Next big cryptocurrency for 2026 is already underway, and it’s happening for a simple reason: crypto cycles don’t wait for headlines. Long before the broader market realizes a trend has shifted, early investors begin repositioning—moving away from yesterday’s winners and toward tomorrow’s possibilities. That’s exactly why conversations are changing. Instead of obsessing over the same large-cap coins, many traders and long-term holders are scanning the market for a cheap altcoin that still has room to grow.

But the phrase “cheap” can be misleading. A low price per token doesn’t automatically mean undervalued. What matters is the relationship between price, supply, adoption, and the utility that a project can realistically deliver. Still, it’s true that a cheap altcoin with credible fundamentals often attracts attention when investors start planning for the next leg of a bull cycle. That attention is magnified even more when the market narrative shifts toward real-world use cases like on-chain payments, decentralized finance, tokenized assets, AI integrations, scaling solutions, and better user experience.

So, what’s driving the current pivot? Part of it is psychology: investors want to be early on the next big cryptocurrency for 2026, not late to the last trend. Another part is macro: liquidity conditions, regulatory clarity, and institutional involvement can reshape where capital flows. And finally, there’s the tech: faster networks, better developer tools, and new token models are opening the door for emerging projects to compete.

In this article, we’ll unpack why investors are switching focus to this cheap altcoin category, what traits to look for, how to evaluate risk, and what could realistically make an asset the next big cryptocurrency for 2026. You’ll also see bolded LSI phrases and related terms throughout to help you understand the bigger context—without turning this into keyword soup. The goal is clarity: a human, engaging guide to making sense of the next cycle.

Why investors rotate into a cheap altcoin before major rallies

Investors rarely rotate because they’re bored. They rotate because they believe the risk-to-reward has shifted. When large-cap coins have already delivered significant gains, upside can appear more limited—especially in the short to medium term. That doesn’t mean big coins stop performing, but it can mean that percentage returns may be less explosive than what a smaller asset could potentially deliver.

This is where the idea of a cheap altcoin becomes so compelling. In every cycle, certain smaller projects capture attention due to a combination of narrative momentum and improving fundamentals. When that momentum builds, capital tends to move quickly. For anyone hunting the next big cryptocurrency for 2026, the early stage matters: the market often prices future potential long before the product feels “finished.”

Another reason rotation happens is that experienced investors look for asymmetric opportunities. A project doesn’t need to be perfect; it needs to be improving, gaining traction, and positioned in a sector with demand. This is why high-upside crypto projects are frequently discussed during periods of consolidation—when investors quietly accumulate rather than chase candles.

A final factor is the evolution of retail behavior. Retail traders often enter after big headlines. By the time a coin becomes the default answer to “what’s the next big cryptocurrency for 2026,” much of the easy upside may already be gone. That’s why investor focus shifts earlier, toward a cheap altcoin with catalysts that haven’t fully played out.

What “next big cryptocurrency for 2026” really means in practice

The next big cryptocurrency for 2026 is not necessarily the coin with the loudest marketing or the most dramatic short-term chart. In practical terms, “next big” usually describes a project that can sustain attention and adoption through multiple phases: discovery, early growth, broader adoption, and staying power.

To earn that status, a project typically needs three things. First, a product that solves a real problem—preferably in a market that is growing. Second, a credible path to adoption, which could come from integrations, partnerships, developer ecosystems, or user-friendly tooling. Third, a token model that makes sense, with incentives aligned so that growth benefits the network rather than just early insiders.

That’s why the next big cryptocurrency for 2026 is often found where technology meets usability. Crypto has matured past the phase where “decentralized” alone is enough. Many new users want speed, clarity, simple onboarding, and clear reasons to use a network.

In that environment, a cheap altcoin can break out if it’s attached to a narrative that remains relevant through 2026: layer-2 scaling, real-world asset tokenization, decentralized identity, cross-chain interoperability, or AI and blockchain infrastructure. These narratives are not guaranteed winners, but they are areas where real demand could expand.

