The cryptocurrency market stands at a pivotal moment as investors worldwide seek reliable insights into the bitcoin price forecast next 6 months. With Bitcoin recently achieving remarkable all-time highs above $124,000 and demonstrating unprecedented institutional adoption, understanding the potential price trajectory through early 2026 has become essential for both seasoned traders and newcomers alike. This comprehensive analysis examines expert predictions, technical indicators, and fundamental market drivers to provide you with an accurate bitcoin price forecast next 6 months outlook that could shape your investment decisions.

Current market dynamics suggest Bitcoin is entering a critical phase where multiple catalysts will converge to determine its valuation through the remainder of 2025 and into early 2026. The bitcoin price forecast next 6 months indicates we’re witnessing a transformative period marked by institutional legitimacy, regulatory clarity, and technological maturation that could propel Bitcoin to unprecedented levels.

Bitcoin’s Current Market Position

Bitcoin’s performance throughout 2025 has exceeded even the most optimistic projections from analysts and investment firms. Bitcoin has surged to $124,128 all-time high driven by ETF launch and institutional adoption, establishing a foundation that supports bullish sentiment for the bitcoin price forecast next 6 months. This surge represents more than just speculative momentum; it reflects fundamental shifts in how institutional investors perceive digital assets as a legitimate asset class.

