Cryptocurrency market is once again testing traders’ patience. After months of sharp volatility and emotional swings, the Top 3 digital assets—Bitcoin, Ethereum, and Ripple—have entered a phase of tight consolidation. Prices are moving sideways, momentum is fading, and uncertainty is growing. While range-bound markets may seem calm on the surface, they often precede powerful directional moves, making this an important moment for price prediction analysis.

Bitcoin continues to struggle with sustained upside momentum, Ethereum is failing to reclaim critical psychological levels, and XRP is coiling in a narrow range that signals an impending breakout or breakdown. As liquidity tightens and volatility compresses, breakdown risks are rising, particularly if key support levels fail. This article provides a detailed Top 3 price prediction for BTC, ETH, and XRP, focusing on technical structure, market psychology, and possible scenarios that could define the next major move. By examining each asset individually and within the broader crypto market context, this analysis aims to offer clarity in a period where conviction is low and risk management is essential.

Market Overview: Why BTC, ETH, and XRP Are Stuck in a Range

Range-bound conditions occur when buyers and sellers reach a temporary equilibrium. Neither side has enough conviction or capital to force a decisive breakout. In the current crypto market, this equilibrium reflects broader uncertainty, cautious sentiment, and selective participation. From a technical perspective, price ranges form when volatility contracts and price repeatedly respects horizontal support and resistance zones. Momentum indicators flatten, trading volume declines, and false breakouts become common. This environment favors short-term trading strategies while making longer-term price prediction more complex.

Psychologically, range-bound markets exhaust participants. Bulls lose confidence after repeated rejection at resistance, while bears hesitate to commit aggressively without confirmation of a breakdown. Over time, this indecision builds pressure, and once the range breaks, the resulting move is often sharp and emotional. For the Top 3 cryptocurrencies, this pressure is clearly visible. Bitcoin is compressing beneath key resistance, Ethereum is struggling to regain lost ground, and XRP is locked in a narrow consolidation band. These conditions make the current phase critical for forecasting future price action.

Bitcoin Price Prediction: BTC Faces Increasing Downside Pressure

Bitcoin remains the bellwether of the cryptocurrency market, and any Top 3 price prediction must start with BTC. While Bitcoin has managed to hold above major long-term support zones, its inability to sustain rallies is a growing concern.

Bitcoin’s Technical Structure and Key Levels

Bitcoin’s price structure reflects weakening bullish momentum. Each recovery attempt has been met with selling pressure, resulting in lower highs within the broader range. This pattern suggests distribution rather than accumulation, a subtle but important distinction for price prediction. Support levels remain intact for now, but repeated tests of the same zone weaken buyer confidence.

In technical analysis, support becomes more fragile each time it is tested without a strong rebound. If Bitcoin fails to hold this floor convincingly, the probability of a deeper pullback increases significantly. On the upside, resistance continues to cap price action. Without a sustained move above this barrier and follow-through buying, bullish scenarios remain limited to short-lived bounces rather than trend reversals.

Bitcoin Price Prediction Scenarios

In the base-case scenario, Bitcoin continues trading sideways within its established range. This would involve periodic dips toward support followed by corrective rallies that stall near resistance. Such behavior aligns with a market waiting for macro or sentiment-driven catalysts. The bullish scenario requires Bitcoin to reclaim key resistance levels and convert them into support. This would signal renewed demand and a shift in market psychology, potentially opening the door to higher price targets.

However, confirmation through volume and structure is essential. The bearish scenario becomes dominant if Bitcoin breaks below its range support and fails to recover quickly. In that case, downside momentum could accelerate as stop-loss orders trigger and sentiment deteriorates. For now, this risk remains elevated but unconfirmed.

Ethereum Price Prediction: ETH Struggles Below Psychological Resistance

Ethereum’s price action mirrors Bitcoin’s hesitation but carries its own set of challenges. As the second-largest cryptocurrency, ETH often amplifies broader market trends while reacting to its internal ecosystem dynamics.

Ethereum’s Current Market Position

Ethereum remains trapped below a major psychological level that previously acted as strong support. Trading below such levels often suppresses bullish sentiment, as investors perceive price as weak even when fundamentals remain unchanged. Technically, Ethereum has formed a consolidation pattern with limited upside momentum.

Attempts to reclaim higher levels have been met with selling, suggesting that traders are using rallies as exit opportunities rather than entry points. Momentum indicators remain neutral to bearish, reinforcing the idea that Ethereum lacks the strength needed for a sustained breakout in the absence of broader market support.

Ethereum Price Prediction Scenarios

The most likely scenario for Ethereum is continued range-bound trading alongside Bitcoin. As long as ETH holds its current support zone, sideways movement remains the dominant expectation. A bullish Ethereum price prediction depends on a successful reclaim of psychological resistance and confirmation through higher highs and increased participation.

Such a move would likely coincide with improved market sentiment and Bitcoin strength. The bearish scenario emerges if Ethereum loses its current support and fails to bounce decisively. In that case, downside risk increases, and ETH could enter a deeper corrective phase before finding meaningful demand.

Ripple Price Prediction: XRP Coils for a Major Move

XRP stands out among the Top 3 cryptocurrencies due to its tendency for sudden, explosive moves following long periods of consolidation. Currently, XRP is trading within a tight range, signaling that volatility compression is nearing its limit.

XRP’s Range-Bound Structure

XRP’s price action shows clear respect for horizontal levels, with buyers defending support and sellers capping rallies at resistance. This level-to-level trading environment is typical of XRP during periods of indecision. Unlike Bitcoin and Ethereum, XRP often reacts strongly to shifts in sentiment rather than gradual trend changes. This makes XRP price prediction particularly sensitive to breakout confirmation or breakdown signals. Volume remains muted, indicating that market participants are waiting for a clear directional signal before committing capital.

