Ripple has taken a significant step toward bridging traditional institutional finance with decentralized markets as Ripple adds Hyperliquid to its prime brokerage platform in what is being described as its first true DeFi integration. This development represents more than a simple platform expansion. It signals a strategic shift in how institutional players may access decentralized finance while maintaining the controls, compliance standards, and operational efficiencies they require.

For years, DeFi has been viewed by institutions as innovative but operationally complex. Fragmented liquidity, disconnected wallets, isolated collateral, and unfamiliar risk frameworks have limited large-scale adoption. At the same time, DeFi derivatives markets have grown rapidly, offering deep liquidity, transparent settlement, and 24/7 global access. Ripple’s move to integrate Hyperliquid into its prime brokerage platform is an attempt to reconcile these two worlds.

By bringing a high-performance decentralized derivatives venue into an institutional-grade prime brokerage environment, Ripple is effectively redefining what prime brokerage can look like in a digital asset era. This article explores why Ripple adds Hyperliquid now, what this first DeFi integration means for institutions, how Hyperliquid fits into Ripple’s broader strategy, and what the implications could be for the future of institutional DeFi adoption.

Ripple’s prime brokerage platform

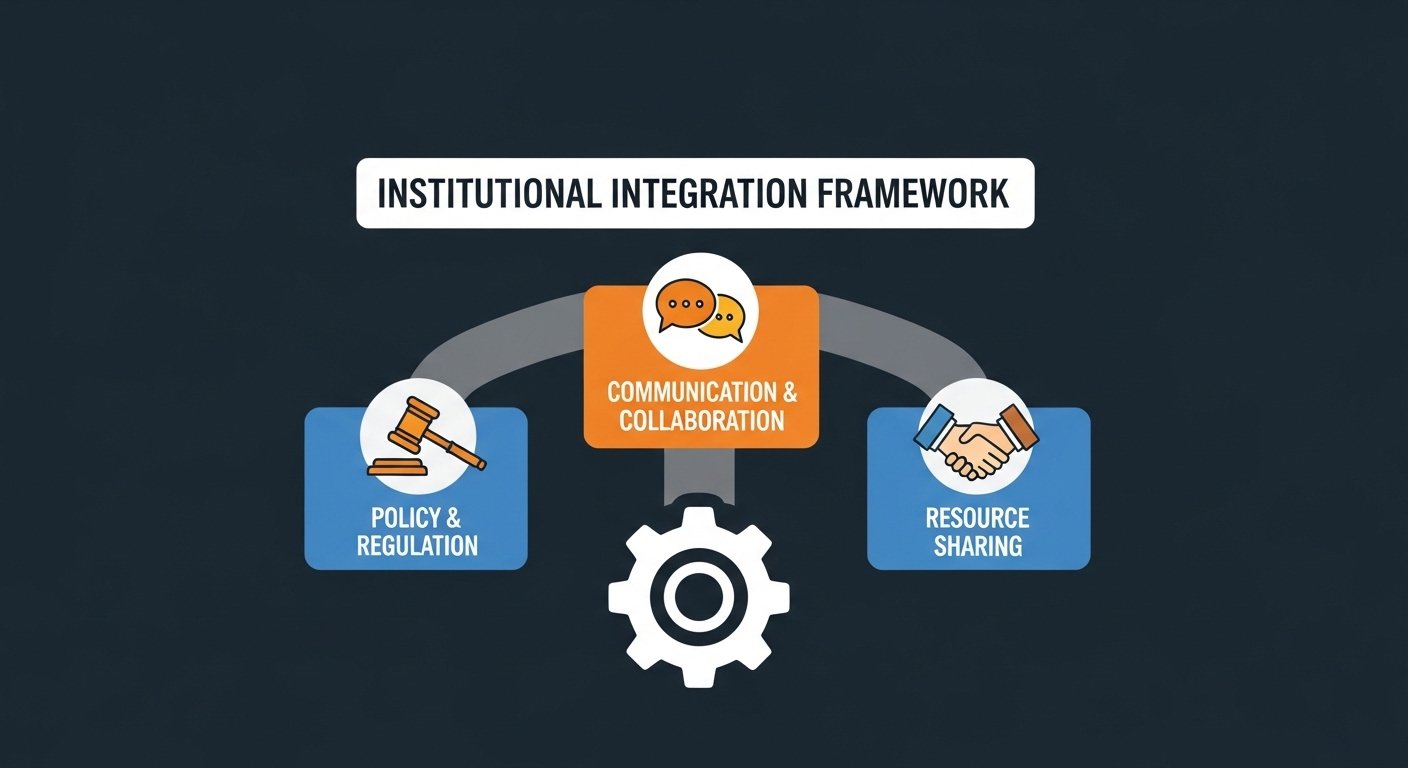

Prime brokerage is fundamentally about simplification and efficiency. In traditional finance, a prime broker provides clients with consolidated access to markets, financing, custody, margining, and risk management under a single relationship. Crypto prime brokerage aims to deliver the same value in a far more fragmented ecosystem.