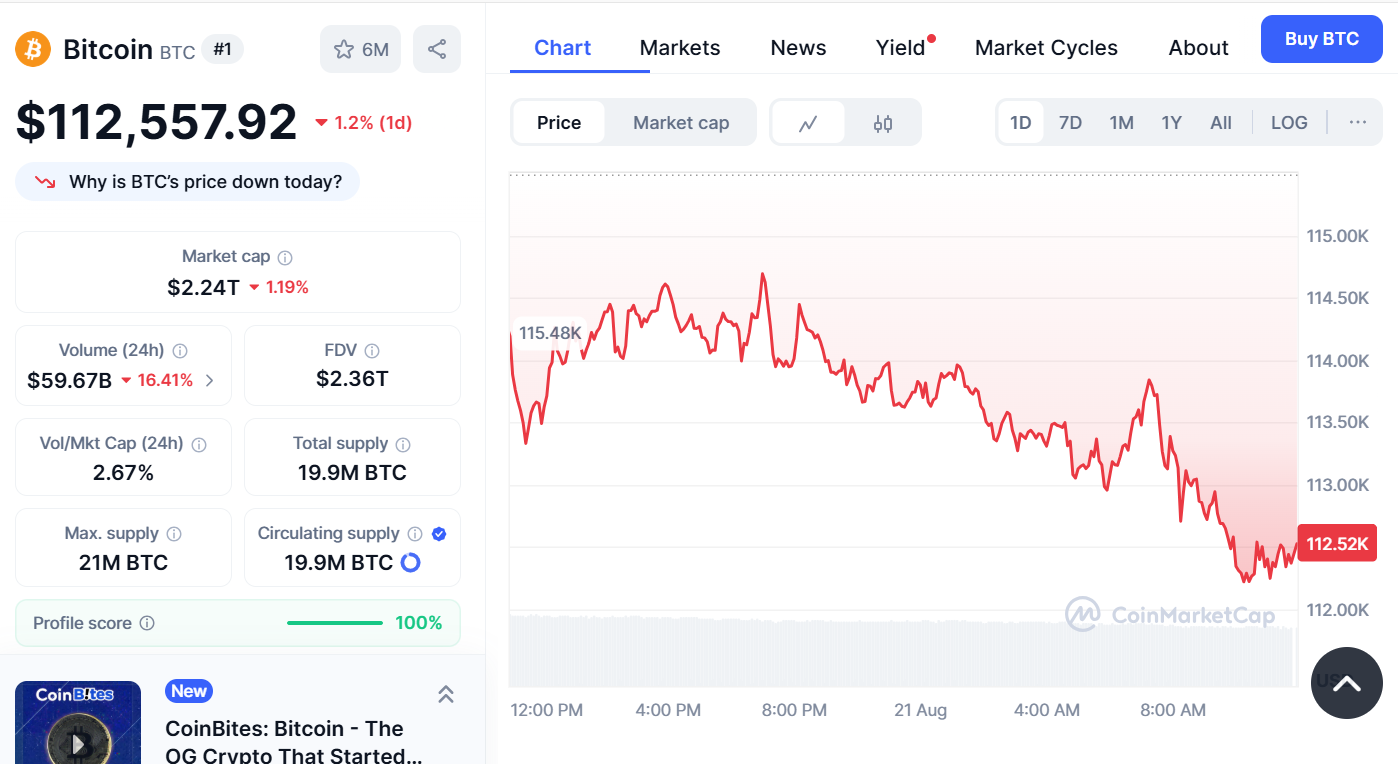

Bitcoin price prediction for August 2025 is at a critical stage as BTC tests $114K-$118K resistance zone, while institutional buying and rising ETF inflows fuel bullish momentum. These technical levels serve as crucial benchmarks for the immediate term cryptocurrency price predictions that analysts use to gauge market strength and potential breakout scenarios.

The transformation from speculative asset to institutional reserve currency has created unprecedented demand dynamics. This rally has been fueled by powerful, overlapping drivers with institutional adoption at an all-time high, as corporations, asset managers, and sovereign entities hold Bitcoin as a strategic reserve. This fundamental shift underpins the optimistic bitcoin price forecast next 6 months that many experts are proposing.

Bitcoin Price Forecast Next 6 Months Expert Predictions and Analysis

Leading cryptocurrency analysts have converged on remarkably bullish projections for the bitcoin price forecast next 6 months. Bitcoin may reach between $125K and $200K in 2025, according to most analyst forecasts, supported by ETF inflows, institutional adoption, and bullish technical patterns. These projections represent a significant evolution from earlier, more conservative estimates and reflect the accelerating pace of institutional adoption.

The technical analysis supporting these forecasts shows compelling momentum indicators. Based on analysis, Bitcoin price prediction suggests reaching $125K–$128K by August 28, 2025, though if support fails, consolidation could occur with downside risk into the $110K–$112K zone. This near-term target establishes a foundation for more aggressive longer-term projections within the bitcoin price forecast next 6 months timeframe.

Elliott Wave analysis provides additional confirmation of bullish sentiment. Experts remain on target to hit $135,000 – $140,000 by the end of 2025, utilizing the Elliott Wave Theory to identify predictable market movement patterns. This technical approach validates the fundamental analysis supporting higher BTC price predictions through the remainder of 2025.

Institutional Adoption Driving Long-Term Value

The institutional narrative has fundamentally transformed the bitcoin price forecast next 6 months landscape. The influx of institutional capital has fundamentally altered Bitcoin’s trajectory in 2025, with a significant portion of institutional portfolios now including digital assets, heralding a new phase of market maturity. This represents a paradigm shift from individual speculation to corporate treasury management and strategic asset allocation.

Exchange-traded funds continue to serve as primary vehicles for institutional exposure. The success of spot Bitcoin ETFs has created sustained demand pressures that support optimistic cryptocurrency market predictions. These financial products have democratized access while providing the regulatory framework that institutional investors require for participation.

Global regulatory progress and infrastructure maturation provided a stronger foundation for long-term adoption, with many institutional investors viewing crypto as a strategic asset class. This regulatory clarity removes significant barriers that previously hindered institutional participation, creating a more favorable environment for the bitcoin price forecast next 6 months.

Technical Analysis and Market Cycle Considerations

Traditional Bitcoin market cycles are experiencing significant evolution that impacts the bitcoin price forecast next 6 months. Bitcoin’s four-year price cycle, which has often had a predictable pattern, has shown signs of breaking or even disappearing altogether. This structural change suggests potential for more sustained growth patterns rather than the sharp boom-bust cycles that characterized earlier periods.

Experts believe the crypto market is entering a new growth cycle, potentially peaking between 2024 and 2025, aligning with the historical four-year market cycle theory. However, the evolution of these cycles indicates that traditional patterns may need recalibration for accurate bitcoin price analysis going forward.

The breakdown of historical cycles could actually support more optimistic projections within the bitcoin price forecast next 6 months. Without the predictable correction phases that characterized previous cycles, Bitcoin may experience more gradual, sustained appreciation supported by continuous institutional demand and improved market infrastructure.

