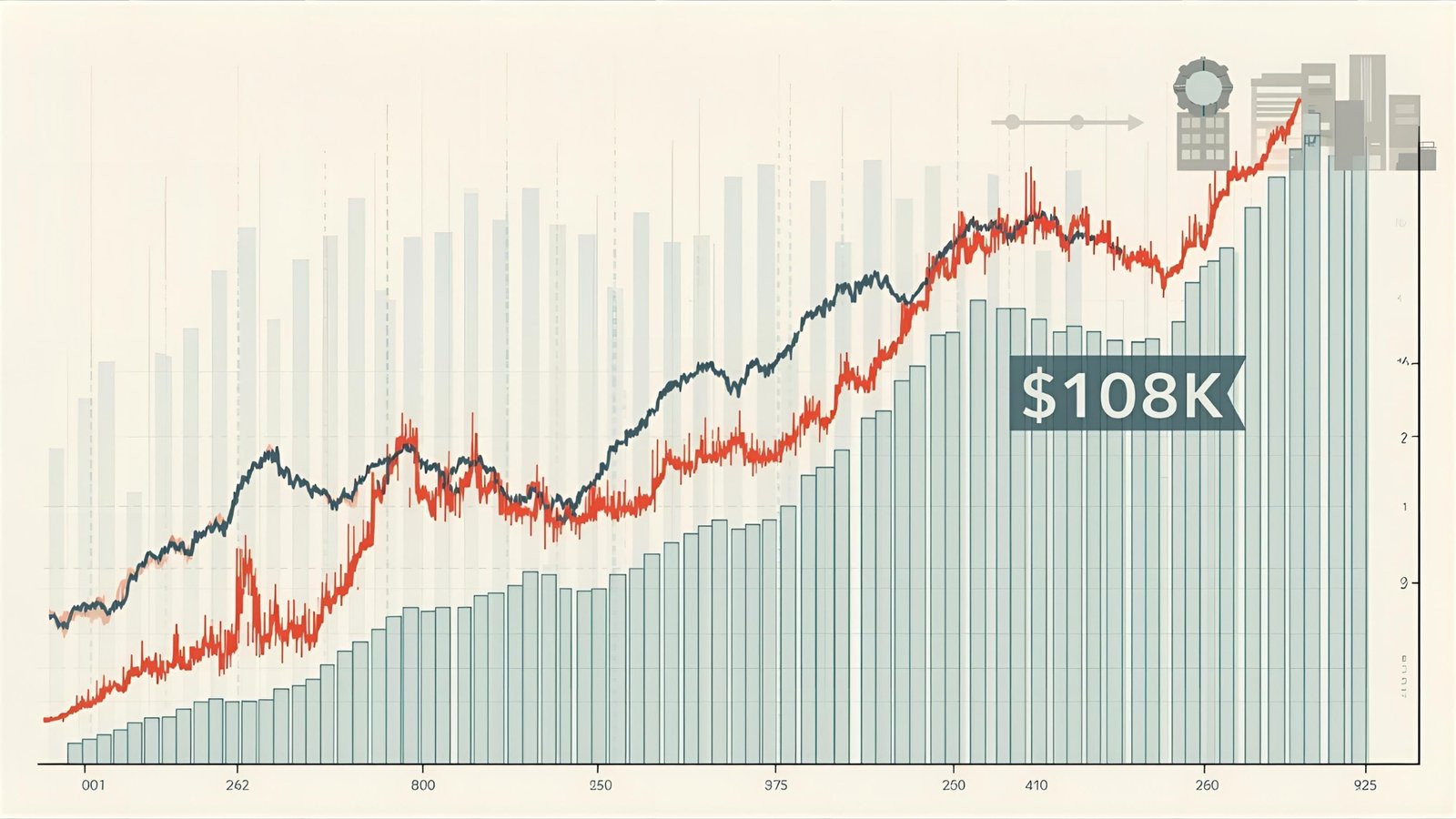

The late-September wobble that pushed the Bitcoin Price Bottom toward the $108,000 area left traders wondering whether another leg lower was coming—or whether that dip quietly marked a cycle-defining higher low. In fast-moving crypto markets, bottoms are recognised only in hindsight. But in this case, several independent data sets are converging on the same message:

The worst may already be over. Spot Bitcoin ETF demand remains resilient, long-term holder supply is near records, and the network’s mining fundamentals are printing fresh highs. Meanwhile, seasonality into Q4 and Bitcoin’s post-halving dynamics add supportive context that aligns with a bottoming process near $108K rather than a breakdown scenario. Recent trading has stabilised above the mid-$110Ks, roughly 10% below last month’s peak, backing the idea that sellers are tiring as buyers lean back in.

