The phrase “inner recession” isn’t an official economic term, but it captures something investors recognize instantly: the moment people feel poorer, more uncertain, and more defensive even before the data confirms a downturn. In that psychological slowdown, spending habits tighten, risk appetite shrinks, and capital starts migrating toward safety. In this environment, gold breaks US$5,500 not merely as a headline, but as a symbol of a deeper shift in market behavior—one where trust, liquidity, and perceived durability matter more than growth narratives.

At the same time, the digital asset market tells a different story. Rather than collapsing outright or surging into euphoria, crypto consolidates. Price action moves sideways, volatility compresses, and traders hesitate. That contrast—gold breaking upward while crypto consolidates—reveals a tug-of-war inside portfolios. On one side sits the instinct to protect purchasing power with hard assets, safe-haven demand, and inflation hedges. On the other side sits the desire to stay exposed to innovation—blockchain, digital assets, and long-term adoption—without taking the full emotional hit of a drawdown.

This is what makes the current setup so compelling. When gold breaks US$5,500, it’s rarely due to a single cause. It tends to be a layered event: a combination of macro stress, currency doubts, policy uncertainty, and a collective preference for assets that feel “real.” Meanwhile, when crypto consolidates, it often means the market is waiting—on regulation clarity, liquidity returning, a catalyst in rates, or simply a new narrative powerful enough to overpower fear. Together, these moves paint a picture of investors battling their own instincts: the urge to run for safety versus the hope that risk assets will recover.

In this article, we’ll explore what it means when gold breaks US$5,500, why crypto consolidates during periods of psychological recession, and how investors can think clearly when emotions become the most influential economic indicator.

Gold Breaks US$5,500: What a Move Like This Really Signals

When gold breaks US$5,500, it isn’t just a technical breakout; it’s a message about confidence. Gold is often described as a store of value, but in practice it behaves like a barometer of trust in policy, currency stability, and the future purchasing power of cash. A surge of this magnitude suggests investors are not simply hedging—they’re repositioning.

One driver behind such an upswing is the perception that real rates are less attractive than they appear. Even if nominal yields look high, markets may believe inflation will remain sticky or that growth risks will force policy pivots that undermine those yields. In that scenario, the appeal of holding cash or bonds weakens, and gold’s role as an inflation hedge becomes more attractive. When gold breaks US$5,500, the market may be pricing in a long period of uncertainty where the true return on “safe” assets isn’t safe at all.

Another implication is currency skepticism. Gold often rallies when people fear currency debasement, rising sovereign debt loads, or expanding deficits. Investors don’t need hyperinflation to buy gold; they only need to believe that policymakers have fewer good options left. A significant gold breakout can reflect a demand for neutrality—an asset that isn’t someone else’s liability.

Finally, a move where gold breaks US$5,500 may also reflect structural demand such as central bank accumulation and long-horizon institutional flows. Even when speculative traders drive short-term acceleration, the more durable trend often comes from buyers who aren’t trying to time a top. In psychological downturns, that kind of sticky demand can turn a rally into a re-rating.

The “Inner Recession” Effect on Gold Demand

An inner recession shifts behavior before it shifts GDP. People delay purchases, reduce discretionary spending, and “feel” recessionary conditions even if official data remains mixed. In markets, this shows up as a preference for capital preservation, lower leverage, and assets with a long history of surviving crises.

That’s where gold thrives. When gold breaks US$5,500, it can reflect a collective emotional decision: investors would rather be early to safety than late to risk. Even those who believe growth will eventually rebound may still buy gold as an insurance policy against the path getting worse before it gets better.

Why Crypto Consolidates While Gold Surges

It might seem counterintuitive that gold can surge while crypto consolidates, especially given the “digital gold” narrative that has followed Bitcoin for years. But consolidation isn’t failure—it’s often the market digesting competing signals.

Crypto assets are still highly sensitive to liquidity conditions. When monetary policy is tight or when financial conditions feel fragile, speculative capital tends to retreat. Even if long-term believers continue to accumulate, the marginal buyer—the one who pushes prices aggressively—may step away. This is when crypto consolidates, creating a range where buyers and sellers temporarily agree on value.

