Bitcoin has once again entered a period of uncertainty as prices retreat from recent highs and market confidence weakens. The latest price decline has reignited long-standing disagreements among traders, analysts, and institutional observers about where the world’s largest cryptocurrency is headed next. While some see the drop as a routine correction within a long-term bullish cycle, others argue it may signal deeper structural weakness and prolonged downside pressure.

The intensity of the discussion highlights Bitcoin’s unique position in global markets. Unlike traditional assets, Bitcoin trades at the intersection of technology, macroeconomics, and investor psychology. When prices fall sharply, interpretations multiply. Bullish voices emphasize historical recovery patterns and long-term adoption trends, while bearish analysts focus on liquidity constraints, weakening momentum, and fragile support levels.

This divergence has made the current moment particularly complex. Bitcoin analysts debate market outlook amid price decline not just because price is falling, but because multiple narratives appear equally plausible. Understanding these perspectives is essential for investors trying to navigate volatility without being swayed by emotion or noise.

In this article, we explore why Bitcoin’s price decline has split analyst opinion, what technical and macro signals matter most, how institutional behavior influences sentiment, and what scenarios could unfold next. The goal is not to predict the future with certainty, but to provide clarity in a market defined by uncertainty.

Why the Bitcoin price decline is dividing analysts

Bitcoin’s recent decline has forced market participants to reassess assumptions that were widely held during more optimistic phases. For months, many believed that increasing institutional involvement and broader acceptance would reduce volatility. Instead, the sell-off reminded investors that Bitcoin remains highly sensitive to shifts in liquidity and sentiment.

Some analysts interpret the decline as a natural correction after an extended rally. From this perspective, price weakness helps reset overheated indicators, flush excessive leverage, and create healthier conditions for the next advance. Supporters of this view often argue that volatility is not a flaw but a defining feature of Bitcoin’s growth process.

Others disagree, suggesting that the drop exposes underlying fragility. They point to declining trading volumes, reduced risk appetite, and the market’s reliance on speculative capital. According to this camp, the price decline reflects more than short-term fear and could indicate a broader revaluation of crypto risk.

These opposing interpretations explain why Bitcoin analysts debate market outlook amid price decline so intensely. The same data—falling prices, increased volatility, and cautious sentiment—can support either a bullish reset or a bearish continuation, depending on context and timeframe.

The bullish case: a corrective phase within a larger cycle

Bullish analysts emphasize Bitcoin’s historical tendency to experience sharp corrections even during strong long-term uptrends. From their perspective, pullbacks are not only normal but necessary to sustain future growth. They argue that the current decline resembles previous phases where price consolidation eventually led to renewed strength.

Supporters of this view also highlight Bitcoin’s fixed supply and ongoing adoption. Despite short-term price weakness, they see continued development in infrastructure, custody solutions, and regulatory clarity as reasons for optimism. In their view, the market is temporarily mispricing Bitcoin due to fear rather than fundamentals.

For these analysts, the Bitcoin price decline represents opportunity rather than danger. They believe patient investors may benefit from accumulating during periods of pessimism, provided they can tolerate volatility and avoid overexposure.

The bearish case: warning signs of prolonged weakness

Bearish analysts take a more cautious stance, arguing that Bitcoin’s recent decline reflects structural issues rather than temporary imbalance. They focus on declining momentum, failure to reclaim key resistance levels, and reduced inflows of fresh capital.

From this angle, the market appears vulnerable to further downside if confidence continues to erode. Bearish commentators often warn that previous support zones could fail, leading to accelerated selling as stop-losses trigger and leveraged positions unwind.

This camp also questions whether institutional participation truly stabilizes the market. Instead of acting as long-term anchors, large players may amplify volatility by exiting positions quickly during risk-off periods. For bearish analysts, the current environment justifies defensive positioning rather than aggressive buying.

Key price levels shaping the Bitcoin market outlook

Technical analysis plays a central role in how analysts interpret Bitcoin’s market outlook. During periods of decline, attention naturally shifts to price levels that may determine whether selling pressure continues or stabilizes.

Support and resistance zones are particularly important because they influence trader behavior. When price approaches support, buyers assess whether demand is strong enough to absorb selling. If support fails, sentiment can deteriorate rapidly.

Support zones and market confidence

A support level becomes meaningful when it consistently attracts buyers and halts declines. Analysts watch not only whether Bitcoin reaches a support zone, but how it behaves once there. A brief bounce followed by renewed selling often signals weak demand, while sustained consolidation suggests accumulation.

In the current environment, uncertainty around support reflects broader hesitation. Many traders prefer confirmation rather than anticipation, which can delay buying activity and allow price to drift lower.

