Bitcoin and Ethereum have once again captured the attention of the crypto market—but not because of explosive price rallies or dramatic crashes. Instead, the spotlight is on a quieter, more subtle signal: large-scale withdrawals from cryptocurrency exchanges. When Bitcoin and Ethereum see large withdrawals as buyers quietly accumulate, it often points to a shift in investor behavior that can precede significant market moves.

Rather than reacting to short-term price fluctuations, many market participants appear to be positioning themselves strategically. Coins are leaving exchanges and moving into private wallets, cold storage, and staking contracts, reducing the amount of supply readily available for selling. This behavior suggests a growing preference for long-term holding over speculative trading, a dynamic that historically has played an important role in shaping crypto market cycles.

Understanding why these withdrawals matter—and what they may indicate about future price action—requires looking beyond surface-level headlines. Exchange outflows alone do not guarantee bullish momentum, but when combined with broader market conditions, they can offer valuable insight into supply, demand, and investor sentiment. This article explores what large Bitcoin and Ethereum withdrawals mean, why buyers may be accumulating quietly, and how traders and investors can interpret these signals responsibly.

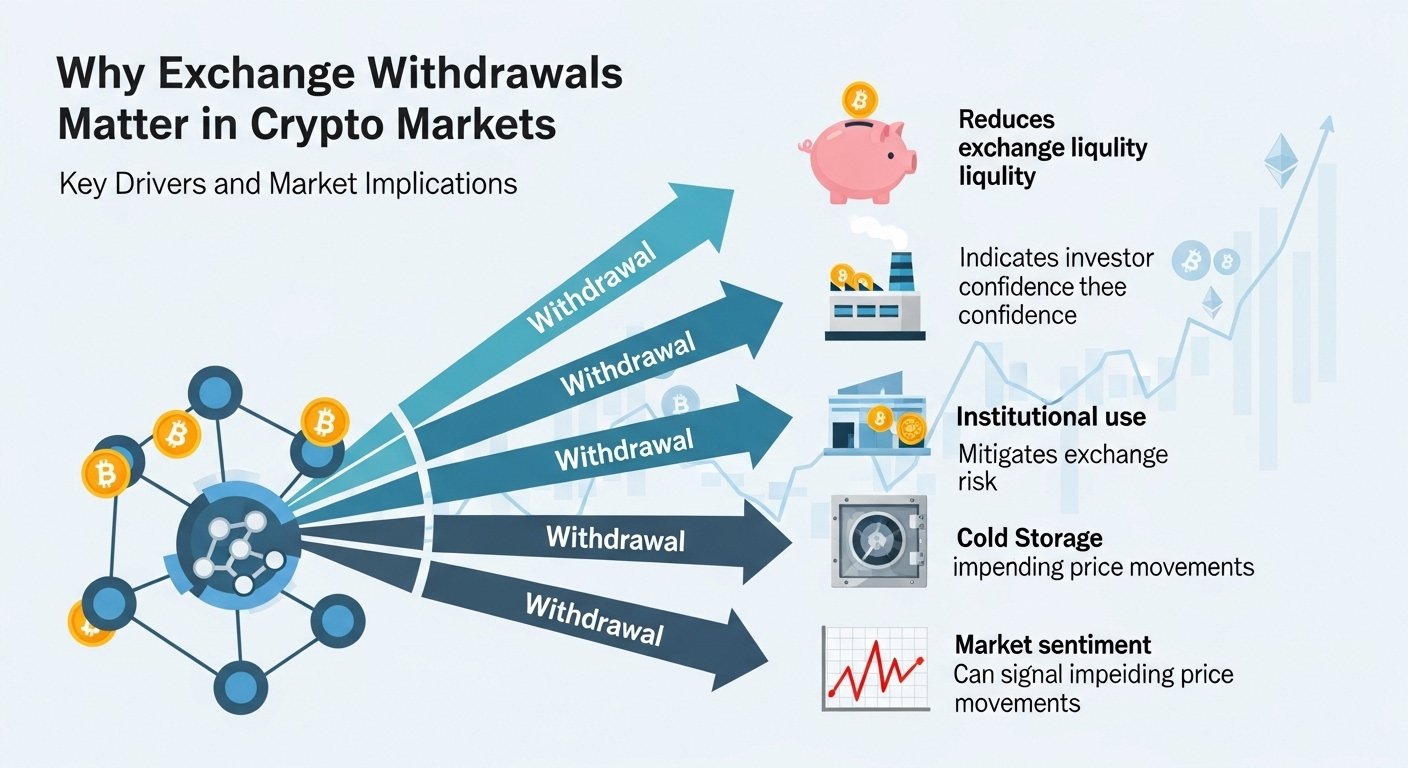

Why Exchange Withdrawals Matter in Crypto Markets

Cryptocurrency exchanges function as the primary venues for buying and selling digital assets. Coins held on exchanges are liquid and easily sold, which means they contribute directly to immediate market supply. When Bitcoin and Ethereum remain on exchanges, they represent potential sell pressure.

When Bitcoin, Ethereum see large withdrawals as buyers quietly accumulate, that dynamic changes. Coins moved off exchanges are often placed into long-term storage or staked, making them less likely to be sold in the short term. As a result, the circulating supply available for trading tightens, which can influence price behavior if demand remains steady or increases.

Exchange withdrawals also reflect investor confidence. Moving assets off an exchange typically signals that holders are not planning to sell imminently. This behavior contrasts with periods of fear or uncertainty, when coins tend to flow back onto exchanges as investors prepare to exit positions.

Quiet Accumulation

Quiet accumulation refers to a gradual, deliberate buying process that occurs without triggering major price spikes. Instead of aggressive market orders that draw attention, buyers accumulate assets slowly and then remove them from exchanges. This strategy helps avoid slippage and minimizes market impact.