Fundamental Drivers Supporting Price Appreciation

Multiple fundamental factors converge to support bullish bitcoin price predictions through the forecast period. Macroeconomic conditions including potential Federal Reserve policy adjustments, inflation concerns, and currency debasement fears create an environment favorable to alternative assets like Bitcoin. These macroeconomic tailwinds provide external validation for positive BTC forecasts extending through 2026.

Supply dynamics continue to favor price appreciation within any realistic bitcoin price forecast next 6 months. Bitcoin’s fixed supply schedule creates inherent scarcity that becomes more pronounced as institutional demand accelerates. The combination of limited supply and expanding demand from both retail and institutional sources creates fundamental support for higher valuations.

Network fundamentals demonstrate continued strength and growth. Hash rate achievements, Lightning Network adoption, and infrastructure development all contribute to Bitcoin’s value proposition as both a store of value and medium of exchange. These technological improvements support long-term cryptocurrency price predictions by enhancing Bitcoin’s utility and security.

Risk Assessment and Potential Corrections

Comprehensive bitcoin price forecast next 6 months analysis must acknowledge potential downside scenarios and risk factors. The crypto market tumbled to begin the week as heightened macro concerns triggered more than $500 million in long liquidations, demonstrating that volatility remains an inherent characteristic despite institutional adoption.

Market corrections of 20-40% remain possible even within bullish scenarios. Downside risk is limited by strong support near $70K–$75K, providing some comfort for long-term holders during potential temporary corrections. These support levels represent accumulation zones where institutional buyers have demonstrated sustained interest.

Regulatory developments, though generally positive, could introduce volatility if unexpected policy changes emerge. Geographic variations in regulatory approaches could create temporary market disruptions, though the overall trajectory toward acceptance and integration appears well-established across major markets.

Market Sentiment and Investor Psychology

Current market sentiment reflects cautious optimism tempered by awareness of Bitcoin’s volatile history. Crypto markets are poised for transformative growth in 2025, continuing their momentum of maturation and adoption, according to major institutional analysis. This sentiment supports sustained demand rather than speculative bubbles that characterized earlier periods.

The evolution from retail-driven speculation to institutional-led adoption has stabilized sentiment patterns. Professional investment managers apply disciplined approaches to position sizing and risk management, creating more sustainable demand patterns that support the bitcoin price forecast next 6 months.

Social media sentiment analysis shows predominantly bullish attitudes while maintaining healthy skepticism regarding extreme price targets. This balanced approach suggests mature market psychology that could support sustained appreciation rather than boom-bust cycles.

Comparative Analysis with Traditional Assets

Bitcoin’s correlation with traditional financial markets continues evolving as institutional adoption accelerates. During periods of macroeconomic uncertainty, Bitcoin increasingly demonstrates characteristics of both growth assets and inflation hedges, creating unique positioning within diversified portfolios.

The bitcoin price forecast next 6 months must consider these correlation dynamics as they influence institutional allocation decisions. As Bitcoin matures as an asset class, its behavior patterns may become more predictable relative to traditional assets, potentially reducing volatility while maintaining growth potential.

Portfolio allocation strategies increasingly incorporate Bitcoin as a strategic holding rather than tactical speculation. This structural shift supports sustained demand that underpins optimistic BTC price predictions extending through the forecast period and beyond.

Global Economic Factors and Market Impact

International economic conditions significantly influence the bitcoin price forecast next 6 months. Currency debasement concerns in major economies create demand for alternative stores of value, positioning Bitcoin favorably regardless of specific regional economic policies.

Central bank digital currency developments paradoxically support Bitcoin adoption by validating digital asset concepts while highlighting Bitcoin’s unique decentralized properties. This dynamic creates additional tailwinds for positive cryptocurrency market predictions as governments inadvertently promote digital asset awareness.

Geopolitical tensions and international sanctions increasingly demonstrate Bitcoin’s utility as a neutral, borderless asset. These real-world use cases provide fundamental support for valuation models that extend beyond pure speculation or investment vehicle applications.

Also Read: Bitcoin Price Prediction August 2025 Will BTC Hit $150K This Month?

Technology Development and Network Growth

Bitcoin’s underlying technology continues advancing through protocol improvements and layer-two solutions. Lightning Network adoption accelerates transaction throughput while maintaining security characteristics, enhancing Bitcoin’s utility for both large institutional transactions and retail payments.