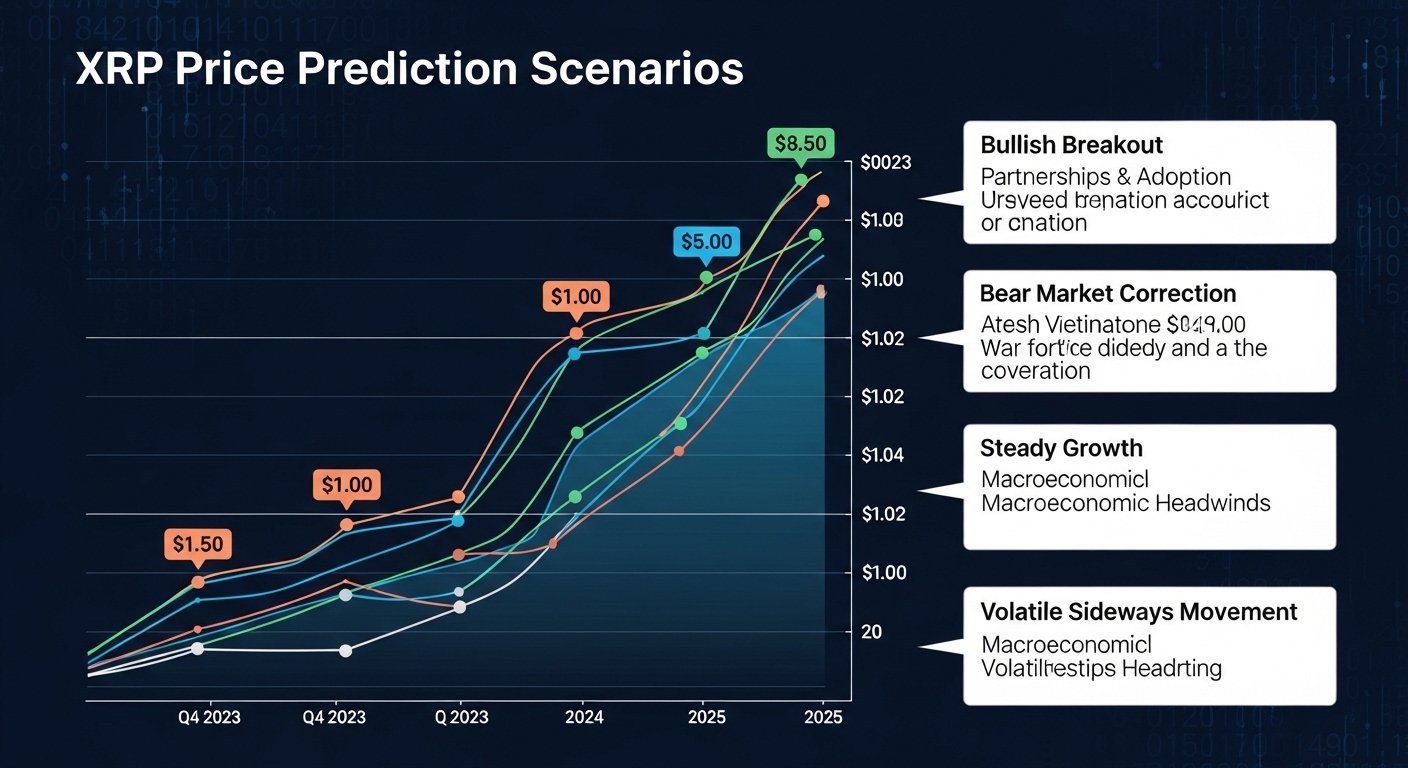

XRP Price Prediction Scenarios

In the base scenario, XRP continues consolidating within its current range, producing short-term volatility without a sustained trend. This scenario favors range traders but offers limited opportunity for directional investors. The bullish scenario requires a clean breakout above resistance followed by consolidation above that level. Such behavior would suggest genuine accumulation and could trigger a momentum-driven rally. The bearish scenario becomes relevant if XRP breaks below support and fails to recover quickly. Given XRP’s historical behavior, such a breakdown could lead to rapid downside movement before stabilization occurs.

Rising Breakdown Risks Across the Top 3

One common theme across Bitcoin, Ethereum, and XRP is the increasing risk of a downside resolution. Prolonged consolidation weakens support zones and exhausts bullish patience. When combined with declining volume and fading momentum, the risk of a breakdown grows. Breakdowns tend to be faster and more aggressive than breakouts because they trigger fear-driven selling.

Traders who entered late in the range rush to exit, while leveraged positions unwind rapidly. This dynamic makes risk management especially important during range-bound phases. For accurate price prediction, it is essential to monitor how price reacts at support levels rather than predicting exact targets. The market will reveal its intentions through behavior, not speculation.

Conclusion

The current Top 3 price prediction for Bitcoin, Ethereum, and Ripple reflects a market at a crossroads. BTC, ETH, and XRP remain range-bound, signaling indecision and a lack of strong conviction from either bulls or bears. While sideways movement may continue in the short term, breakdown risks are rising as support zones face repeated tests.

Bitcoin must defend its range floor to avoid deeper losses, Ethereum needs to reclaim key psychological levels to restore confidence, and XRP is approaching a volatility expansion that could define its next major trend. Until confirmation arrives, caution, patience, and disciplined risk management remain the most valuable strategies.