The cryptocurrency market is witnessing a remarkable surge in Ethereum whale activity that bears striking similarities to the patterns observed during the legendary 2017 bull run. Recent on-chain data reveals that large Ethereum holders are engaging in unprecedented accumulation behaviors, sparking intense speculation about whether ETH is positioned for another explosive price rally.

On June 12, 2025, wallets holding between 1,000 and 10,000 ETH added more than 871,000 ETH in a single day, marking the highest daily whale inflow of the year and the most significant accumulation event since the historic 2017 cycle. This massive buying spree represents a substantial shift in market dynamics, suggesting that institutional and high-net-worth investors are positioning themselves for potential upward price movements.

Record-Breaking Accumulation Patterns Emerge

The scale of current whale activity has reached levels not witnessed in over seven years. For nearly a week, daily whale accumulation has exceeded 800K ETH, pushing holdings in 1k–10k wallets to >14.3M ETH. This sustained accumulation pattern indicates firm conviction among large holders and suggests a coordinated effort to build substantial positions at current price levels.

The data becomes even more compelling when examined over a longer timeframe. Wallets holding 1,000-100,000 ETH add 1.49 million tokens worth $3.79 billion over 30 days, representing one of the most significant accumulation periods in Ethereum’s history. This $3.79 billion influx of capital into whale wallets demonstrates the serious financial commitment these large players are making to Ethereum’s prospects.

Historical Parallels to the 2017 Bull Market

The current accumulation patterns are drawing immediate comparisons to the market conditions that preceded Ethereum’s meteoric rise in 2017. During that pivotal year, similar whale buying behavior preceded ETH’s surge from under $10 to nearly $1,400, delivering extraordinary returns to early investors. The parallels are not merely coincidental but represent a fundamental shift in market sentiment and positioning.

Ethereum whales are ramping up their buying, controlling 27% of the supply. This accumulation mirrors 2017 trends, indicating that large holders are consolidating a significant portion of the available Ethereum supply. This concentration of holdings in strong hands typically reduces selling pressure and creates conditions favorable for price appreciation, especially when combined with increasing demand from other market participants.

Current Market Dynamics and Price Action

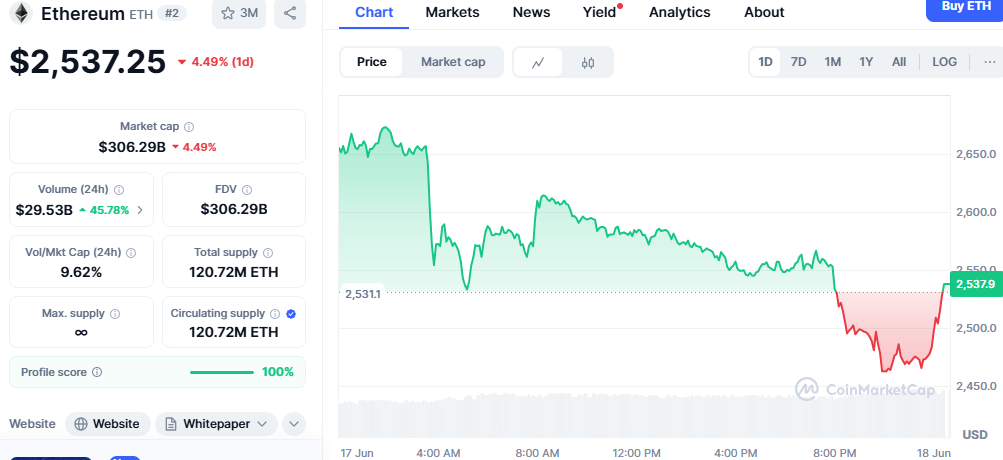

Despite the massive accumulation activity, Ethereum’s price action has remained relatively subdued in the short term. ETH slipped 3.7% on Tuesday to $2,555 but held key support amid persistent whale accumulation. This disconnect between accumulation and immediate price response is often characteristic of market bottoms, where smart money positions itself before the broader market recognizes value.

