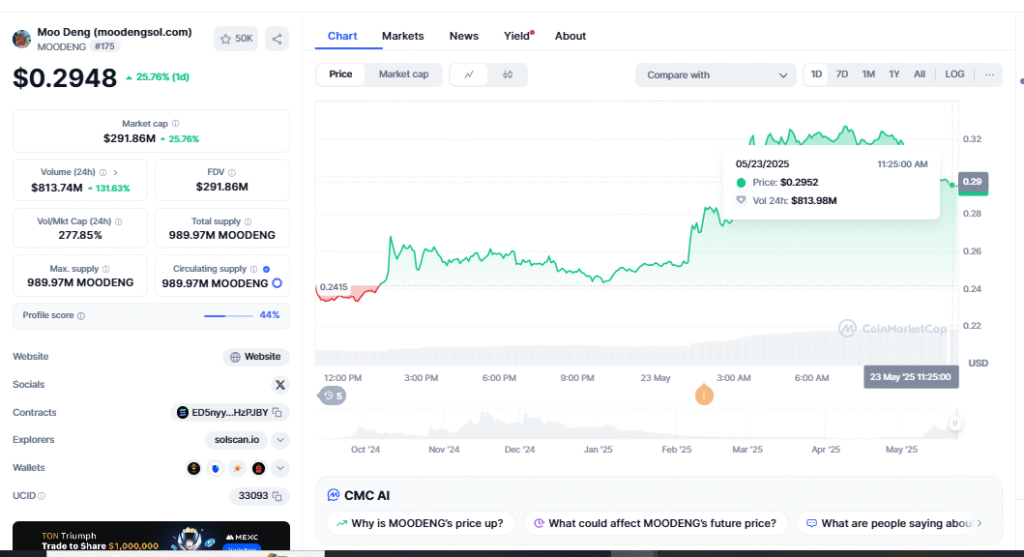

The news of the forthcoming listing on Robinhood drove the notable price rise the cryptocurrency MOODENG underwent today. Traders and investors have become interested in this development since it places MOODENG as a trending digital asset at the forefront. $MOODENG’s Price Momentum, Beyond the surface of this movement, though, is a market dynamic that calls for more attention than grassroots retail support, one that exposes more about whale and institutional engagement.

Whale Inflows and Institutional Momentum Driven the Rally

MOODENG’s recent increase seems to be driven mainly by activity from institutional investors and big holders. As the Robinhood news leaked, market data shows a significant increase in trading volume and large capital inflows from wallets renowned for high-value transactions. Often ahead of more general retail actions, these whales have built significant positions quickly.

This influx of money has pushed MOODENG’s price toward the $0.40 mark, a significant resistance level that traders are monitoring closely. There is obvious momentum, and right now the trend is upward. Although the immediate market response appears positive, this shift may be more fundamentally vulnerable than it initially seems. The lack of widespread participation raises questions about the movement’s sustainability, especially considering that the momentum is being driven solely by institutional support.

Restless Retail Participation Affects Long-Term Prospective

Retail investor mood has not matched the substantial price rise. The MOODENG network has added 600 fresh members during the last four days. This number implies a large gap between community involvement and price performance. Usually, a listing on a big exchange like Robinhood would inspire a lot of retail excitement, which would hasten uptake and a frenzy of fresh wallet designs.

Rather, we are seeing a cautious, even dubious retail base. Many small investors question the foundations underlying the surge or are reluctant to join the market at high costs. The low participation percentage reflects more general worries about the possibility of temporary price reversals, especially if the market believes that the surge is mostly supported by speculative activity from big players.

Unbalance of Sentiment Results in a Weak Market Structure

This mismatch between institutional purchases and retail reluctance sets MOODENG up fragrantly. Although the price might keep rising shortly, it does not have the basis given by extensive market involvement. This type of dynamic can lead to sudden reversals, especially when large holders begin to take profits or momentum slows down. The present surge could be fleeting without more general investor interest to stabilize prices and create natural demand.

The question over the actual influence of the Robinhood listing adds still another layer of complexity. While these postings enhance accessibility and visibility, their long-term value remains uncertain. Should the listing fail to draw consistent user involvement and trading activity, the initial buzz may fade, and a correction, shaking out speculative capital, may result.

Risk Factors and Price Objectives

Technical experts are eagerly observing for confirmation of a breakthrough or indicators of tiredness since MOODENG is currently trading close to the $0.40 resistance zone. A move above this level, particularly in high volume, could provide more upside. But a failure to break through—or a retreat following a fleeting breakthrough—may indicate the start of a turnaround.

Those thinking about a starting point must carefully evaluate the risk-to-return ratio. Starting a position at or near the peak of a momentum-driven action, especially one that lacks broad support, carries inherent risks. A possible retreat might rapidly wipe out previous increases, exposing latecomers to downward pressure. MOODENG may create a better basis for future profits if it can translate present interest into sustainable development, especially by drawing more retail users and improving wallet distribution.

A defining moment for MOODENG.

The following days will probably decide whether MOODENG’s most recent jump marks the start of a more general rally or a transient surge motivated by speculative interest. Unquestionably, the Robinhood listing has raised awareness of the initiative; recognition alone does not equal acceptance. Long-term success depends on the MOODENG ecosystem’s capacity to involve users meaningfully, offer value, and create a devoted community beyond transient financial behavior.

Retail interest is still missing. If developers and core community members can properly convey the long-term vision and maximize the existing visibility, MOODENG could go from a trader’s token to a pillar of a more involved, active user base.

Stay Current and Analyze the Risk.

Now is a crucial period for traders and investors to track MOODENG’s development. High-profile listing news, institutional interest, and a subdued retail mood create both risk and opportunity. As always, independent research, well-defined risk criteria, and avoidance of emotionally motivated decisions will be crucial.

Whether MOODENG can maintain this breakthrough and generate long-term momentum is yet unknown. What is evident, though, is that it attracts the market; Mode Network Airdrop, hence, the way it uses that attention will define the direction of the next chapter.