February unfolds, the crypto market is entering a phase where short-term sentiment, liquidity shifts, and event-driven volatility are becoming increasingly important. Weekends, in particular, tend to magnify price movements as traditional financial markets pause while digital assets continue trading non-stop. For traders and investors alike, this creates a unique environment where select altcoins to watch this weekend can offer valuable insight into broader market direction.

Unlike weekdays, weekend crypto trading often reflects pure sentiment. Lower trading volumes can amplify price swings, while unresolved narratives from the previous week either gain momentum or completely unwind. This makes weekends ideal for tracking high-conviction altcoins with active catalysts, strong narratives, or meaningful structural changes.

In this article, we’ll take a deep dive into three altcoins to watch this weekend—February 7–8—each representing a different market theme. One focuses on infrastructure and institutional-grade utility, another revolves around unlock-driven volatility, and the third highlights supply dynamics that could reshape near-term price behavior. Together, these assets provide a well-rounded snapshot of what matters most in the crypto market right now.

Why Altcoins Deserve Special Attention on Weekends

Altcoins tend to react more aggressively to changes in sentiment than Bitcoin or Ethereum, particularly when liquidity is thinner. This makes weekends a critical time for identifying whether momentum is strengthening or fading. A strong altcoin that holds support over a weekend often leads the next leg higher when weekday volume returns. Conversely, an altcoin that collapses during low-liquidity conditions can signal deeper weakness.

Another reason weekends matter is positioning. Many traders reduce exposure before Friday’s close, waiting to see how the market behaves without institutional participation. If bullish momentum survives this period, confidence tends to grow. That’s why identifying the right altcoins to watch this weekend can help traders stay ahead of the curve rather than reacting late.

Market Conditions Heading Into February 7–8

The broader crypto market is currently navigating a mix of optimism and caution. On one hand, long-term narratives such as real-world asset tokenization, decentralized infrastructure, and advanced trading platforms remain intact. On the other hand, short-term pressures like token unlocks and profit-taking are forcing the market to reassess valuations.

This push-and-pull dynamic makes selectivity essential. Instead of watching dozens of charts, focusing on a few altcoins to watch this weekend with clear drivers can lead to better decision-making and reduced emotional trading.

Chainlink (LINK): Infrastructure Strength in a Narrative-Driven Market

Chainlink continues to stand out as one of the most resilient infrastructure-focused altcoins in the market. While newer projects often dominate headlines, LINK has quietly maintained relevance by expanding its role in decentralized finance and bridging on-chain and off-chain data.

Why LINK Is One of the Altcoins to Watch This Weekend

Chainlink’s core value lies in its ability to deliver reliable data to smart contracts. As blockchain use cases grow more sophisticated, especially around tokenized assets and hybrid financial systems, the demand for secure and flexible data feeds increases. This positions LINK as a foundational layer rather than a speculative trend.

Heading into the weekend, LINK benefits from renewed interest in utility-driven altcoins. When traders rotate out of high-risk plays, they often seek assets with established ecosystems and long-term relevance. That rotation dynamic alone makes LINK one of the altcoins to watch this weekend.

LINK Price Structure and Weekend Behavior

LINK typically reacts well to market stabilization. When volatility cools and Bitcoin trades sideways, LINK often builds gradual momentum rather than sharp spikes. This makes weekend price action particularly revealing.

If LINK holds its support levels through Saturday and Sunday, it suggests that buyers are comfortable accumulating even during low-volume conditions. This kind of behavior often precedes stronger weekday moves. Conversely, repeated failures to reclaim short-term resistance may indicate lingering hesitation.

What LINK Signals About the Broader Market

Because Chainlink sits at the intersection of DeFi, data infrastructure, and institutional narratives, its performance often reflects overall confidence in the crypto ecosystem. A stable or strengthening LINK over the weekend would suggest that market participants are still willing to back long-term fundamentals rather than chasing short-lived hype.

Hyperliquid (HYPE): Volatility, Supply, and Trader Psychology

Hyperliquid has quickly gained attention as a trading-focused ecosystem, but its near-term price behavior is being driven less by features and more by changes in circulating supply. This makes HYPE one of the most technically interesting altcoins to watch this weekend.

