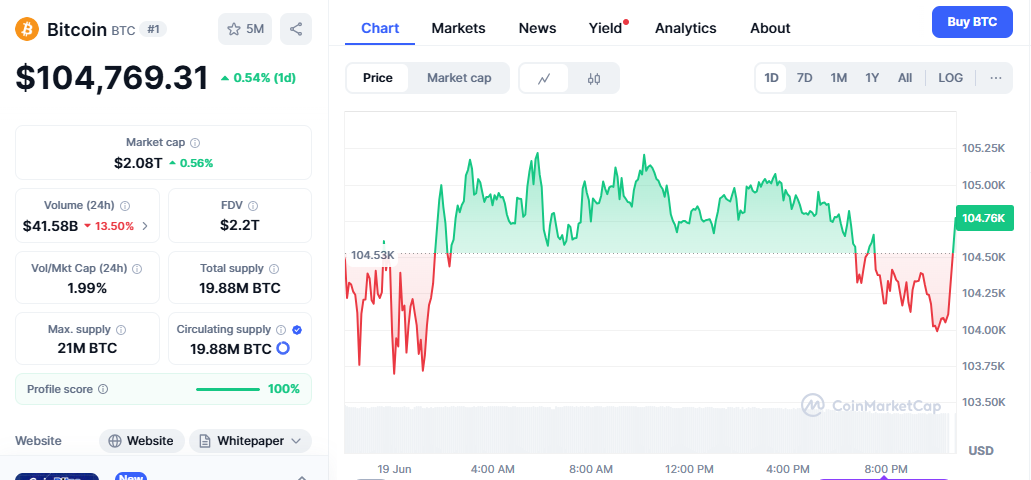

Bitcoin price $100K support: The cryptocurrency market is witnessing a pivotal moment as Bitcoin (BTC) hovers around the $105,000 mark, with technical analysts suggesting that a drop below the psychological $100,000 threshold is becoming increasingly unlikely. As market dynamics shift and liquidity patterns emerge, Bitcoin’s price action around the $106,000 level has become a focal point for traders and institutional investors alike.

Current Market Snapshot: Bitcoin’s Resilient Stand Above $100K

Bitcoin price hovers around $105,000 on June 18 and shows staying power as BTC’s chance of falling to $100,000 appears to be decreasing, new analysis suggests. This resilience comes amid a complex market environment where multiple factors are converging to support Bitcoin’s elevated price levels.

The cryptocurrency has demonstrated remarkable strength in maintaining its position above the six-figure mark, marking the second time in 2025 that Bitcoin has sustained these levels. This persistence above $100,000 represents a significant psychological and technical milestone for the world’s largest cryptocurrency.

The $106K Liquidity Zone: A Critical Technical Level

Understanding Liquidity Clusters

If the $106,000 level is broken, it could spark a liquidation squeeze, forcing short sellers to close positions and driving prices toward $110,000, which is the next central liquidity cluster. This dynamic highlights the importance of understanding how liquidity zones function in cryptocurrency markets.

Market analysts have identified several key characteristics of the current liquidity environment:

- Concentrated Ask Orders: Several traders eye a potential upside liquidity grab with ask orders clustering above $106,000

- Strong Support Structure: Significant support is in place down to $97,000, boosting the odds of price holding

- Institutional Backing: Large bid orders totaling $260 million have been placed to defend current price levels

Technical Analysis: Why $106K Matters

The $106,000 level represents more than just a round number—it’s a confluence of technical factors that make it a critical resistance point. “$100K is a strong psychological level and liquidity tends to stack in these levels,” said CrypNuevo in a separate post on X.

Key technical indicators supporting this analysis include:

- Volume Profile: Heavy trading activity has created significant price memory at these levels

- Order Book Depth: Substantial liquidity pools have formed above and below current prices

- Moving Average Convergence: Multiple-timeframe moving averages are converging near these critical levels

Market Sentiment and Institutional Dynamics

Profit-Taking Patterns Differ from Previous Cycles

One of the most interesting aspects of the current market cycle is how profit-taking behavior differs from historical patterns. Profit-taking is underway but lacks the intensity of classic cycle tops, research says. This suggests that the current bull market may have more room to run compared to previous cycles.

Global Liquidity and Bitcoin’s Correlation

Bitcoin’s relationship with global liquidity continues to be a driving force behind its price movements. Bitcoin sits above $100,000 for the second time in 2025, reasserting its capacity to track and reflect global liquidity cycles, demonstrating the cryptocurrency’s evolution as a macro asset.

