Crypto Goes Mainstream 2025 Digital currencies transitioned from speculative assets to mainstream financial instruments. This year witnessed unprecedented institutional adoption, regulatory clarity, and technological advancement that fundamentally altered how individuals, corporations, and governments perceive blockchain technology and cryptocurrency investments. The journey from fringe technology to household financial tool represents one of the most significant economic shifts of the 21st century.

Throughout 2025, the crypto market experienced remarkable growth, with total market capitalization reaching historic milestones that exceeded even the most optimistic predictions from previous years. Traditional financial institutions that once dismissed cryptocurrency as a passing trend now actively integrate digital assets into their core offerings. Major banks, investment firms, and payment processors have embraced blockchain-based solutions, fundamentally changing the infrastructure of global finance. This widespread acceptance signals that cryptocurrency has firmly established itself as a legitimate asset class deserving serious consideration from investors of all backgrounds.

The mainstream adoption of crypto in 2025 wasn’t merely about price appreciation or market capitalization growth. Instead, it represented a fundamental shift in how society views money, ownership, and financial sovereignty. Ordinary consumers began using cryptocurrency wallets for everyday transactions, while businesses incorporated blockchain solutions to streamline operations and reduce costs. This transformation occurred not through revolutionary disruption but through gradual integration into existing financial systems, making cryptocurrency accessible to everyone from tech-savvy millennials to traditional investors approaching retirement.

The Regulatory Revolution That Changed Everything

The regulatory landscape surrounding cryptocurrency underwent dramatic transformation in 2025, providing the clarity and legitimacy that markets desperately needed. Governments worldwide recognized that outright prohibition was neither practical nor desirable, instead opting for comprehensive frameworks that protect consumers while fostering innovation. The United States led this charge with landmark legislation that established clear guidelines for crypto exchanges, token classifications, and tax treatment of digital assets. This regulatory certainty removed significant barriers that previously prevented institutional investors from entering the market.

European Union countries collectively implemented the Markets in Crypto-Assets (MiCA) regulation, creating a unified approach to cryptocurrency regulation across member states. This harmonization eliminated the previous patchwork of conflicting national regulations that had complicated operations for crypto businesses and confused consumers. Asian markets, particularly Singapore and Japan, refined their already progressive frameworks to accommodate emerging trends like decentralized finance and non-fungible tokens. These regulatory developments didn’t stifle innovation but rather channeled it into productive directions that benefit both businesses and consumers.

The regulatory clarity achieved in 2025 had immediate positive effects on market stability and investor confidence. Crypto trading platforms implemented robust compliance measures, including enhanced know-your-customer protocols and anti-money laundering systems that satisfied government requirements while maintaining user privacy where appropriate. Institutional investors who previously cited regulatory uncertainty as their primary concern began allocating significant portions of their portfolios to cryptocurrency. The establishment of clear rules transformed cryptocurrency from a regulatory gray area into a well-defined asset class with predictable legal treatment.

Institutional Investment Reaches Critical Mass

Institutional adoption of cryptocurrency accelerated dramatically in 2025, fundamentally altering market dynamics and price stability. Major pension funds, endowments, and sovereign wealth funds announced substantial allocations to Bitcoin and other established cryptocurrencies, bringing unprecedented liquidity and legitimacy to the market. These institutional players approached cryptocurrency with the same rigorous analysis and risk management frameworks they apply to traditional assets, conducting thorough due diligence that validated the asset class for other conservative investors.

The approval and success of spot Bitcoin ETFs in early 2025 represented a watershed moment for institutional adoption. These exchange-traded funds provided traditional investors with familiar vehicles for gaining cryptocurrency exposure without the technical complexities of self-custody or the risks associated with unregulated exchanges. Within months, Bitcoin ETFs accumulated billions in assets under management, demonstrating massive pent-up demand from retail and institutional investors alike. This development effectively eliminated one of the final barriers preventing mainstream investment in cryptocurrency.

Corporate treasuries increasingly diversified into cryptocurrency throughout 2025, following the pioneering path established by forward-thinking companies in previous years. Technology firms, payment processors, and even some traditional corporations allocated portions of their cash reserves to Bitcoin and Ethereum, recognizing these assets as inflation hedges and long-term stores of value. This corporate adoption signaled confidence in cryptocurrency’s staying power and prompted other companies to seriously evaluate digital assets for their own balance sheets. The cascading effect of institutional adoption created a virtuous cycle that reinforced mainstream acceptance.