At the same time, crypto is influenced by factors gold doesn’t face in the same way: regulatory headlines, exchange and custody risks, technological cycles, and narrative rotations between majors and smaller tokens. During periods of widespread anxiety, investors often simplify. They choose fewer positions, fewer unknowns, and less complexity. Gold is simple: it has no protocol risk, no software risk, no dependency on an issuer. That doesn’t make crypto inferior, but it does make it easier to postpone buying until clarity returns.

Consolidation as a Sign of Maturing Market Structure

When crypto consolidates, it can indicate that the market is becoming more structured. Consolidation phases often feature tighter spreads, more hedging activity, and a shift from retail-driven momentum to institution-influenced positioning. Instead of wild swings, the market rotates capital, absorbs supply, and waits for a catalyst.

This can be healthy. A sustained period where crypto consolidates may reduce leverage, flush weak hands, and set the groundwork for a more stable advance later. In other words, gold breaking upward may represent a fear trade, while crypto consolidating may represent patience.

Macro Forces Behind Gold’s Breakout and Crypto’s Pause

When gold breaks US$5,500 and crypto consolidates, the macro backdrop usually involves a complex mix of inflation psychology, growth anxiety, and policy uncertainty. Investors are not reacting to a single headline—they’re reacting to a world where outcomes feel less predictable.

A key factor is the ongoing debate over whether inflation is defeated or merely resting. If markets believe inflation can re-accelerate—or that it will remain high enough to erode purchasing power—gold benefits as a long-term hedge. Even if inflation prints cool temporarily, supply-side constraints, geopolitics, or energy volatility can keep inflation expectations alive.

Growth uncertainty also matters. If consumers and businesses become cautious, earnings forecasts can soften and risk assets can struggle to attract new buyers. In that setting, gold’s appeal rises and crypto consolidates because traders don’t want to overcommit without confirming momentum.

Policy credibility is another driver. Markets often price gold higher when central banks appear boxed in: ease too soon and risk inflation; stay tight too long and risk recession. That dilemma is fertile ground for a breakout where gold breaks US$5,500.

The Role of Geopolitics and Fragmentation

Gold has historically responded to geopolitical stress because it’s viewed as a neutral reserve. When trade blocs fragment, when sanctions expand, or when global supply chains face disruption, gold can attract flows from entities seeking stability outside the traditional financial system.

Crypto can also respond to fragmentation, but in a more uneven way. Some investors view crypto as a parallel system; others view it as a risk asset. That split perception is one reason crypto consolidates while gold rallies: the market is still deciding which identity matters most in the current moment.

Market Psychology: The Battle Inside Investor Portfolios

The most powerful driver of an “inner recession” is psychology. When people feel uncertain, they anchor to safety. They prefer assets that reduce stress rather than maximize returns. That’s why, in this environment, gold breaks US$5,500 can feel inevitable—because the purchase is as much emotional as it is analytical.

Gold ownership often represents a desire for control. It’s a way to say, “No matter what happens, I own something that has survived centuries.” Crypto ownership often represents optimism about the future. When fear rises, optimism doesn’t disappear, but it becomes cautious. That caution is how crypto consolidates: investors still want exposure, but they want confirmation.

This tug-of-war creates portfolio tension. Some investors reduce crypto exposure to increase gold. Others hold both, viewing gold as insurance and crypto as asymmetric upside. In both cases, the inner recession shapes decisions. Investors don’t just ask what will perform; they ask what will help them sleep.

Narrative Rotation: From Growth to Defense

When the market shifts from “risk-on” to “risk-aware,” narratives change. The stories that worked in easy-money conditions—hypergrowth, endless liquidity, aggressive speculation—lose dominance. Defensive narratives take over: wealth preservation, safe-haven assets, hard money, and risk management.

In that narrative environment, it makes sense that gold breaks US$5,500 while crypto consolidates. Gold perfectly fits the defensive story. Crypto may still fit it for some, but not for everyone, and not with the same simplicity.