Research indicates that Bitcoin moves in the direction of global liquidity 83% of the time in any given 12-month period, reinforcing its role as a liquidity barometer in international financial markets.

Supply Dynamics: The Liquidity Crunch Factor

Declining Liquid Supply Creates Upside Potential

A significant factor supporting Bitcoin’s price stability is the ongoing reduction in liquid supply. BTC’s circulating supply is thinning out with an estimated 30% drop in liquid BTC over the last 18 months, a steep drain that could set the stage for potential upside volatility in the coming months, according to Sygnum Bank’s market outlook.

This supply squeeze is attributed to several factors:

- Long-term Holding: Increased adoption of “HODLing” strategies among retail and institutional investors

- ETF Inflows: Continued accumulation by Bitcoin ETFs, removing coins from active trading

- Corporate Treasury Adoption: More companies adding Bitcoin to their balance sheets as a treasury asset

Expert Price Predictions: Bullish Outlook for 2025

Institutional Forecasts Point Higher

Major financial institutions have raised their Bitcoin price targets for 2025, with several prominent forecasts emerging:

- Bernstein Analysts: Predict a price rally to $200,000 by 2025, up from their previous target of $150,000

- VanEck, Fundstrat, and Standard Chartered: Forecast a 2025 BTC top between $180,000 and $250,000, citing institutional adoption and historical market cycles

- Technical Analysis Projections: Bitcoin price has the potential to reach $200,000 before the end of 2025

Key Support Levels to Watch

For the near term, analysts are monitoring specific support levels that could determine Bitcoin’s next significant move:

- Primary Support: $102,000-$104,000 range

- Secondary Support: $97,000 level

- Critical Resistance: $106,000-$108,000 zone

Technical indicators such as the oversold RSI and flattening MACD suggest that a relief bounce is likely if Bitcoin can maintain above key support levels.

Market Structure and Trading Dynamics

Leveraged Position Implications

The current market structure reveals interesting dynamics in leveraged positions. Bitcoin failed to sustain its position above the $106,000 mark, triggering a sharp decline as it cascaded southward, liquidating leveraged positions, highlighting the importance of this level for derivative markets.

Key insights from leveraged trading data:

- Short Squeeze Potential: High short interest Bitcoin price $100K support could fuel rapid upward moves

- Liquidation Cascades: Breaks below key levels could trigger automated selling

- Risk Management: Institutional traders are positioning with wider stop-losses

Spot Market vs. Derivatives

The relationship between spot and derivatives markets continues to influence Bitcoin’s price discovery:

- ETF Impact: Record spot ETF inflows provide underlying support

- Futures Contango: Forward curves suggest continued optimism

- Options Skew: Call option demand remains elevated at higher strikes

Risk Factors and Potential Headwinds

Macro Economic Considerations

Despite the bullish technical setup, several macro factors could impact Bitcoin’s trajectory:

- Interest Rate Policy: Central bank decisions continue to influence crypto flows

- Regulatory Environment: Ongoing regulatory clarity efforts in major jurisdictions

- Global Liquidity: Changes in monetary policy could affect Bitcoin’s correlation patterns

Technical Risk Scenarios

Key risk scenarios that traders are monitoring include:

- Failed Breakout: Inability to clear Bitcoin price $100K support could lead to consolidation

- Volume Decline: Reduced trading activity might signal waning momentum

- Correlation Shifts: Changes in Bitcoin’s relationship with traditional assets

Investment Implications and Strategy Considerations

For Retail Investors

The current market environment presents both opportunities and challenges for individual investors:

Opportunities:

- Strong technical foundation above $100,000

- Institutional adoption continues to grow

- Supply constraints supporting price appreciation

Considerations:

- High volatility requires careful position sizing

- Dollar-cost averaging may be prudent given price swings

- LA’s long-term perspective is recommended, given the macro trends

For Institutional Players

Institutional investors are focusing on:

- Treasury Allocation: Strategic Bitcoin reserves for corporate balance sheets

- ETF Exposure: Regulated investment vehicles for broader portfolio integration

- Hedging Strategies: Using Bitcoin as a Hedge Against Currency Debasement

Conclusion

As Bitcoin navigates the critical $106,000 liquidity zone, multiple factors are converging to support a bullish outlook. The combination of reduced liquid supply, institutional adoption, and favorable technical patterns suggests that a drop below $100,000 is indeed becoming less likely.

However, the cryptocurrency market remains inherently volatile, and investors should prepare for continued price swings as Bitcoin works through these key resistance levels. The successful breach of $106,000 could open the door to the next central liquidity cluster at $110,000 and beyond, potentially validating the most optimistic price predictions for 2025.