Technology Advancements That Enabled Mass Adoption

Technological improvements in 2025 addressed many of the usability challenges that previously hindered mainstream cryptocurrency adoption. Blockchain networks implemented scaling solutions that dramatically increased transaction throughput while reducing fees to levels competitive with traditional payment systems. Layer-2 networks and sidechains matured significantly, offering users fast and inexpensive transactions without sacrificing the security of base-layer protocols. These technical achievements made cryptocurrency practical for everyday purchases rather than limiting it to high-value transactions.

User experience improvements transformed cryptocurrency from a technology requiring technical expertise into something accessible to average consumers. Crypto wallets evolved into intuitive applications that rival traditional banking apps in ease of use, with features like social recovery, biometric authentication, and seamless fiat on-ramps. Major smartphone manufacturers integrated cryptocurrency functionality directly into their operating systems, allowing users to send and receive digital assets with the same simplicity as traditional messaging. These enhancements removed friction points that previously discouraged non-technical users from experimenting with cryptocurrency.

Crypto Goes Mainstream 2025 platforms matured significantly in 2025, offering sophisticated financial services without traditional intermediaries. Users accessed lending, borrowing, trading, and yield-generating opportunities through streamlined interfaces that abstracted away complex technical details. Smart contract security improved dramatically through better auditing practices and formal verification methods, reducing the frequency of exploits that had plagued earlier DeFi implementations. These developments transformed DeFi from experimental technology into legitimate alternatives to traditional financial services.

The Payment Revolution and Everyday Crypto Usage

Cryptocurrency transitioned from investment vehicle to practical payment method throughout 2025, with merchants worldwide accepting digital currencies for goods and services. Major payment processors integrated cryptocurrency functionality into their existing networks, allowing merchants to accept Bitcoin and other cryptocurrencies without technical expertise or infrastructure changes. This seamless integration meant consumers could pay with cryptocurrency wherever they normally used credit cards, fundamentally expanding the utility of digital assets beyond investment and speculation.

Cross-border payments emerged as a particularly compelling use case for cryptocurrency in 2025, with remittances and international business transactions increasingly settling through blockchain networks. Traditional wire transfers that previously took days and cost significant fees were replaced by near-instantaneous cryptocurrency transactions costing mere cents. Migrant workers sending money to families in their home countries particularly benefited from this development, retaining more of their hard-earned money instead of losing it to intermediary fees. This practical application demonstrated cryptocurrency’s genuine utility rather than theoretical promise.

Central bank digital currencies gained significant traction in 2025, with numerous countries launching or expanding pilot programs for government-backed digital currencies. These CBDCs bridged the gap between traditional fiat currencies and cryptocurrency, offering the efficiency and programmability of blockchain technology while maintaining government backing and monetary policy control. The coexistence of CBDCs and decentralized cryptocurrencies created a diverse ecosystem where different types of digital assets served complementary purposes. This development validated blockchain technology while acknowledging ongoing roles for both centralized and decentralized systems.