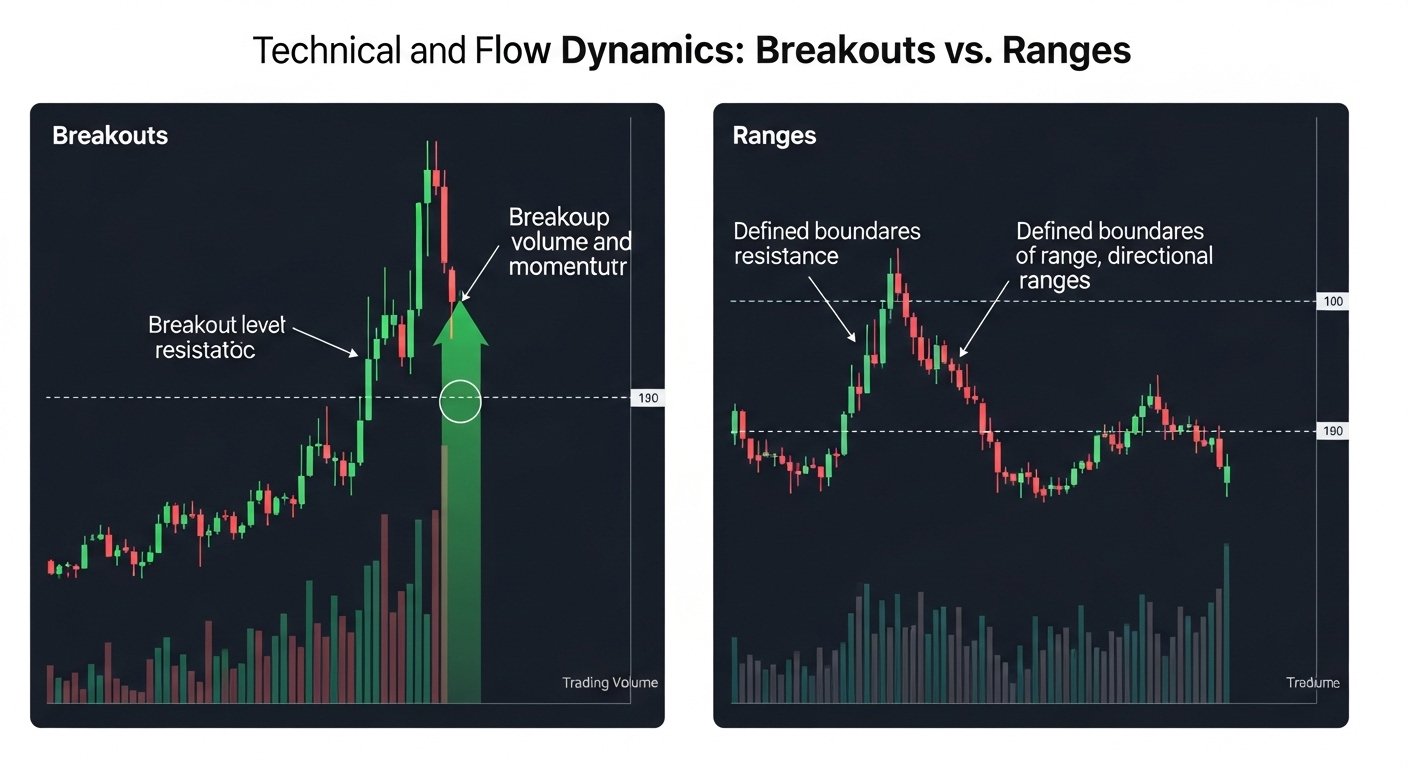

Technical and Flow Dynamics: Breakouts vs Ranges

Technical behavior often mirrors macro psychology. When gold breaks US$5,500, it typically does so by clearing major resistance levels, triggering momentum strategies, and pulling in trend-following capital. Breakouts create urgency. Investors fear missing the move, so they chase, which reinforces the trend.

When crypto consolidates, it reflects the opposite: agreement rather than urgency. Buyers step in at support, sellers take profit at resistance, and the market forms a range. Ranges often occur when conviction is split and new information is needed to resolve the debate.

Flow dynamics matter here. Gold markets benefit from deep liquidity and a broad set of buyers, from individuals to institutions to central banks. Crypto markets can be liquid too, but the buyer base and leverage profile can shift quickly. In uncertain times, that can translate into consolidation rather than breakout.

The Liquidity Lens: Why Timing Feels Different

Liquidity is like oxygen for risk assets. When it’s abundant, speculative markets expand. When it’s scarce, markets become selective. In inner-recession conditions, liquidity often feels psychologically scarce even before it becomes mechanically scarce. Investors hoard cash, reduce leverage, and demand higher certainty.