Ripple’s prime brokerage platform was designed to meet institutional expectations by offering multi-asset access, centralized risk oversight, and capital-efficient trading workflows. Instead of managing relationships with multiple exchanges, custodians, and liquidity providers, institutions can operate through a unified framework.

When Ripple adds Hyperliquid to its prime brokerage platform, it expands that framework to include decentralized derivatives markets. This is notable because DeFi venues have historically existed outside prime brokerage models, accessed directly through wallets rather than institutional intermediaries.

Why prime brokerage matters for institutions

Institutional investors prioritize predictability, capital efficiency, and governance. They need clear visibility into margin requirements, exposure limits, and portfolio-level risk. Without these elements, even attractive trading opportunities may remain inaccessible.

The value of Ripple’s prime brokerage platform lies in its ability to standardize workflows. Adding DeFi exposure within this structure makes decentralized markets easier to evaluate and potentially easier to scale. That is why this integration is being described as a milestone rather than a routine feature update.

Why Ripple adds Hyperliquid as its first DeFi integration

Choosing Hyperliquid as the first DeFi integration is not accidental. Hyperliquid has positioned itself as a decentralized exchange optimized for derivatives trading, particularly perpetual contracts. Its design emphasizes speed, liquidity depth, and an order-book-based trading experience that aligns more closely with institutional expectations than many automated market maker models.

By integrating Hyperliquid first, Ripple is effectively signaling that DeFi derivatives have reached a level of maturity where institutional participation is no longer experimental. The integration allows institutions to interact with onchain derivatives while maintaining the familiar guardrails of a prime brokerage environment.

The importance of “first DeFi integration”

The phrase “first DeFi integration” carries strategic weight. Many platforms offer indirect DeFi exposure through structured products or wrapped instruments. What differentiates this move is that Hyperliquid is being brought directly into the prime brokerage workflow.

This suggests that DeFi positions can be treated as part of a broader institutional portfolio rather than as isolated bets. For institutions, that distinction matters. It affects how risk is modeled, how capital is allocated, and how compliance teams evaluate exposure.

Hyperliquid’s role in the decentralized derivatives market

To understand the significance of this integration, it is essential to understand Hyperliquid’s market position. Hyperliquid is designed as a high-performance decentralized derivatives exchange, built to handle professional trading volumes while operating fully onchain.

Unlike many early DeFi platforms, Hyperliquid focuses on execution quality and trader experience. Its infrastructure is optimized for low latency, high throughput, and transparent settlement. These characteristics make it more attractive to institutional traders who are accustomed to centralized exchange performance.

Onchain order books and institutional familiarity

One of Hyperliquid’s defining features is its onchain order book model. This structure mirrors the mechanics used in traditional markets, making it easier for professional traders to assess liquidity, manage execution strategies, and control slippage. For institutions entering DeFi, familiarity reduces friction. When Ripple adds Hyperliquid, it brings a DeFi venue into prime brokerage that already aligns with how institutional desks think about trading.

Liquidity and growth considerations

Liquidity is a non-negotiable factor for institutions. Hyperliquid’s growth in decentralized perpetuals has drawn attention because it demonstrates that onchain derivatives can attract sustained trading volume. Ripple’s decision to integrate Hyperliquid reflects confidence that the venue can support institutional-scale activity.

How the integration works from an institutional perspective

The practical impact of this integration lies in how institutions can use it. When Ripple adds Hyperliquid to its prime brokerage platform, the goal is not simply access but operational integration. Institutions typically operate portfolios that span multiple asset classes and venues. Managing these exposures efficiently requires consolidated margining, unified reporting, and centralized risk controls. The integration aims to bring Hyperliquid exposure into this consolidated framework.

Cross-margining and capital efficiency

One of the most important benefits highlighted by the integration is cross-margining. Instead of posting separate collateral for DeFi positions, institutions may be able to offset risk across their entire portfolio. Capital efficiency directly affects returns. If DeFi derivatives require isolated over-collateralization, many strategies become unattractive. Cross-margining allows institutions to deploy capital more effectively while still managing downside risk.