The cheap altcoin thesis: price vs. value vs. market cap

When investors say they’re switching to a cheap altcoin, they’re often reacting to a price tag—like a token trading under a dollar. But price alone is the least informative metric in crypto. A token can cost $0.01 and still be “expensive” if supply is enormous and adoption is weak. Meanwhile, a token trading at $100 can be “cheap” relative to its market cap potential if usage grows fast.

A better framework is to compare price to value through market cap, circulating supply, emission schedules, and real demand. If you’re hunting the next big cryptocurrency for 2026, you want to understand whether price is low because the market hasn’t discovered the project yet—or because the project hasn’t proven itself.

This is why market cap matters more than token price. A cheap altcoin with a small-to-mid market cap can move faster because it takes less capital to reprice it upward. However, that same low market cap can mean higher volatility and less liquidity. In other words, the upside can be larger, but the ride can be rougher.

Value also depends on what drives token demand. If demand is purely speculative, growth may fade when hype cools. If demand is tied to actual utility—fees, governance, staking, access, or network usage—there’s a stronger case for sustained performance into 2026.

Key traits that can make a cheap altcoin the next big cryptocurrency for 2026

A cheap altcoin becomes a candidate for the next big cryptocurrency for 2026 when it checks multiple boxes at once. One box alone isn’t enough; the strongest contenders stack advantages.

Strong real-world use case and clear user demand

The best projects serve a purpose that people actually care about. That can mean cheaper transactions, faster settlement, privacy, easier developer deployment, or reliable cross-chain transfers. The market is increasingly rewarding projects that reduce friction.

If a project can demonstrate real usage—wallet growth, transactions, active addresses, developer commits, or meaningful integrations—it becomes easier for investors to justify switching focus. That’s especially true when the broader market narrative shifts toward utility-driven crypto rather than purely speculative plays.

Scalable infrastructure and long-term roadmap execution

A roadmap is just a promise until it ships. The next big cryptocurrency for 2026 is likely to come from a team that executes consistently and communicates clearly. Investors watch whether milestones are met and whether upgrades actually improve performance.

Scalability is not a buzzword here; it’s survival. Projects that can handle growth—without fees exploding or performance collapsing—have a stronger chance of staying relevant into 2026. That’s why sectors like layer-2 ecosystems, modular chains, and performance-focused networks keep attracting attention.

Tokenomics that reward sustainable participation

A project can be technically brilliant and still struggle if its token model is broken. If inflation is too high, early unlocks flood the market, or incentives encourage short-term farming, price can remain suppressed. For a cheap altcoin to become the next big cryptocurrency for 2026, tokenomics should align participation with long-term health.

This often includes sensible emissions, transparent vesting schedules, and mechanisms where network growth can translate into token demand. It doesn’t guarantee price appreciation, but it reduces structural headwinds that can keep a token “cheap” for the wrong reasons.

Community strength and narrative fit for the next cycle

Community isn’t just memes and hype. It’s also developer interest, ecosystem building, governance participation, and consistent engagement. A strong community can push adoption forward, attract integrations, and sustain attention during dips.

Narrative fit matters too. The market tends to rally around themes. If a cheap altcoin is positioned inside a narrative expected to matter through 2026—like Web3 payments, DeFi infrastructure, or tokenized assets—it has a better chance of becoming the next big cryptocurrency for 2026.

Why investors are switching focus now instead of later

Timing in crypto is never perfect, but behavior patterns repeat. Investors often switch focus during quieter moments: when hype is low, valuations are reasonable, and the market is building a base. That’s when a cheap altcoin can offer a more attractive entry compared to a coin that has already surged.

Another reason the switch happens early is that liquidity rotates in waves. Capital flows from majors to mid-caps and then to smaller caps in many cycles. If investors believe the next wave is coming, they try to position ahead of it. That doesn’t mean every small project will win, but it explains why “next big cryptocurrency for 2026” searches spike before the mainstream narrative catches up.

Finally, more investors are learning from past cycles. They’re trying to avoid buying tops and instead focus on projects with catalysts: network upgrades, major listings, partnerships, ecosystem grants, or upcoming product launches.