Resistance and the challenge of recovery

Resistance levels become especially relevant after sharp declines. These are areas where previous buyers may look to exit positions, creating selling pressure. Analysts note that failed attempts to reclaim resistance can reinforce bearish sentiment. For Bitcoin to improve its market outlook, many analysts believe it must demonstrate strength by breaking above key resistance zones and holding them. Until that happens, rallies may be viewed with skepticism.

Macro conditions influencing Bitcoin’s price decline

Bitcoin’s behavior is increasingly linked to global macroeconomic conditions. While often described as an alternative asset, Bitcoin frequently trades in line with broader risk sentiment, especially during periods of uncertainty. Interest rates, inflation expectations, and monetary policy all influence the flow of capital into speculative assets. When financial conditions tighten, investors tend to reduce exposure to volatile instruments like Bitcoin.

Interest rates and liquidity

Higher interest rates generally reduce appetite for risk by increasing the attractiveness of safer assets. When borrowing becomes more expensive, leverage decreases, and speculative trades unwind. This dynamic can weigh heavily on Bitcoin during tightening cycles. Analysts closely monitor central bank signals for clues about future liquidity. Even subtle shifts in tone can affect market sentiment and trigger significant price movements.

Currency strength and global risk appetite

A strong reserve currency often coincides with reduced global liquidity. In such environments, assets perceived as risky may struggle to attract capital. Bitcoin, despite its unique characteristics, is not immune to these forces. Understanding macro trends helps explain why Bitcoin analysts debate market outlook amid price decline. Price action is not driven solely by crypto-specific factors but by broader economic dynamics.

Institutional behavior and its impact on sentiment

Institutional participation has reshaped Bitcoin’s market structure. Large funds, corporations, and investment vehicles now influence price dynamics in ways that differ from retail-driven cycles. While institutional involvement was once viewed as a stabilizing force, recent price action has challenged that assumption. Analysts note that institutions often follow strict risk management rules, leading to rapid exits during periods of volatility.

Investment vehicles and flow dynamics

Structured investment products can magnify market moves. Inflows provide steady demand, but outflows can accelerate declines. Analysts track these flows closely, as they offer insight into broader sentiment. During the current Bitcoin price decline, concerns about sustained outflows have contributed to cautious outlooks among analysts.

Corporate holdings and psychological effects

Corporate Bitcoin holdings also influence perception. When market prices approach or fall below corporate acquisition costs, headlines can amplify fear, even if those entities have long-term intentions. Such narratives can impact short-term sentiment, reinforcing bearish interpretations and discouraging new buyers.