The Role of Token Unlocks in HYPE’s Price Action

Token unlocks introduce new supply into the market, and their impact depends heavily on timing and sentiment. When unlocks occur during uncertain conditions, they can amplify selling pressure. When they happen during stable or bullish phases, the market may absorb them with minimal disruption.

For HYPE, the recent unlock event has shifted trader focus toward short-term structure rather than long-term vision. The weekend period becomes a testing ground to see whether sellers have finished distributing or whether more downside remains.

Reading HYPE’s Weekend Signals

HYPE’s price action this weekend should be analyzed through the lens of absorption. If price stabilizes and forms higher lows, it suggests that buyers are stepping in to meet new supply. This often marks the end of unlock-driven volatility.

However, if HYPE continues to break support levels with weak rebounds, it may indicate that the market is still searching for equilibrium. In that case, patience becomes more valuable than prediction.

Why Traders Are Watching HYPE Closely

Unlock-driven altcoins tend to attract both short-term traders and opportunistic investors. This combination can create fast, emotional moves—especially on weekends. That volatility alone earns HYPE a spot among the top altcoins to watch this weekend, regardless of directional bias.

Berachain (BERA): Supply Shock and Market Repricing

Berachain enters the weekend with one of the most dramatic supply narratives currently in play. Large-scale unlocks don’t just affect price; they reshape how traders think about valuation and risk.