That’s why crypto consolidates: liquidity isn’t gone, but it’s cautious. Meanwhile, gold can rally precisely because fear reallocates liquidity toward defense.

What This Means for Long-Term Investors

For long-term investors, the key is not to worship a single narrative. A world where gold breaks US$5,500 while crypto consolidates is a world where diversification of “beliefs” matters as much as diversification of assets.

Gold can serve as portfolio insurance, especially when policy uncertainty and inflation risk rise. Crypto can serve as a long-duration bet on new financial infrastructure and monetization models. The challenge is sizing: holding enough of each to benefit, but not so much that volatility dictates behavior.

Long-term investors also need to recognize that inner-recession markets punish impatience. Gold’s breakout can tempt late buyers to chase. Crypto’s consolidation can tempt frustrated holders to capitulate. Both impulses can be costly. In these environments, a calmer approach—one that focuses on time horizon—often outperforms frantic repositioning.

Risk Management Without Overreacting

If gold breaks US$5,500, it’s reasonable to ask whether the move is sustainable or stretched. If crypto consolidates, it’s reasonable to ask whether the range is accumulation or distribution. But neither question should be answered with panic.

A smarter framing is: What role does each asset play in my plan? Gold is typically about protection and stability. Crypto is typically about growth and optionality. If you treat them as the same thing, inner-recession stress can force you into inconsistent decisions.

Potential Catalysts: What Could Break the Standoff

Markets rarely stay in extremes forever. If gold breaks US$5,500 and keeps climbing, the catalyst may be a worsening of inflation expectations, a new phase of geopolitical stress, or a clear loss of confidence in fiscal sustainability.

For crypto, a phase where crypto consolidates can resolve upward if liquidity improves, regulatory clarity reduces headline risk, or adoption narratives strengthen. It can resolve downward if risk sentiment deteriorates sharply or if a systemic shock pushes investors into pure defense.

The most important point is that consolidation is not inactivity; it’s preparation. When crypto consolidates, it often precedes a larger move. The question is whether the next impulse aligns with the macro environment or defies it.

Conclusion: The Inner Recession Trade-Off

When gold breaks US$5,500, it’s not just a price milestone—it’s a psychological milestone. It reflects investors choosing certainty, durability, and protection in a moment when the future feels fragile. When crypto consolidates, it reflects a different psychological state: cautious optimism, waiting for confirmation, and refusing to abandon the long-term thesis even while respecting short-term risk.

Together, these trends tell a coherent story: investors are battling an inner recession where emotions front-run data. In this environment, the best advantage isn’t prediction—it’s discipline. Gold and crypto can both play meaningful roles, but only if investors understand what each one represents and why they hold it. Whether gold continues higher or crypto breaks out of consolidation, the real challenge remains the same: staying rational when markets try to make you reactive.

FAQs

Q: Why does gold break US$5,500 during recession fears?

When gold breaks US$5,500, it often reflects elevated demand for safe-haven assets as investors worry about growth, policy uncertainty, and long-term purchasing power. Gold benefits when trust in risk assets weakens.

Q: If crypto consolidates, does that mean crypto is bearish?

Not necessarily. When crypto consolidates, it can signal balance and digestion after volatile moves. Consolidation may represent accumulation by long-term holders or uncertainty ahead of a catalyst, rather than outright weakness.

Q: Is gold a better hedge than crypto in an inner recession?

In an “inner recession,” gold often performs as a clearer store of value because it’s widely accepted and less sensitive to liquidity swings. Crypto can still act as a hedge for some investors, but it may behave more like a risk asset in the short term.

Q: What should investors watch when gold breaks US$5,500?

Investors typically watch real yields, inflation expectations, currency strength, and broader risk sentiment. If gold breaks US$5,500 and holds, it may indicate sustained defensive positioning rather than a short-lived spike.

Q: What could end the phase where crypto consolidates?

A breakout from the range where crypto consolidates often needs a catalyst such as improved liquidity conditions, clearer regulation, stronger institutional flows, or a renewed risk-on environment that boosts demand for digital assets.

Also More: Crypto Stocks Split as Bitcoin Miners Surge Higher