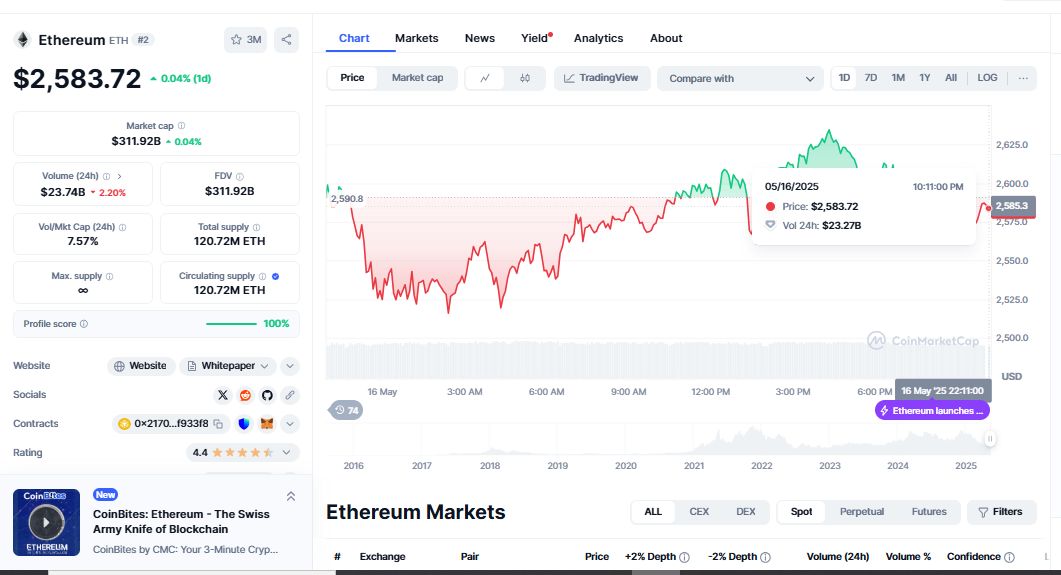

Ethereum has accomplished something unprecedented in the realm of cryptocurrencies. With a filtered on-chain stablecoin volume of $908 billion in April, an all-time high that emphasises Ethereum’s role as the foundation of distributed finance, the network noted that this historic success shows growing acceptance and emphasises Ethereum’s indispensable contribution to running stablecoin transactions and DeFi systems.

Ethereum has always changed over the last few years to meet rising scalability, efficiency, and practical value needs. This latest volume surge shows how crucial stablecoins are in the blockchain economy. Ethereum is becoming the preferred infrastructure for value settling at scale as worldwide interest in digital assets surges and conventional financial systems show uncertainty.

Why Stablecoins Are Fueling Ethereum’s Expansion

It is not a coincidence that stablecoin activity centred on Ethereum is rising. It marks a more fundamental change in crypto interaction. For transactions, cross-border payments, lending, yield farming, and institutional trading execution, stablecoins such as USDT, USDC, and DAI provide a consistent, dollar-pegged value. For many consumers and systems, these tokens have replaced conventional banking channels and evolved into vital instruments for digital finance.

Ethereum’s design makes it the perfect host for these assets. Its smart contract features allow developers to create DeFi apps, exchanges, lending platforms, and more by providing programmatic control over money, which grants them flexibility. Ethereum’s reputation for security and decentralization draws consumers, developers, and institutional actors as the ecosystem develops.

The explosive rise in stablecoin volume demonstrates how much high-value financial operations now rely on Ethereum as a basic settlement layer. The phenomenon goes beyond crypto speculation. It’s about actual use; capital flows through wallets and smart contracts at a hitherto unheard-of rate.

Second Fueling Stablecoin Velocity

The advent of Ethereum Layer 2 scaling solutions is one of the main forces behind this explosion. Thanks to sites like Arbitrum, Optimism, and Base, token transfers now take far less time and money. Ethereum Price Soars, These networks, intended for high-frequency stablecoin use, inherit Ethereum’s security while providing quicker and less expensive transactions.

Stablecoins become even more accessible and effective as more consumers migrate to Layer 2s. While dApps onboard customers at a speed not conceivable on Layer 1 alone, traders complete deals in milliseconds with insignificant expenses. From NFT collectors to corporate finance teams looking at blockchain for treasury operations, this optimization improves stablecoin transaction frequency and draws new demographics into DeFi.

The advent of scalable Ethereum solutions has fundamentally altered the flow of value on the blockchain. Ethereum has opened a new layer of use for stablecoins by smoothing out transactions and lowering costs, therefore enabling the $908 billion milestone to be reached and probably exceeded in the not-too-distant future.

Stablecoins’ Growing Strategic Value on Ethereum

This record-breaking volume has strategic consequences even beyond on-chain measurements. In the crypto universe, stablecoins are the closest form of fiat money; Ethereum’s hegemony over this market has an exaggerated impact on forming world distributed finance. Especially when their models rely on stablecoin interaction, projects increasingly prioritize launching on Ethereum to leverage its liquidity and user base.

Moreover, financial institutions and central banks are paying closer attention to emerging trends. Ethereum’s infrastructure is under more institutional-grade research as tokenised assets and Central Bank Digital Currencies (CBDCs) emerge. Ethereum has positioned itself as a long-term participant in crypto innovation and the future of finance by firmly anchoring itself in real-world financial use cases via stablecoins.

As worldwide frameworks for digital currencies develop, regulators are now paying attention to Ethereum’s visible data, open procedures, and extensive decentralisation. Stablecoin activity is, in many respects, a leading sign of Ethereum’s readiness for more general financial integration.

What This Means for Future Ethereum

This landmark might be only the start. As adoption rises, more capital will enter stablecoin ecosystems; Ethereum is likely to capture much of that expansion. Developers will develop products using stablecoins for speed, dependability, and integration on an ongoing basis. Institutional participants will seek stablecoins for collateral uses, custody, and settlement, hence strengthening Ethereum’s network effects.

At the same time, ETH itself might also benefit financially. Increased use of stablecoins stimulates on-chain activity, which drives demand for blockspace and raises the value of ETH as gas. Ethereum thus becomes a neutral platform and a benefactor of the activities it helps create.

Builders, analysts, and investors should pay close attention to April’s $908 billion record. Ethereum’s stablecoin ecosystem primarily drives its increasing importance in the digital economy.

Stay up to date.

Ethereum keeps pushing limits, and its stablecoin volume leadership is only one aspect of a far more complex tale. Ethereum Weekly Breakout, Monitoring Ethereum’s stablecoin performance is crucial regardless of your level of DeFi participation, crypto investment, or simple following of financial innovation. The statistics show us something significant: Ethereum is meeting demand and determining the tempo for the evolution of money.