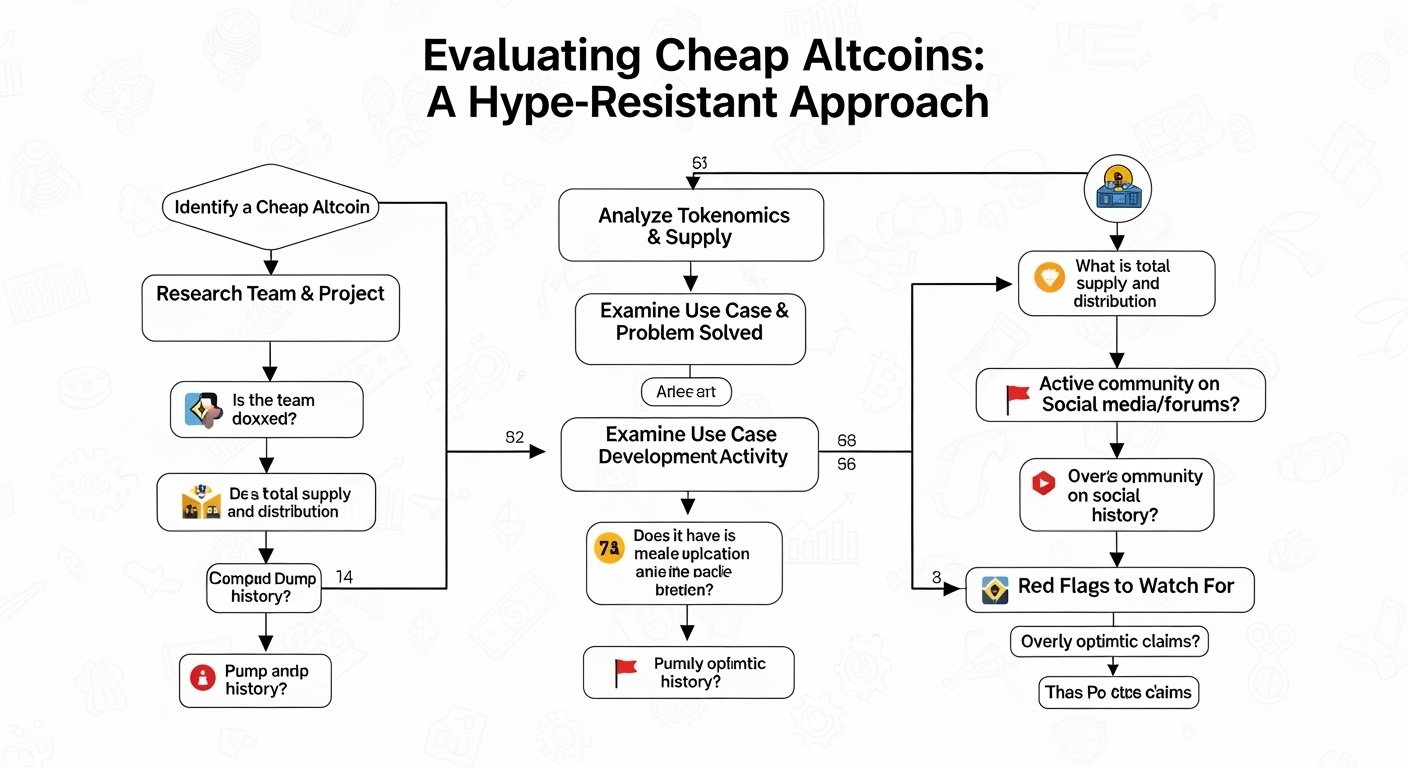

How to evaluate a cheap altcoin without getting trapped by hype

If you’re targeting the next big cryptocurrency for 2026, you need a filter strong enough to reject most projects. The market is full of noise, and hype can look like momentum right until it collapses.

The first step is to study fundamentals: what the project does, why it needs a token, and how adoption would realistically grow. Look for evidence of real development rather than vague promises. On-chain metrics can help, but they should be interpreted carefully because activity can be artificially inflated.