When buyers quietly accumulate Bitcoin and Ethereum, they often do so during periods of consolidation or muted sentiment. Prices may move sideways, volume may decline, and public interest may cool—creating ideal conditions for accumulation. Large withdrawals during these phases can indicate that sophisticated investors are positioning themselves ahead of a potential trend shift.

The Psychology Behind Accumulation

Market psychology plays a major role in quiet accumulation. Experienced investors understand that buying during hype often leads to poor entries. Accumulating during uncertainty or boredom requires patience and conviction. Withdrawing coins reinforces that mindset, as it aligns with a longer-term investment horizon.

Supply Reduction and Market Sensitivity

When assets leave exchanges, available supply decreases. If demand rises unexpectedly—due to macroeconomic news, regulatory clarity, or renewed retail interest—prices may react more sharply because fewer coins are readily available for sale.

On-Chain Data and Exchange Reserves

On-chain analysis allows market participants to track how much Bitcoin and Ethereum are held on exchanges versus private wallets. Declining exchange reserves often coincide with accumulation phases, while rising reserves can signal increased selling intent.

Recent data trends have shown notable reductions in exchange-held Bitcoin and Ethereum balances over sustained periods. This pattern supports the narrative that buyers are moving assets into longer-term storage rather than preparing to sell.

However, interpreting on-chain data requires nuance. Not all withdrawals reflect new buying. Some represent internal exchange wallet reorganizations or custody migrations. The most meaningful signals emerge when large withdrawals persist over time and align with other indicators such as stable prices, rising long-term holder supply, or increased staking participation.

Why Investors Withdraw Bitcoin and Ethereum

There are several reasons investors choose to withdraw assets from exchanges, and not all of them are purely speculative.

Self-Custody and Asset Control

One of the most common motivations is self-custody. Holding private keys gives investors full control over their assets and removes counterparty risk. As awareness of security best practices grows, more holders prefer hardware wallets and cold storage over exchange custody. This trend naturally contributes to declining exchange balances, especially during periods when investors feel confident about long-term prospects.

Institutional Storage Practices

Institutional investors rarely keep significant balances on retail exchanges. Instead, they rely on specialized custodians and cold storage solutions. As institutional participation increases, exchange balances can decline even if overall demand rises. Large Bitcoin and Ethereum withdrawals may reflect this structural shift rather than retail speculation.