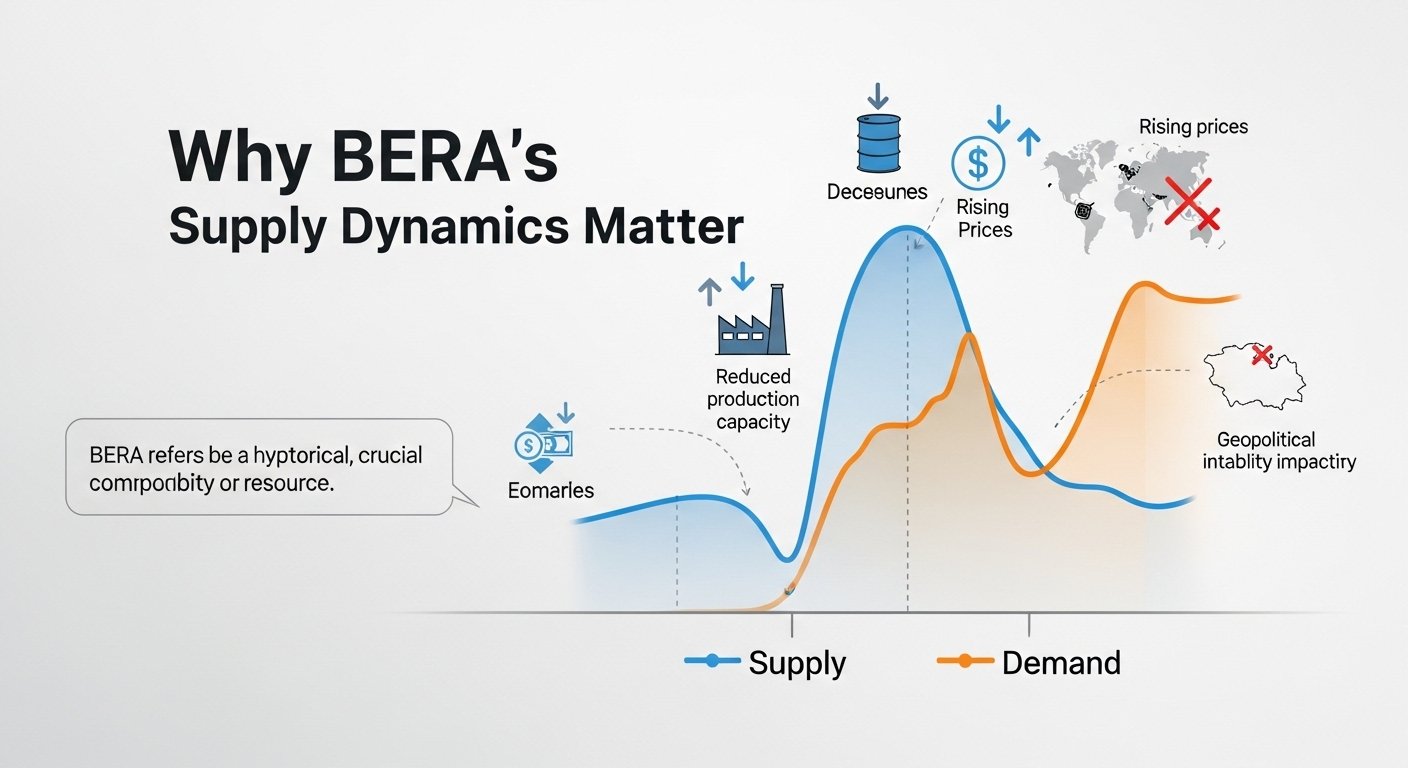

Why BERA’s Supply Dynamics Matter

When a significant percentage of an altcoin’s circulating supply becomes available, it changes the market’s internal math. Holders reassess their exposure, new participants evaluate entry points, and liquidity providers adjust positioning. This process rarely resolves instantly.

As a result, weekends following major unlocks often reveal whether the market has accepted the new supply or is still in the process of repricing. That’s exactly why BERA is one of the most important altcoins to watch this weekend.

Weekend Structure and Price Stability in BERA

For BERA, the key signal is stabilization. If price begins to move sideways after sharp volatility, it often indicates that forced selling is slowing. Sideways consolidation during a weekend can be a constructive sign, especially if volume gradually decreases.

On the other hand, continued erratic movement suggests uncertainty remains high. In such cases, traders typically wait for clearer structure before committing capital.

What BERA Reveals About Market Sentiment

BERA’s behavior this weekend may reflect how the broader market is handling supply-driven events. If BERA finds stability, it suggests traders are becoming more comfortable navigating unlock-heavy environments. If not, it could signal lingering risk aversion across altcoins.

Comparing the Three Altcoins This Weekend

Each of these altcoins to watch this weekend represents a different market dynamic. Chainlink reflects confidence in long-term infrastructure and institutional narratives. Hyperliquid highlights short-term volatility driven by supply changes and trader psychology. Berachain showcases how markets react to significant shifts in circulating supply.

Together, they offer a balanced view of the crypto landscape heading into February 7–8. Watching how these assets behave can provide valuable clues about whether the market is stabilizing, rotating, or preparing for another wave of volatility.

Conclusion

Weekends in crypto are less about prediction and more about observation. With reduced liquidity and heightened sensitivity to sentiment, price action during this period often reveals the market’s true posture. That’s why identifying the right altcoins to watch this weekend is so important.

Chainlink (LINK) stands out as a quality infrastructure play that reflects confidence in real utility and long-term adoption. Hyperliquid (HYPE) offers insight into how traders are digesting new supply and volatility. Berachain (BERA) provides a clear example of how large unlock events can reshape short-term price behavior.

As February 7–8 unfolds, these three altcoins will offer valuable signals for traders and investors alike. Whether you’re actively trading or simply observing market structure, keeping an eye on these names can help you better understand where the crypto market may head next.

FAQs

Q: Why are weekends important when tracking altcoins?

Weekends often have lower liquidity, which can amplify price movements and reveal true market sentiment without institutional influence.

Q: Are token unlocks always bearish for altcoins?

Not necessarily. While unlocks increase supply, their impact depends on demand and market conditions. Some unlocks are absorbed quickly with minimal downside.

Q: Is Chainlink still a good altcoin to watch despite being older?

Yes. Chainlink remains highly relevant due to its infrastructure role and continued expansion into advanced on-chain data use cases.

Q: How should beginners approach weekend crypto trading?

Beginners should focus on observation rather than aggressive trading, paying attention to support, resistance, and overall market behavior.

Q: Can weekend price action predict weekday trends?

While not guaranteed, strong or weak weekend performance often sets the tone for the following week, especially for high-interest altcoins.