Market Maturation and Price Stability

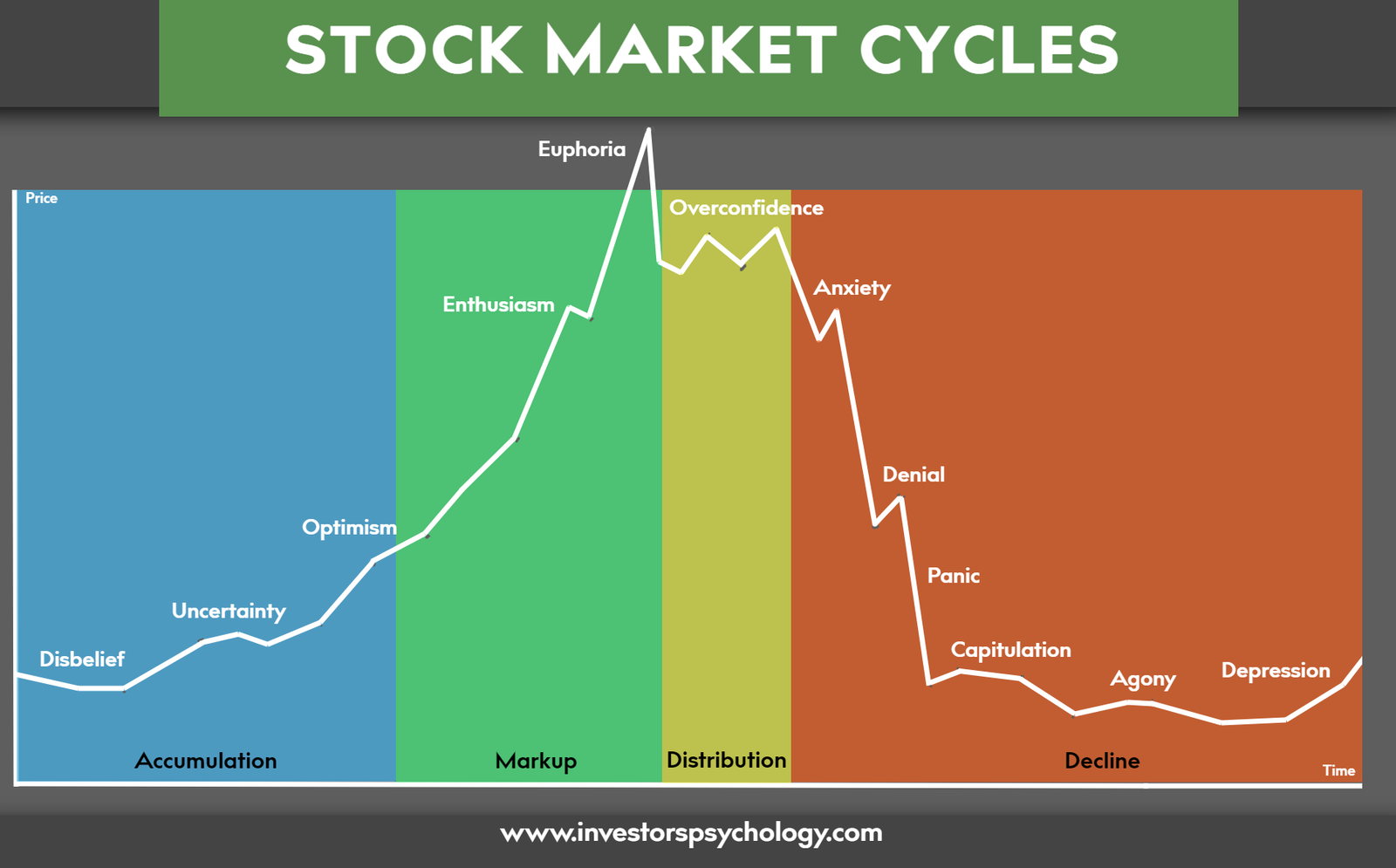

The cryptocurrency market demonstrated unprecedented maturity in 2025, with reduced volatility and more predictable price movements compared to previous years. Increased institutional participation brought sophisticated trading strategies and risk management approaches that dampened extreme price swings. The presence of large, long-term holders with low time preference created natural price support during downturns, while profit-taking by experienced investors prevented unsustainable parabolic rallies. This maturation made cryptocurrency more palatable to risk-averse investors and businesses considering it for operational purposes.

Crypto market analysis evolved significantly as traditional financial analysts applied their expertise to digital assets, creating robust frameworks for valuation and risk assessment. On-chain analytics matured into sophisticated tools providing insights into network health, holder behavior, and market sentiment. Professional research firms published comprehensive reports on cryptocurrency that met the same standards expected for traditional securities analysis. This analytical rigor helped investors make informed decisions rather than relying on speculation or hype cycles that characterized earlier market phases.

The diversification of the cryptocurrency ecosystem contributed to overall market stability in 2025, with numerous projects serving distinct use cases rather than competing directly. Bitcoin solidified its position as digital gold and store of value, while Ethereum maintained dominance in smart contract platforms and DeFi applications. Alternative layer-1 blockchains carved out niches serving specific industries or geographic regions. This specialization created a more resilient ecosystem where the success or failure of individual projects had limited impact on the broader market.

Education and Public Understanding

Public education initiatives in 2025 dramatically improved general understanding of cryptocurrency and blockchain technology, dispelling myths and misconceptions that previously hindered adoption. Universities expanded cryptocurrency coursework beyond computer science departments into business schools, law programs, and economics departments. Professional certification programs emerged for cryptocurrency advisors, ensuring that financial professionals guiding clients possessed genuine expertise rather than superficial knowledge. This educational infrastructure created a knowledgeable population capable of making informed decisions about cryptocurrency investments and usage.

Media coverage of cryptocurrency evolved significantly throughout 2025, with mainstream outlets moving beyond sensationalist headlines about price volatility toward substantive analysis of technological developments and regulatory changes. Respected financial journalists developed cryptocurrency expertise, producing balanced coverage that acknowledged both opportunities and risks. This responsible journalism helped the public develop realistic expectations rather than viewing cryptocurrency as either a guaranteed path to wealth or a fraudulent scheme. Nuanced media coverage contributed substantially to mainstream acceptance and informed decision-making.