Infrastructure development including custody solutions, trading platforms, and financial services creates an ecosystem that supports institutional participation. These improvements reduce friction and operational risks that previously hindered large-scale adoption, supporting the bitcoin price forecast next 6 months through enhanced usability.

Mining network security reaches new heights with hash rate achievements that demonstrate network resilience. This technical strength provides confidence for institutional investors concerned about security and operational risks, supporting sustained demand and positive bitcoin price analysis.

Investment Strategies and Portfolio Considerations

Strategic approaches to Bitcoin investment have evolved alongside institutional adoption patterns. Dollar-cost averaging strategies help mitigate timing risks while participating in long-term appreciation trends identified in the bitcoin price forecast next 6 months. This systematic approach aligns with institutional investment methodologies and reduces emotional decision-making impacts.

Risk management techniques become increasingly sophisticated as Bitcoin matures as an asset class. Position sizing relative to overall portfolio risk tolerance, correlation analysis with other holdings, and rebalancing triggers all contribute to disciplined approaches that support sustained institutional participation.

Tax considerations play increasingly important roles as Bitcoin appreciation accelerates. Long-term capital gains treatment, tax-loss harvesting opportunities, and jurisdiction-specific regulations all influence investment timing and structuring decisions within the bitcoin price forecast next 6 months framework.

Regional Market Dynamics and Adoption Patterns

Different geographic regions contribute varying influences to the global bitcoin price forecast next 6 months. North American ETF demand provides sustained institutional access, while European regulatory frameworks create additional legitimacy for institutional participation across developed markets.

Asian markets demonstrate strong retail adoption alongside growing institutional interest. Corporate treasury adoption in various countries creates additional demand sources that support positive cryptocurrency price predictions regardless of specific regional regulatory developments.

Emerging markets increasingly utilize Bitcoin for currency hedging and international transactions. This real-world utility creates fundamental demand that supports valuation models extending beyond pure investment speculation, contributing to sustained BTC forecast optimism.

Future Market Structure Evolution

The bitcoin price forecast next 6 months occurs within a rapidly evolving market structure landscape. Traditional financial institutions increasingly integrate Bitcoin services, creating additional access points and demand sources that weren’t available during previous market cycles.

Derivatives markets provide additional liquidity and price discovery mechanisms while enabling sophisticated hedging strategies. These developments create more efficient markets that may reduce volatility while supporting sustained appreciation trends identified in expert bitcoin price predictions.

Custody and security solutions continue improving, addressing institutional concerns about operational risks. These infrastructure improvements reduce barriers to participation while enhancing confidence in Bitcoin as a long-term strategic holding.

Long-Term Value Proposition Analysis

Bitcoin’s value proposition continues strengthening through demonstrated resilience, network effects, and institutional validation. The bitcoin price forecast next 6 months reflects these fundamental improvements rather than purely speculative dynamics that characterized earlier periods.

Monetary policy uncertainties in major economies create ongoing demand for alternative assets with predictable monetary policies. Bitcoin’s algorithmic supply schedule provides certainty that traditional currencies cannot match, supporting sustained institutional interest and positive cryptocurrency market predictions.

Network effects accelerate as adoption spreads across various user categories. Each new institutional participant increases Bitcoin’s legitimacy and utility, creating positive feedback loops that support optimistic BTC price predictions extending well beyond the immediate forecast period.

Conclusion

The bitcoin price forecast next 6 months presents compelling opportunities supported by unprecedented institutional adoption, favorable macroeconomic conditions, and technological maturation. Expert projections consistently target price levels between $125,000 and $200,000 by early 2026, reflecting fundamental shifts in how markets perceive Bitcoin’s role within global financial systems.

However, investors must maintain realistic expectations regarding volatility and potential corrections that remain inherent characteristics of Bitcoin markets. The evolution from speculative asset to institutional reserve currency creates more sustainable growth patterns, but temporary setbacks of 20-40% should be anticipated and planned for accordingly.

Successful navigation of this opportunity requires balanced approaches combining strategic allocation, disciplined risk management, and flexibility to adapt to rapidly changing market conditions. Whether you represent institutional capital or individual investment interests, understanding these dynamics becomes crucial for making informed decisions within the bitcoin price forecast next 6 months framework.