This article unpacks three reasons the decline appears exhausted—and why the path of least resistance may again tilt upward. We’ll look at institutional flows into spot ETFs, on-chain supply behaviour among long-term holders, and miner health via hashrate and difficulty. Along the way, we’ll place those signals in the macro and seasonal context that typically shapes fourth-quarter crypto performance.

Spot ETF demand re-accelerates, absorbing supply

Net creations continue to funnel capital directly into BTC

In this cycle, the arrival of U.S. spot Bitcoin ETFs fundamentally changed how capital enters the asset. When shares are created, authorised participants buy or deliver Bitcoin into ETF vehicles—turning primary-market demand into direct spot BTC absorption. Through September, multiple flow trackers reported renewed net inflows, led by BlackRock’s IBIT, even as prices chopped and headlines turned cautious. Data points include a day with roughly $300.5 million in net creations on September 3 and a strong September tally with hundreds of millions of dollars in positive flow, emphasising that demand returned quickly after the shakeout.

Earlier this year, market-structure analysts noted that IBIT climbed into the top five ETFs by year-to-date inflows across the entire U.S. ETF universe, a level of institutional adoption that simply didn’t exist in prior cycles. That “vacuum cleaner” effect—absorbing supply on red days and compounding on green days—helps explain why pullbacks have been shorter and shallower, and why the $108K drop was met with renewed buying rather than panic.

Prices held key support while flows stayed positive

When Bitcoin slid under $109,000 amid late-September liquidations, the move looked more like a forced-seller event than a trend change. Within days, BTC retraced back above $113,000–$114,000. That rebound coincided with steady sentiment and no systemic stress, suggesting that price weakness was met by structurally sticky ETF demand. Historically, bottoms often form when spot buyers quietly accumulate in fear, not when euphoria reigns. Recent price action fits that script.

On-chain signals show supply tightening, not loosening

Record long-term holder supply signals conviction

If you want to know where the Bitcoin price is headed beyond the next headline, follow the coins that rarely move. Long-term holders (LTHs)—addresses that have held their BTC for many months—tend to be the market’s strong hands. Over the summer, their coin supply surged to record highs near 14.46 million BTC, according to Glassnode data reported by CoinDesk. Rising LTH supply means more of the float is in patient custody rather than on exchanges, shrinking available supply and dampening downside follow-through on selloffs. That is exactly what we saw around $108K—a shove lower that failed to unlock broad LTH distribution.

Valuation metrics reset from froth to constructive

Another way to gauge risk/reward is the MVRV Z-Score, which compares Bitcoin’s market value to its realised value (the on-chain cost basis). Historically, extremes in MVRV have coincided with tops and bottoms. Mid-2025 readings fell substantially from earlier highs, with values around ~2–3—well off classic blow-off zones—pointing to a market that de-levered and rebalanced rather than one at unsustainable exuberance. While the exact print moves day-to-day, the broader takeaway is consistent: valuation froth cooled before and during the $108K dip, providing room for upside re-expansion.

Exchange balances and seasonality add context

September is often called “Rektember,” historically one of Bitcoin’s weakest months. Yet September 2025 bucked that trend with gains that ranked among the best in 13 years, underlining how supply dynamics and new demand channels have altered seasonal patterns. When a typically soft month finishes positive and with low realised volatility, it often marks accumulation rather than distribution—a setup that complements the bottoming thesis around $108K.

Miners are stronger than ever despite post-halving pressure

Hashrate and difficulty at record highs

Bitcoin’s security budget is reflected in hashrate and difficulty. Despite the April 2024 halving, both metrics have not only recovered but pushed to fresh all-time highs into September, signalling miners’ capital investment and confidence in future revenues. Recent estimates place network hashrate at unprecedented levels, with difficulty following suit. This matters for price because historically, persistent hashrate uptrends come alongside structurally bullish cycles, while miner capitulation often marks late-stage bottoms—conditions not currently present.

Post-halving digestion looks mature

Halvings reduce new BTC issuance, tightening structural supply. The most recent halving landed on April 19–20, 2024, and the following months typically involve miner margin recalibration. As the network hashrate/difficulty pushes higher alongside price stability above $110K, it suggests the market has worked through the post-halving digestion phase. With fewer new coins hitting the market each day and miners demonstrating resilience, the supply overhang that can weigh on price appears limited.