Community-led education efforts complemented formal educational initiatives, with experienced cryptocurrency users creating accessible content for newcomers. Tutorials, workshops, and mentorship programs helped curious individuals navigate the learning curve without falling victim to scams or making costly mistakes. This grassroots education fostered a welcoming community atmosphere that encouraged questions and knowledge-sharing. The combination of formal education and community support created multiple pathways for people to learn about cryptocurrency at their own pace and comfort level.

The Environmental Narrative Shifts

Environmental concerns surrounding cryptocurrency mining underwent significant reevaluation in 2025 as the industry made substantial progress toward sustainability. Bitcoin mining operations increasingly utilized renewable energy sources, with many facilities locating near hydroelectric, solar, or wind farms that generated excess capacity. This transition transformed Bitcoin mining into a flexible energy consumer that could absorb surplus renewable energy that would otherwise go to waste. Studies demonstrated that cryptocurrency mining could actually support renewable energy development by providing reliable demand that justified infrastructure investments.

Ethereum’s successful transition to proof-of-stake consensus in previous years served as a model for other networks seeking to reduce energy consumption. Several major blockchain networks completed similar Crypto Goes Mainstream 2025, dramatically reducing their environmental footprints while maintaining security and decentralization. These technical achievements demonstrated that cryptocurrency could achieve its goals without excessive energy consumption, addressing one of the primary criticisms from environmentally conscious potential adopters. The environmental narrative shifted from whether cryptocurrency could become sustainable to how quickly the entire ecosystem could complete the transition.

Transparent reporting of energy consumption and carbon emissions became standard practice for cryptocurrency projects in 2025, allowing stakeholders to make informed decisions. Third-party auditors verified sustainability claims, preventing greenwashing and ensuring accountability. Some projects pioneered innovative approaches like carbon-negative operations that actively removed more carbon from the atmosphere than they emitted. This transparency and genuine commitment to environmental responsibility helped cryptocurrency overcome one of its most persistent public relations challenges.

Global Financial Inclusion Through Crypto

Cryptocurrency demonstrated its potential for advancing financial inclusion throughout 2025, providing banking services to populations previously excluded from traditional financial systems. Individuals in developing countries with unstable currencies used stablecoins to preserve purchasing power and conduct international transactions. The only requirements were a smartphone and internet connection, bypassing the documentation, credit history, and minimum balance requirements that excluded many people from traditional banking. This accessibility represented a genuine improvement in financial sovereignty for hundreds of millions of people worldwide.

Microfinance initiatives leveraged blockchain technology to provide small loans and financial services at lower costs than traditional microfinance institutions. Smart contracts automated loan servicing and repayment, reducing overhead costs and making smaller loan amounts economically viable. These blockchain-based microfinance programs reached rural and remote populations that traditional institutions found too expensive to serve. The combination of reduced costs and expanded reach demonstrated cryptocurrency’s potential for positive social impact beyond investment returns.

Remittance corridors saw particularly dramatic improvements as cryptocurrency enabled fast, low-cost international money transfers. Workers sending money to families in other countries retained more of their earnings instead of paying exorbitant fees to traditional remittance services. Several countries with large diaspora populations reported significant increases in remittance volumes as cryptocurrency made transfers more affordable. This practical application showcased cryptocurrency solving real problems for real people rather than serving only speculative investors.

Crypto’s Continued Evolution

Looking beyond 2025, the cryptocurrency ecosystem continues evolving rapidly with emerging trends and technologies promising further innovation. Integration between traditional finance and cryptocurrency deepens as banks, brokerages, and payment processors enhance their digital asset offerings. The distinction between crypto companies and traditional financial institutions blurs as each adopts features and technologies from the other. This convergence suggests a future where cryptocurrency and traditional finance coexist and complement each other rather than competing for dominance.

Technological development continues addressing remaining challenges around scalability, privacy, and user experience. Next-generation blockchain architectures promise even greater transaction throughput and lower costs while maintaining decentralization and security. Privacy-preserving technologies evolve to balance individual privacy rights with legitimate regulatory compliance needs. These ongoing improvements ensure that cryptocurrency infrastructure continues meeting user needs as adoption grows and use cases expand.

Crypto Goes Mainstream 2025 extends far beyond finance, influencing how people think about ownership, governance, and organizational structures. Decentralized autonomous organizations experiment with new forms of collective decision-making and resource allocation. Non-fungible tokens create novel approaches to digital ownership and creator monetization. These social and cultural dimensions of cryptocurrency may ultimately prove as transformative as the financial innovations that initially captured public attention.

