May 14 marked a significant milestone in the continuous evolution of digital assets as instruments for institutional investment. The most recent ETF statistics show a clear flood of money into Bitcoin and Ethereum, indicating that big investors are doubling down on crypto risk in diversified portfolios. These inflows reflect a strategic reallocation of capital toward dispersed assets progressively considered long-term reservoirs of value, not only numerical measures.

ETF Inflows for Bitcoin Rising Past $319 Million

The enormous amount of Bitcoin bought via ETFs is among the most startling statistics from May 14. Added across several funds, about 3,070 BTC represents a net capital inflow of $319.5 million. This evolution shows a consistent belief among institutional players that Bitcoin is a wise long-term asset in the face of continuous macroeconomic uncertainty, not only a daily snapshot of buying activity.

Given the rather cautious attitude in more general financial markets, Bitcoin ETF inflows of this kind are rare and noteworthy. Bitcoin is becoming increasingly sought after by investors not just as a speculative asset but also as a respectable part of portfolio diversification. Bitcoin vs Ethereum, The volume of the inflows also points to fund managers shifting toward cryptocurrencies in reaction to geopolitical uncertainty, inflation worries, and rising regulatory clarity over digital financial products.

Ethereum ETF Performance Indices Rising Trust

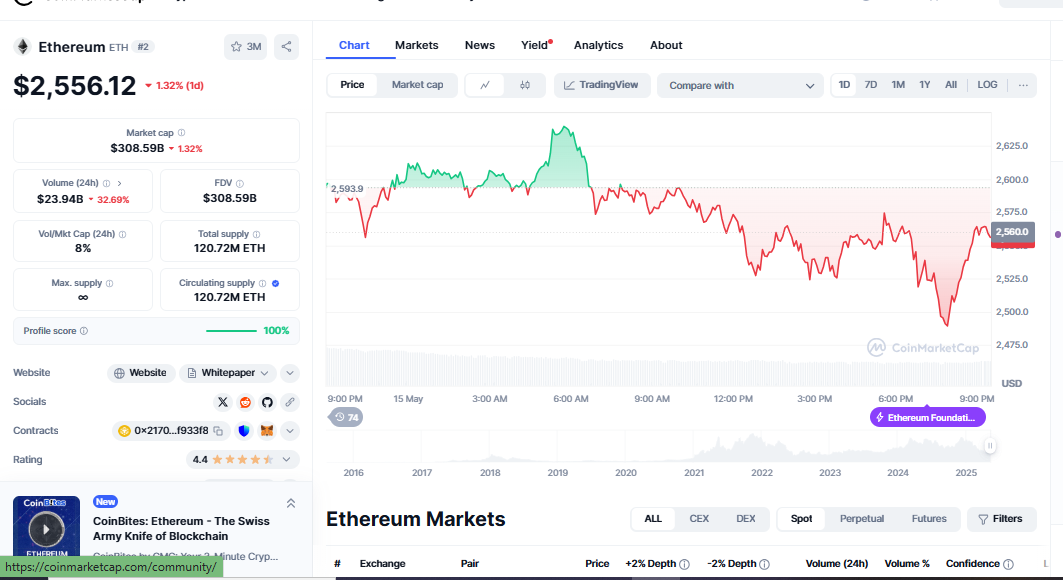

While Ethereum is rapidly catching up in institutional attractiveness, Bitcoin is still the flagship digital asset. Ethereum ETFs also had immense popularity on the same day Bitcoin ETFs absorbed almost $300 million in net inflows. Acquired about 23,710 ETH, representing new capital being put into Ethereum-oriented exchange-traded funds valued at $63.5 million.

This development is especially significant since it emphasizes Ethereum’s rising significance outside a secondary cryptocurrency asset. Institutional investors are increasingly recognizing Ethereum’s utility-based value proposition, driven by smart contracts, distributed apps, and its transition to proof-of-stake. Ethereum ETF performance shows a more complex institutional strategy that emphasizes the infrastructure and long-term scalability of the network.

Strong institutional confidence signal

The inflows of Bitcoin and Ethereum ETF attest to the growing rather than just constant institutional interest in digital assets. ETFs remain the most compliant and familiar means of access for financial institutions, pension funds, hedge funds, and other big capital allocators entering the crypto market. These controlled products expose legacy investors without direct custody or on-chain activity by bridging traditional finance with distributed assets.

The timing of the current inflows is especially relevant. Because of more general market conditions and global economic events, crypto markets have consolidated, and the mood has been very cautious. That institutional investors are still making millions of dollars in commitments at this point says volumes about their long-term perspective. These capital movements imply that there is at least hedging against further weakening in fiat-denominated assets, or significant money is positioned ahead of a possible market breakthrough.

Growing Part Crypto Plays in Portfolio Strategy

The rapid rise in crypto ETF inflows draws attention to a more significant change in the building of institutional portfolios. Forward-looking asset management plans now include digital assets as essential components, no longer viewed as experimental or fringe. Apart from Bitcoin’s fixed supply and distributed character, Ethereum’s growing ecosystem and smart contract features drive this progress.

Currently, portfolio managers increasingly view cryptocurrencies as an asset class that offers asymmetric returns and acts as a buffer against traditional market risks. This institutional story redefines the market and creates conditions for more general public acceptance.

Future developments for cryptocurrency ETFs

Looking ahead, the market will be keen to see whether these ETF inflows stay constant or even quicken. While it promotes the creation of new financial instruments connected to digital assets, sustained curiosity could drive a more general crypto price increase. Furthermore, more regulatory support and clarity brought about by higher ETF activity could open even more institutional demand.

Clearly, crypto has found its place in the current investment playbook as institutional capital keeps pouring into Bitcoin and Ethereum ETFs. These inflows’ constancy and scale are helping redefine what it means to create a diversified, future-ready portfolio.

Remain tuned for institutional movements.

Understanding ETF flow trends is vital for both institutional and retail investors. They provide a clear and immediate gauge of how the best money in the room is positioned. Whether your approach is long-term or active trading, you should not overlook these inflows.

Institutional interest in Bitcoin and Ethereum signals the developing crypto market rather than just a trend. Ethereum Price Soars, Over $380 million came into just two assets in one day, indicating that crypto’s influence in world banking is rising and quickening.