Next, examine token distribution and vesting. A cheap altcoin can remain cheap if large unlocks constantly add sell pressure. If insiders hold too much supply, the risk profile increases. Transparency is important here—good projects tend to publish tokenomics clearly.

Also consider liquidity and exchange support. If liquidity is thin, price swings can be dramatic, both up and down. A token can spike and crash in the same week. For long-term investors looking for the next big cryptocurrency for 2026, consistent liquidity and a growing set of venues can reduce risk.

Finally, evaluate competition. If the project is entering a crowded sector, it needs a clear edge. “We’re faster” is rarely enough. Differentiation might come from integrations, user experience, compliance alignment, unique architecture, or an ecosystem strategy that brings developers in.

Potential catalysts that could create the next big cryptocurrency for 2026

The next big cryptocurrency for 2026 will likely ride multiple catalysts, not just one. A catalyst creates attention, but sustained growth requires follow-through.

One major catalyst is product maturity. When a network shifts from “promising” to “useful,” adoption can accelerate. Another catalyst is ecosystem expansion—developer grants, launchpads, better tooling, and integrations that make building easy.

Regulatory clarity can be a catalyst too. When rules become clearer, institutional participation can increase, and capital can flow toward projects that are positioned for compliance and longevity. Similarly, macro liquidity improvements can lift the entire market and amplify gains in a cheap altcoin segment.

Narratives can also act as catalysts. If the market rallies around decentralized finance, cross-chain liquidity, or RWA tokenization, projects aligned with those themes can outperform—even if they were ignored months earlier.

Risk factors investors must understand before chasing the next big cryptocurrency for 2026

Chasing the next big cryptocurrency for 2026 is exciting, but it comes with real risk. Smaller coins can be more volatile, more easily manipulated, and more sensitive to project setbacks. A single exploit, regulatory issue, or failed upgrade can erase years of price progress.

Smart investors also recognize that most projects will not become the next big thing. Survivorship bias is huge in crypto. For every winner, there are many tokens that stagnate or fade. That’s why position sizing, diversification, and risk management matter—especially with a cheap altcoin that can swing wildly.

Another major risk is liquidity risk. Even if a project looks strong, exiting a large position can be difficult if trading volume is low. And finally, narrative risk is real: the market may decide a theme is “done” even if the technology is good. The best approach is to combine conviction with humility.

Conclusion

The idea of the next big cryptocurrency for 2026 is appealing because it suggests there’s a clear winner waiting to be discovered. In reality, the next breakout often looks obvious only in hindsight. Still, investors switch focus to a cheap altcoin category for rational reasons: higher upside potential, earlier positioning, and exposure to emerging narratives that could dominate the next cycle.

The most effective strategy is not chasing hype, but finding projects with real traction, strong execution, sensible tokenomics, and a narrative fit that could stay relevant through 2026. If you treat “cheap” as a starting point rather than a conclusion, you’ll make better decisions. The next big cryptocurrency for 2026 may come from the altcoin market—but it will be the one that earns attention through utility, adoption, and consistent delivery.

FAQs

1) What does “next big cryptocurrency for 2026” actually mean?

It usually refers to a crypto asset that could see significant adoption and price growth by 2026, supported by real utility, strong execution, and sustained market narrative rather than a short-lived pump.

2) Is a cheap altcoin always a good investment?

No. A cheap altcoin can be cheap because it’s undervalued or because the tokenomics, adoption, or project quality is weak. Market cap, supply, and demand drivers matter far more than token price.

3) How can I research a cheap altcoin before investing?

Review the project’s use case, roadmap delivery, token distribution, vesting schedule, developer activity, ecosystem growth, and liquidity. If those fundamentals don’t hold up, hype won’t save it.

4) What sectors are most likely to produce the next big cryptocurrency for 2026?

Sectors with expanding demand include layer-2 scaling, DeFi infrastructure, cross-chain interoperability, and real-world asset tokenization—but no sector is guaranteed.

5) What are the biggest risks when chasing the next big crypto?

The biggest risks include high volatility, low liquidity, token unlock sell pressure, smart contract exploits, regulatory uncertainty, and narrative shifts that can pull attention away from otherwise solid projects.