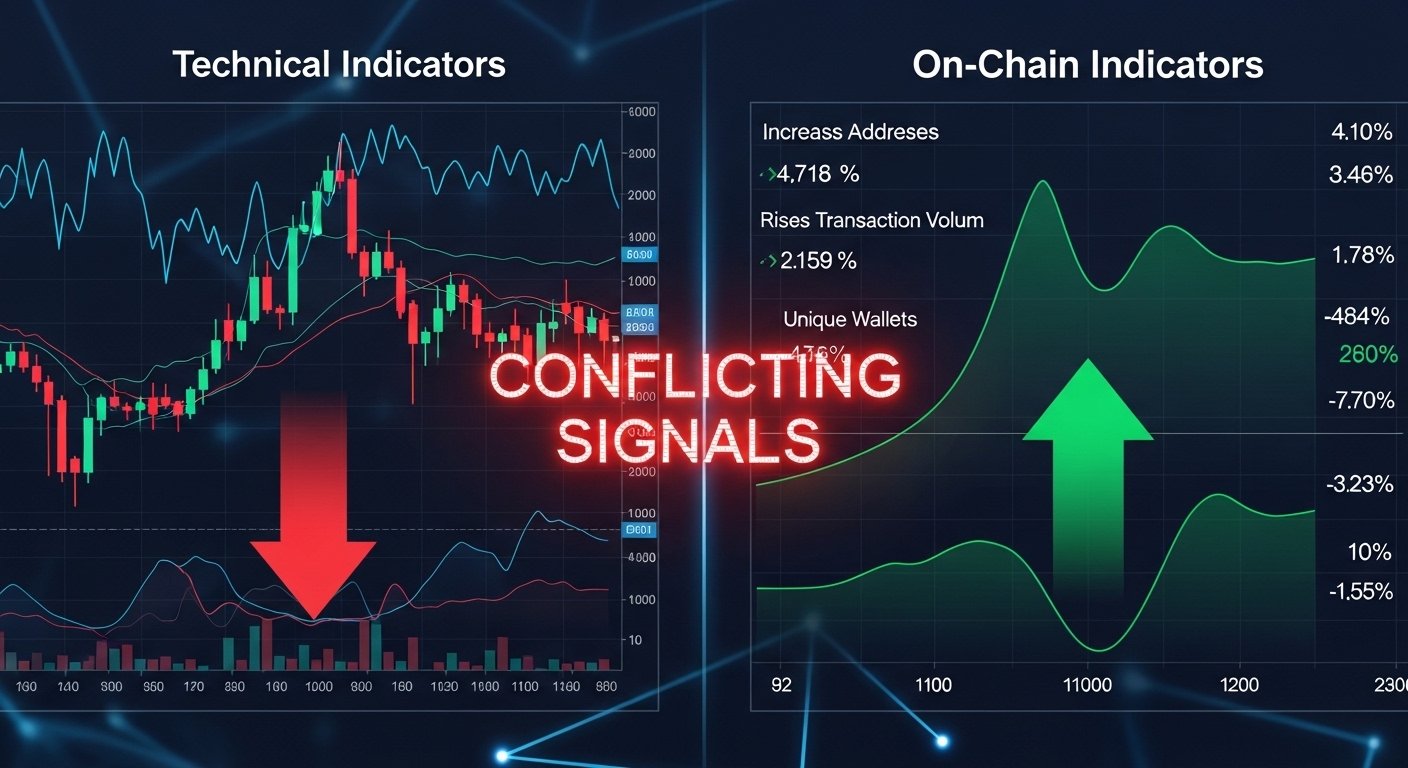

Technical and on-chain indicators: conflicting signals

One reason analysts disagree so strongly is that indicators often send mixed messages. Momentum oscillators may suggest oversold conditions, while trend indicators continue to point downward. On-chain data adds another layer of complexity. Metrics related to holding behavior, transaction activity, and network usage can be interpreted in multiple ways, depending on timeframe and assumptions.

Leverage and volatility

Leverage plays a critical role during declines. Forced liquidations can push prices lower than expected, creating sudden spikes in volatility. Analysts debate whether recent liquidations represent capitulation or merely an early phase of deleveraging. Until leverage is fully reduced, many analysts remain cautious about declaring a bottom.

Long-term structure versus short-term weakness

Some analysts focus on long-term trends, arguing that short-term weakness does not invalidate broader adoption narratives. Others prioritize immediate price structure, emphasizing that trends remain bearish until proven otherwise. This tension underscores why Bitcoin analysts debate market outlook amid price decline with such intensity. Both perspectives can coexist, even if they imply very different strategies.

Possible scenarios for Bitcoin’s next move

Rather than relying on a single forecast, many analysts consider multiple scenarios. This approach acknowledges uncertainty and helps investors prepare for different outcomes.

Stabilization and consolidation

In this scenario, Bitcoin finds a range where selling pressure diminishes. Volatility decreases, and price moves sideways as buyers and sellers reach temporary balance. This outcome could restore confidence gradually.

Short-term rebound followed by renewed weakness

Another possibility is a relief rally driven by short covering. While such rebounds can be sharp, they may fail if broader conditions remain unfavorable. Analysts warn that failed rallies often lead to deeper declines.

Extended downside and capitulation

The most bearish scenario involves further breakdowns and widespread capitulation. While painful, this process can eventually create conditions for a durable bottom by exhausting sellers.

Conclusion

Bitcoin’s latest price decline has reopened fundamental debates about its role, resilience, and future trajectory. Bulls view the sell-off as a corrective phase within a larger growth story, while bears interpret it as a warning sign of deeper structural weakness. The reality may lie somewhere in between.

As Bitcoin analysts debate market outlook amid price decline, investors are reminded that certainty is rare in volatile markets. Price levels, macro conditions, and institutional behavior all matter, but none provide absolute answers on their own.

For participants, the most practical approach is to remain informed, manage risk carefully, and recognize that Bitcoin’s history is defined by cycles of fear and recovery. Understanding the arguments on both sides can help investors make more balanced decisions in uncertain times.

FAQs

Q: Why is Bitcoin experiencing a price decline?

Bitcoin prices can decline due to macroeconomic tightening, reduced liquidity, shifting risk sentiment, and the unwinding of leveraged positions.

Q: Are Bitcoin analysts bearish or bullish right now?

Analysts are divided. Some see the decline as a healthy correction, while others believe it signals prolonged weakness.

Q: What role do institutions play in Bitcoin’s volatility?

Institutions can amplify both gains and losses through large inflows and outflows, especially during periods of market stress.

Q: Can Bitcoin recover after this decline?

Historically, Bitcoin has recovered from major drawdowns, but timing and magnitude vary depending on market conditions.

Q: How should long-term investors view the current market?

Long-term investors often focus on fundamentals and cycles, while remaining aware of short-term risks and volatility.