The macro and seasonal backdrop supports higher lows

Q4 tendencies and risk appetite

Bitcoin’s best months historically cluster in Q4, with October and November frequently producing robust gains. Analysts tracking cycle seasonality note that October has averaged sizable positive returns across many years, and 2025 is shaping up with the same undertone. That doesn’t guarantee a melt-up, but it does layer a statistical tailwind onto an already constructive on-chain and ETF-flow setup.

Correlation, but on Bitcoin’s terms

Short-term, Bitcoin’s correlation with equities has ticked up, but crucially, equity indices remain firm, and crypto’s own drivers—spot ETF flows, supply capture, miner investment—are in the driver’s seat. In recent sessions, even as U.S. political headlines injected uncertainty, the Bitcoin Price Bottom slotted back above key levels with poise. That resilience is consistent with a higher-low narrative rather than a breakdown to fresh cycle lows.

Why $108K looks like a bottom (or close to it)

The anatomy of a higher low

Bottoms in Bitcoin rarely look like picture-perfect “V” reversals. More often, they form as higher lows after a swift shakeout, with buyers stepping in sooner than the prior correction’s trough. The $108K area checks those boxes: a swift, liquidation-driven flush; ETF inflows that didn’t blink; LTH supply still near records; and miners powering the network at all-time-high security. Each component, on its own, argues against a deep and sustained breakdown. Together, they outline a credible bottoming case.

What would invalidate the thesis?

Good analysis also maps the risk. A sudden reversal in ETF flows (several consecutive sessions of net redemptions), a meaningful drawdown in LTH supply (coins moving to exchanges), or a sharp hashrate signalling miner distress would weaken the bottoming argument. For now, none of those conditions dominate the data; the balance of evidence favours the worst being behind us.

Putting it together: A constructive roadmap

Near term

In the near term, the market’s task is to reclaim and hold the mid-$110Ks to low-$120Ks, converting them into a sturdy range floor. That would set up attempts on last month’s all-time highs later in Q4, provided flows stay positive and volatility remains orderly. So far, price action has respected that script, stabilising around the $113K–$114K area after the $108K scare.

Medium term

As capital continues to funnel through spot ETFs, and as post-halving supply dynamics restrict new issuance, dips are likely to be shallow and contested. On-chain metrics show conviction holders entrenched, which historically precedes advances rather than breakdowns. In that environment, $108K looks less like a trap door and more like the launchpad for the next sustained leg.

Conclusion

No single metric can “prove” that Bitcoin price bottomed at $108K. But when ETF inflows remain firm, long-term holder supply sits near records, and miners are expanding hashpower to new highs, the burden of proof shifts. Add supportive Q4 seasonality and the natural post-halving supply squeeze, and the case that the worst is over becomes persuasive. The market may yet retest support or shake out weak hands—this is Bitcoin, after all—but the data argues that the September dip was a higher low, not the start of a deeper slide.

FAQs

Q: What exactly happened during the drop to ~$108K?

The slide below $109K was tied to a sharp liquidation wave and risk jitters, but spot ETF demand did not reverse. Prices quickly rebounded above $113K–$114K, consistent with a flush-and-recover pattern rather than a trend breakdown.

Q: Why do spot ETFs matter so much for Bitcoin now?

With U.S. spot Bitcoin ETFs, primary-market share creations require purchasing or delivering BTC, which directly absorbs supply. Sustained net inflows—including days with $300M+ creations—translate into steady demand independent of derivatives sentiment.

Q: How do long-term holders influence price bottoms?

When LTH supply climbs to record levels (around 14.46 million BTC mid-year), fewer coins are available to sell on exchanges. That supply scarcity tends to cushion drawdowns and supports higher-low formations after shakeouts.

Q: What do hashrate and difficulty tell us about price?

Rising hashrate and difficulty to all-time highs signal that miners are investing and confident about future revenues. Strong miner health historically aligns with bullish cycles, while miner capitulation often marks late-bear bottoms—conditions not evident now.

Q: Does the 2024 halving still matter in late 2025?

Yes. The April 19–20, 2024 halving permanently cut daily issuance, tightening structural supply. As the network hashrate climbs and ETF demand persists, that reduced issuance amplifies the impact of even modest net inflows, supporting the case that $108K was a bottom or very close to it.

See More: Current Bitcoin Price: How Much is Bitcoin Worth Today?