin mining, as the proof-of-work consensus process requires substantial computing power and electricity. When oil prices rise, energy costs increase in many sectors. This could make Bitcoin mining less profitable and alter the overall market sentiment. The connection between the energy market and the Bitcoin market complicates matters, and technical experts are increasingly using it to inform their Bitcoin Price Analysis predictions.

The correlation coefficient between Bitcoin and WTI crude oil futures has fluctuated over time, exhibiting both positive and negative associations at various points in the market. When the economy is uncertain, both assets have sometimes moved in the same direction, as investors seek alternative places to store their wealth. However, when the market is stable, their correlation tends to decrease significantly.

Technical Analysis: The $119K Price Target

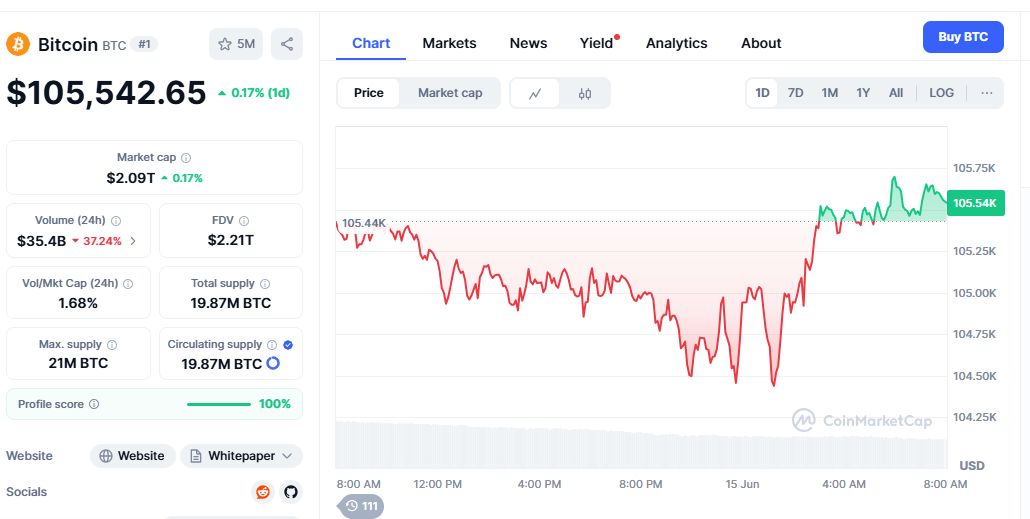

Market researchers have identified specific technical signals indicating that Bitcoin may reach $119,000 if the current surge in oil prices persists. An analysis of historical pricing data, which takes into account prior volatility and market behaviour patterns, suggests that Bitcoin will trade at $118,169 on June 13, 2026.

Several key indicators support this price target. Fibonacci retracement levels, historical support and resistance zones, and moving average convergence divergence patterns all suggest that there is considerable upward momentum potential. The $119,000 level is a key psychological barrier that matches past all-time high predictions and institutional price goals.

Chart pattern analysis indicates that Bitcoin’s current consolidation period resembles patterns that preceded significant oil price rises in traditional commodity markets. The rising triangle pattern, characterised by higher lows and steady resistance levels, indicates that institutional investors and long-term holders are increasing their purchases. This technical setup, combined with favourable market conditions in the oil market, may lead to a significant increase in the price of Bitcoin.

Market Sentiment and Institutional Adoption

The cryptocurrency market has undergone significant changes since major banks, hedge funds, and corporate treasuries began to get involved. MicroStrategy, Tesla, and Square are just a few of the companies that have made significant investments in Bitcoin. This has changed the way prices are discovered.

H.C. Wainwright analysts say that by the end of 2025, Bitcoin will be worth $225,000. This shows that more people believe in Bitcoin’s long-term potential. There are several reasons for this positive mood, including changes in monetary policy, strategies for protecting against inflation, and the growing recognition that more people are viewing BitUSin as a legitimate asset class.