The ability of ETH to maintain key support levels despite short-term selling pressure demonstrates the underlying strength provided by whale accumulation. This price stability in the face of selling pressure suggests that the accumulated positions are providing a floor for the market, preventing significant downside moves while setting the stage for potential upward momentum.

Technical Analysis and Market Structure

From a technical perspective, the current market structure presents several bullish indicators that align with the whale accumulation data. Both charts illustrate similar price consolidation zones, horizontal resistance levels, and key breakout signals when comparing current patterns to the 2017 cycle structure. This technical alignment reinforces the narrative that Ethereum may be following a similar trajectory to its previous primary bull market.

The consolidation phase that Ethereum is currently experiencing mirrors the base-building period that preceded the 2017 breakout. During similar historical periods, sustained whale accumulation has typically preceded significant price appreciation as the market eventually recognizes the supply-demand imbalance created by prominent holder positioning.

Institutional Adoption and Infrastructure Development

The current whale accumulation is occurring against a backdrop of increasing institutional adoption and infrastructure development within the Ethereum ecosystem. Unlike the 2017 cycle, which was driven primarily by retail speculation, the current accumulation appears to be driven by sophisticated institutional players who understand Ethereum’s long-term value proposition.

The institutions are building on Ethereum, not XRP, not Solana, highlighting the fundamental preference that institutional developers and investors have for the Ethereum platform. This institutional focus provides a more stable foundation for price appreciation than the previous cycle’s primarily retail-driven demand.

Price Predictions and Market Expectations

Analysts and market experts are expressing increasingly bullish sentiment regarding Ethereum’s potential price analysis. The Bulls can hit $5,925 in 2025 according to some technical analysis, while more aggressive predictions suggest even higher targets. Johnny Gabriele, head analyst of blockchain economics and AI integration at the Lifted Initiative, is pretty bullish, predicting ETH will close 2025 worth $10,000.

These price targets, while ambitious, are grounded in the fundamental improvements to Ethereum’s infrastructure, the growing institutional adoption, and the current accumulation patterns that mirror historical precedents for significant price appreciation.

Network Fundamentals and Ecosystem Growth

The whale accumulation is occurring during a period of significant network development and ecosystem expansion. Ethereum’s transition to proof-of-stake, the ongoing development of layer-2 solutions, and the growing decentralized finance ecosystem provide fundamental support for the current accumulation thesis.

The network’s ability to maintain and grow its position as the primary platform for decentralized applications and smart contracts provides a strong foundation for long-term value appreciation. This fundamental strength, combined with the current accumulation patterns, creates a compelling case for potential price appreciation.

Risk Factors and Market Considerations

While the whale accumulation data presents a bullish case for Ethereum whale accumulation, investors should remain aware of potential risk factors that could impact price performance. Market volatility, regulatory developments, and broader economic conditions can all influence cryptocurrency prices regardless of accumulation patterns.

The concentration of holdings among large players, while providing price support, also creates potential risks if these positions are liquidated rapidly. However, the sustained nature of the current accumulation suggests that these holders have long-term conviction rather than short-term trading intentions.

Looking Ahead: Potential Catalysts for Price Movement

Several factors could serve as catalysts for translating the current whale accumulation into significant price appreciation. These include continued institutional adoption, regulatory clarity, network upgrades, and improvements in broader cryptocurrency market sentiment.

The timing of the current accumulation, occurring during a period of relative market stability, suggests that large holders are positioning for future developments rather than reacting to immediate market conditions. This forward-looking positioning often precedes significant market movements as the accumulated positions provide the foundation for sustained price appreciation.

Conclusion

The unprecedented scale of Ethereum whale accumulation, combined with the historical parallels to the 2017 bull market, suggests that ETH may be approaching a significant inflection point. While past performance does not guarantee future results, the current on-chain data provides compelling evidence that large holders are positioning for potential upward price movement.

The combination of record-breaking accumulation, institutional adoption, network development, and favorable technical patterns creates a confluence of factors that historically have preceded significant price appreciation. Whether this accumulation will translate into the explosive price gains seen in 2017 remains to be seen. Still, the foundation for such a move appears to be solidifying with each passing day of continued whale buying activity.