Ethereum Staking and Network Participation

Ethereum has an additional factor influencing withdrawals: staking. ETH holders can lock up their assets to secure the network and earn rewards. When staking demand increases, ETH leaves exchanges and becomes illiquid for extended periods. This dynamic reduces circulating supply and reinforces the idea that Ethereum is increasingly viewed as a productive asset rather than just a speculative one.

Bitcoin vs. Ethereum: Different Accumulation Dynamics

While Bitcoin and Ethereum often move together, their accumulation narratives differ. Bitcoin is widely regarded as a store of value. Withdrawals often reflect long-term holding, macro hedging, or strategic allocation decisions. Bitcoin accumulation tends to emphasize scarcity and preservation. Ethereum, by contrast, is both a monetary asset and a utility token.

Withdrawals may signal accumulation, but they can also reflect participation in staking, decentralized finance, or ecosystem growth. Ethereum’s supply dynamics are therefore more complex and influenced by network usage as well as investment demand. When Bitcoin, Ethereum see large withdrawals as buyers quietly accumulate, it’s important to consider these differences rather than treating both assets identically.

Are Large Withdrawals Always Bullish?

While exchange withdrawals are often interpreted positively, they are not a guarantee of rising prices.

Exchange Wallet Movements

Exchanges regularly move funds between wallets for security and operational reasons. These internal transfers can appear as large withdrawals on-chain without reflecting actual investor behavior.

Over-the-Counter Transactions

Large buyers often use over-the-counter desks to avoid moving the market. In these cases, coins may leave exchanges after trades are completed, meaning the buying pressure has already occurred.

Macro and Liquidity Risks

Macroeconomic conditions can override on-chain signals. Tight financial conditions, regulatory uncertainty, or global risk-off sentiment can push prices lower even when exchange balances are declining. Because of these factors, withdrawals should be viewed as one piece of a larger analytical framework rather than a standalone indicator.

How Traders and Investors Can Use This Signal

For long-term investors, sustained exchange withdrawals can support a thesis of accumulation and reduced sell pressure. This information may reinforce confidence in holding or gradually increasing exposure. For traders, the signal is more nuanced. Lower exchange liquidity can lead to sharper price movements, increasing both opportunity and risk. Monitoring price structure, volume, and derivatives data alongside exchange flows can help traders assess whether accumulation is translating into momentum. The key is patience. Quiet accumulation often precedes major moves, but timing those moves precisely is difficult. Using withdrawal data as context rather than a trigger can lead to more disciplined decision-making.

What Happens If Withdrawals Continue

If large Bitcoin and Ethereum withdrawals persist, several outcomes become more likely. First, reduced exchange supply can make prices more responsive to demand shocks. Second, long-term holder dominance may increase, potentially stabilizing the market. Third, in Ethereum’s case, staking and ecosystem growth could further constrain liquid supply. However, the narrative can shift quickly. A return of coins to exchanges would signal changing sentiment and potentially rising sell pressure. Watching the direction and consistency of flows is therefore critical.

Conclusion

When Bitcoin, Ethereum see large withdrawals as buyers quietly accumulate, the market is sending a subtle but important signal. Exchange outflows suggest that investors may be prioritizing long-term positioning over short-term speculation, reducing immediate sell pressure and altering supply dynamics.

While these withdrawals do not guarantee higher prices, they provide valuable context for understanding market behavior. Combined with broader indicators and disciplined risk management, exchange withdrawal trends can help investors and traders navigate the evolving crypto landscape with greater clarity and confidence.

Frequently Asked Questions

Q: What do large Bitcoin and Ethereum withdrawals indicate?

They often suggest reduced selling intent, increased self-custody, or long-term accumulation, though they can also reflect operational or institutional factors.

Q: Does quiet accumulation always lead to a bull market?

No. Quiet accumulation can precede rallies, but prices are still influenced by macroeconomic conditions, liquidity, and overall market sentiment.

Q: Why is Ethereum more affected by withdrawals than Bitcoin?

Ethereum withdrawals are influenced by staking and ecosystem participation, which can lock up supply for extended periods.

Q: Should investors buy when exchange balances fall?

Falling balances can be a supportive signal, but investment decisions should consider price action, risk tolerance, and broader market conditions.

Q: How long can accumulation phases last?

Accumulation phases can last weeks or even months. They often occur during low-volatility periods before significant directional moves.