Conclusion

The year 2025 marked a historic inflection point when cryptocurrency transitioned from fringe technology to mainstream financial infrastructure. Regulatory clarity, institutional adoption, technological advancement, and improved public understanding converged to create conditions for mass adoption. The crypto market demonstrated resilience and maturity that validated long-term believers while attracting new participants who previously remained skeptical. This transformation wasn’t merely about price appreciation but represented fundamental shifts in how society approaches money, ownership, and financial services.

The journey toward mainstream acceptance required overcoming substantial challenges including regulatory uncertainty, environmental concerns, security vulnerabilities, and usability barriers. The cryptocurrency community and industry addressed these challenges through persistent innovation, responsible self-regulation, and good-faith engagement with stakeholders. The result is a more robust, accessible, and sustainable ecosystem that serves diverse needs from investment and speculation to practical payments and financial inclusion.

As cryptocurrency continues evolving beyond 2025, its impact will likely extend far beyond finance into governance, social organization, and cultural expression. The technologies and principles underlying cryptocurrency challenge traditional assumptions about centralization, intermediation, and trust. Whether cryptocurrency ultimately fulfills its most ambitious promises or settles into a more modest role within the existing financial system, 2025 will be remembered as the year it definitively moved from the margins to the mainstream of global economic activity.

FAQs

Q: What made 2025 the breakthrough year for cryptocurrency adoption?

The convergence of several factors made 2025 the breakthrough year for mainstream crypto adoption. Regulatory clarity in major markets removed uncertainty that previously deterred institutional investors and businesses. The approval of Bitcoin ETFs provided familiar investment vehicles for traditional investors. Technological improvements dramatically enhanced usability and reduced transaction costs. Major corporations and financial institutions publicly embraced cryptocurrency, lending credibility and legitimacy. These developments collectively created a tipping point where cryptocurrency shifted from speculative asset to mainstream financial tool.

Q: Is cryptocurrency safe for average investors in 2025?

Cryptocurrency became significantly safer for average investors in 2025 compared to previous years, though risks remain. Regulatory frameworks now protect consumers through mandatory exchange insurance, transparency requirements, and enforcement against fraud. Reputable exchanges implement robust security measures including cold storage and insurance for customer funds. However, investors should still exercise caution, conduct thorough research, only invest amounts they can afford to lose, and use established platforms rather than unknown services. Education and responsible practices remain essential for safe cryptocurrency investing.

Q: How does cryptocurrency compare to traditional investments?

Cryptocurrency offers different characteristics compared to traditional investments like stocks and bonds. Digital assets tend to have higher volatility but also potentially higher returns, making them suitable for risk-tolerant investors seeking growth. Cryptocurrency provides portfolio diversification since its performance doesn’t always correlate with traditional markets. Unlike stocks representing company ownership, cryptocurrency represents various things depending on the specific asset including store of value, utility tokens, or governance rights. Most financial advisors suggest limiting cryptocurrency to a modest percentage of overall portfolios while maintaining core holdings in traditional assets.

Q: Can I use cryptocurrency for everyday purchases now?

Cryptocurrency became increasingly practical for everyday purchases throughout 2025, though cash and credit cards remain more universally accepted. Major payment processors now support cryptocurrency transactions, allowing merchants to accept digital assets without technical complexity. Some regions and merchants offer discounts for cryptocurrency payments due to lower processing fees. However, tax reporting requirements in many jurisdictions make small cryptocurrency purchases administratively burdensome. Stablecoins offer better price stability than volatile cryptocurrencies for everyday transactions. The practicality of cryptocurrency payments continues improving but varies significantly by location and merchant.

Q: What environmental impact does cryptocurrency have in 2025?

The environmental impact of cryptocurrency improved substantially in 2025 through multiple developments. Bitcoin mining increasingly utilizes renewable energy sources, with many operations powered entirely by hydroelectric, solar, or wind energy. Major blockchain networks transitioned to energy-efficient proof-of-stake consensus mechanisms that use a fraction of the energy required by proof-of-work mining. Industry transparency increased through standardized energy consumption reporting and third-party audits. While Bitcoin mining still consumes significant energy, much of it now comes from renewable sources or excess capacity that would otherwise be wasted. The cryptocurrency industry demonstrated that blockchain technology can operate sustainably with continued innovation and commitment.

Read More: 88% of Crypto Airdrops Flop, here’s how to Break the Curse