Centralized risk oversight

DeFi offers transparency, but transparency alone does not replace institutional risk management. Institutions need real-time visibility into exposure, stress scenarios, and liquidation thresholds. By integrating Hyperliquid into a prime brokerage environment, Ripple aims to provide centralized oversight without altering the decentralized nature of the underlying protocol. This hybrid approach allows institutions to benefit from DeFi innovation while maintaining internal governance standards.

Simplified operations and workflow consistency

Operational complexity has been one of the biggest barriers to institutional DeFi adoption. Managing wallets, smart contract interactions, and protocol-specific mechanics requires expertise and operational resources.

Prime brokerage integration abstracts much of that complexity. Institutions can interact with DeFi markets through workflows that resemble existing trading and risk management processes. This consistency lowers the barrier to entry and reduces operational risk.

Strategic timing: why Ripple adds Hyperliquid now

The timing of this integration reflects broader shifts in the digital asset market. DeFi derivatives have grown rapidly, while institutions have become more comfortable with digital assets as an asset class.

At the same time, competition among prime brokerage providers is intensifying. Differentiation increasingly depends on the breadth of accessible liquidity and the efficiency of capital deployment. By adding DeFi derivatives access, Ripple strengthens its value proposition to institutional clients.

Responding to market fragmentation

Crypto markets are fragmented across centralized exchanges, OTC desks, and decentralized protocols. Institutions seek platforms that can unify this fragmentation. Integrating Hyperliquid is a step toward offering a single interface for multiple liquidity sources.

Positioning for future DeFi integrations

Calling this the first DeFi integration implies that more may follow. If successful, the Hyperliquid integration could serve as a template for incorporating additional DeFi venues into prime brokerage workflows.

Benefits and risks institutions should consider

While the integration offers clear advantages, it also introduces new considerations that institutions must evaluate carefully.

Potential benefits

The benefits include access to onchain derivatives liquidity, improved capital efficiency through cross-margining, and exposure to innovative market structures. Institutions may also gain diversification benefits by trading across both centralized and decentralized venues.

Key risks

DeFi derivatives carry unique risks, including smart contract vulnerabilities, protocol governance changes, and rapid liquidity shifts during market stress. Prime brokerage integration can mitigate operational risk, but it does not eliminate protocol-level risk. Institutions must still conduct due diligence on Hyperliquid’s design, security assumptions, and risk parameters.

Balancing innovation with control

The integration highlights a broader theme in institutional crypto adoption: balancing innovation with control. By embedding DeFi within a prime brokerage framework, Ripple is attempting to strike that balance.

What this means for the future of institutional DeFi

When Ripple adds Hyperliquid to its prime brokerage platform, it sends a signal to the market that DeFi is no longer peripheral to institutional strategy. Instead, it is becoming a liquidity source that can be integrated, managed, and scaled.

If more prime brokers follow this path, DeFi could transition from an alternative market to a core component of institutional trading infrastructure. That shift would have profound implications for liquidity distribution, market structure, and the evolution of digital asset finance.

Conclusion

Ripple’s decision to integrate Hyperliquid into its prime brokerage platform marks a meaningful step in the convergence of institutional finance and decentralized markets. By offering access to onchain derivatives within a centralized risk and margin framework, Ripple is redefining how institutions can engage with DeFi.

This first DeFi integration demonstrates that decentralized protocols can coexist with institutional-grade infrastructure. Whether this model becomes standard will depend on execution quality, risk outcomes, and market adoption. What is clear is that Ripple adds Hyperliquid at a moment when the boundaries between traditional finance and DeFi are becoming increasingly fluid.

FAQs

Q: What does it mean that Ripple adds Hyperliquid to its prime brokerage platform?

It means institutional clients using Ripple’s prime brokerage can access Hyperliquid’s decentralized derivatives markets through a unified trading, margin, and risk management framework.

Q: Why is this considered Ripple’s first DeFi integration?

This is described as the first time Ripple has directly integrated a DeFi protocol into its prime brokerage offering, rather than offering indirect or structured exposure.

Q: What is Hyperliquid?

Hyperliquid is a decentralized exchange focused on perpetual derivatives, designed for high performance, deep liquidity, and an order-book-based trading experience.

Q: How does this benefit institutional traders?

Institutions gain access to onchain derivatives liquidity while maintaining capital efficiency, centralized risk oversight, and consistent operational workflows.

Q: Does this integration directly impact XRP usage?

The integration is focused on institutional access to DeFi derivatives rather than expanding direct XRP utility, so any impact on XRP would be indirect rather than structural.