The rules and regulations have also changed for the better, with several nations implementing more explicit guidelines for investing in and trading cryptocurrencies. The US Securities and Exchange Commission’s approval of Bitcoin exchange-traded funds (ETFs) has opened up new avenues for both institutional and retail investors to invest, potentially leading to higher prices and sustained demand.

Oil Prices and Bitcoin Mining Energy Dynamics

Mining for Bitcoin consumes a significant amount of electricity, making energy expenses a crucial factor in determining the profitability of mining. The link between oil prices and electricity generation has indirect, significant effects on the availability of Bitcoin. When oil prices rise, the cost of energy increases for everyone, potentially harming the profit margins of mining companies.

In recent years, the locations of Bitcoin mining operations have undergone significant changes. They have transitioned to alternative energy sources, including renewable energy. This tendency has linked oil prices and the cost of mining Bitcoin less directly; however, there are still significant indirect effects on energy markets. Kazakhstan, Russia, and some U.S. states that produce a lot of oil have become important Bitcoin mining centres. This has led to local connections between the cost of energy and mining activity.

Advanced mining operations are increasingly utilising intelligent energy management techniques, including harnessing energy from renewable sources and using dynamic pricing contracts. These new ideas help mining companies stay profitable when energy prices are high, and they also make the Bitcoin network more secure and decentralised.

Macroeconomic Factors and Global Financial Markets

The broader economic picture has a significant impact on both Bitcoin and oil prices. Central bank monetary policies, particularly those of the Federal Reserve, the European Central Bank, and the Bank of Japan, influence the amount of risk investors are willing to take and how they allocate their assets. When traditional monetary policies raise doubts about the stability of fiat currency, people often seek alternative ways to hold value, such as Bitcoin and commodities like oil.

People are increasingly discussing inflation in the global economy, and Bitcoin is gaining more attention as a potential means of protection against it. The cryptocurrency’s fixed supply cap of 21 million coins makes it deflationary, a distinct characteristic that differs from the fluctuating value of regular fiat currencies. This trait has attracted investors who want to protect themselves from currency devaluation and the loss of purchasing power.

Geopolitical tensions and supply chain issues can simultaneously impact both the Bitcoin and oil markets. International sanctions, trade disputes, and regional conflicts can all destabilise traditional markets. At the same time, they may make people want to use decentralised alternatives like Bitcoin. Bitcoin is gaining popularity as a borderless, censorship-resistant asset, as the global banking industry continues to transition to digital platforms.

Risk Factors and Market Volatility Considerations

Bitcoin might technically reach $119,000, but several risks could prevent this price rise. Uncertainty about regulations remains a significant concern, as government rules regarding the taxation of cryptocurrencies, limitations on trading, and the use of these assets by institutions are frequently changing. Changes in regulations in key markets that occur quickly could have a significant impact on Bitcoin values, potentially leading to a decline.

People are still worried about market manipulation, especially since the bitcoin sector is much smaller than traditional financial markets. Big holders, also known as “whales,” can change the price by placing large buy or sell orders. Numerous Bitcoin addresses hold a significant amount of Bitcoin, which enables individuals to collaborate and potentially manipulate the market.

Bitcoin Eyes $250K price stability remains at risk due to technical issues, possible security breaches, network congestion, and scalability problems. The Bitcoin network has demonstrated remarkable resilience over the years; however, unforeseen technological problems remain a possibility.

Conclusion

Bitcoin might reach $119,000, which would be a big deal. To achieve this, the market would need to be bullish across several key parameters. One way to consider possible price movements is to examine how they relate to oil rally patterns. However, investors should also consider how technical, fundamental, and macroeconomic elements interact to affect cryptocurrency prices.

The combination of institutional adoption, clear regulations, and favourable macroeconomic conditions makes it easier for Bitcoin to maintain its upward value trend. Cryptocurrency markets are very volatile, though, so you need to be very careful with your money and know exactly what causes prices to go up and down.