A single day of Bitcoin ETF inflows reaching $844 million is the kind of market event that forces everyone—from long-term allocators to short-term traders—to re-check their assumptions. Days like this stand out not only because of the size, but because of what they imply: institutions didn’t just nibble, they re-engaged with force. In a market that often swings between extremes of fear and euphoria, a major surge in Bitcoin ETF inflows can act like a spotlight, revealing where real capital is moving and why.

Spot Bitcoin ETFs have become one of the cleanest, most transparent windows into institutional behavior. Unlike opaque over-the-counter activity or fragmented exchange flows, ETF creations and redemptions reflect an organized pipeline for demand. When Bitcoin ETF inflows accelerate sharply, it signals a renewed willingness to gain exposure through regulated vehicles that fit within familiar compliance frameworks. In other words, it’s not just crypto-native enthusiasm; it’s traditional capital expressing a view.

The headline number—$844 million—also matters because it tends to change how narratives form. When inflows are modest, the story can remain ambiguous: maybe it’s retail, maybe it’s tactical. But when the market prints a figure this large, it suggests the presence of serious buyers with size, patience, and a mandate. That’s why talk of institutions “resuming accumulation” feels credible here. Accumulation is not a one-day impulse; it’s a process. The question is whether this day marks the start of a sustained phase or a powerful burst that fades.

In this article, we’ll unpack what a one-day $844 million surge in Bitcoin ETF inflows can mean, how institutions use spot Bitcoin ETFs, what catalysts can trigger a return of demand, and what investors should watch next. Along the way, we’ll naturally weave in LSI keywords and related phrases—like spot Bitcoin ETFs, institutional accumulation, digital asset investment, crypto market liquidity, and Bitcoin price momentum—to provide the context searchers actually want.

Understanding Bitcoin ETF Inflows and Why They Matter

Bitcoin ETF inflows describe net new money entering Bitcoin exchange-traded funds over a period, usually a day. If inflows are positive, it means more capital entered the ETF products than left them after accounting for redemptions. This is a big deal because spot ETFs are designed to offer exposure that aligns with traditional market infrastructure—brokerage accounts, wealth platforms, and institutional custodians.

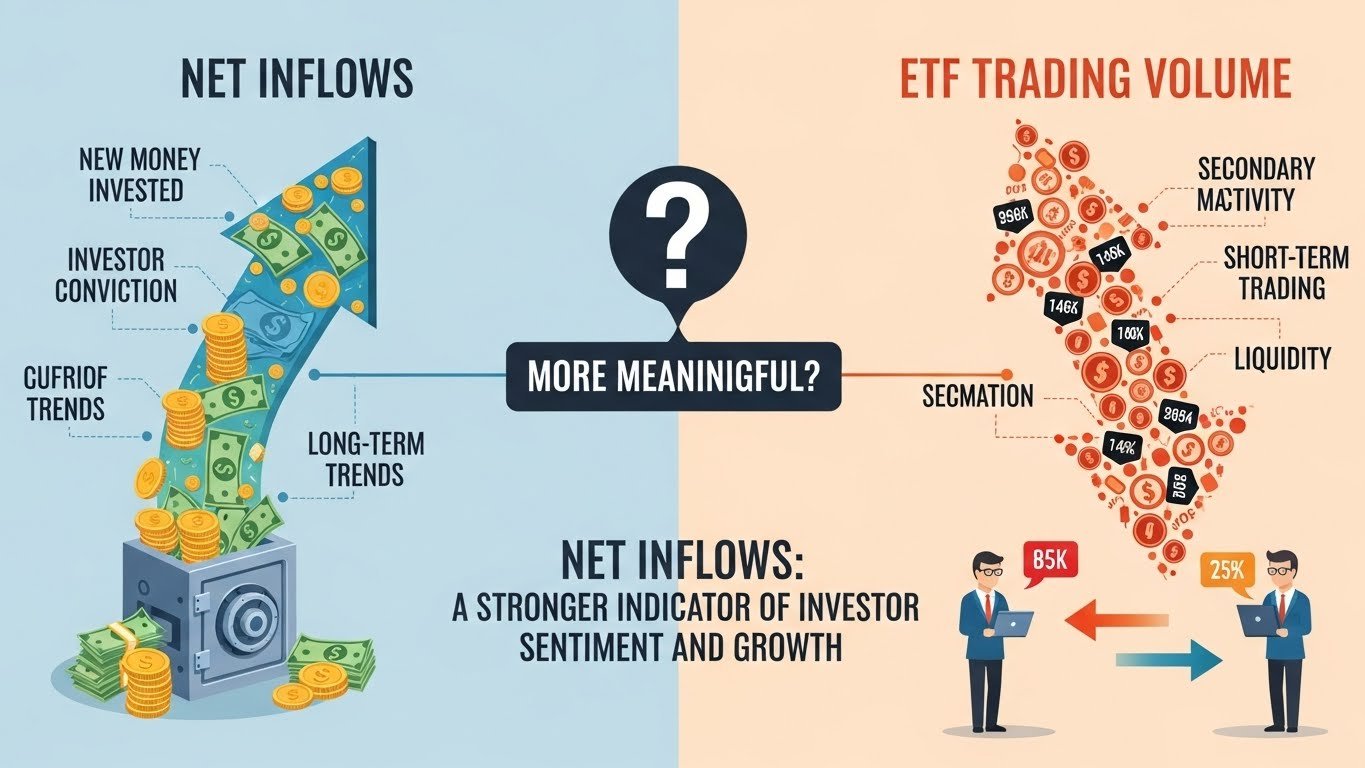

Why net inflows are more meaningful than ETF trading volume

A common confusion is mixing trading activity with real demand. ETFs can trade heavily on exchanges without necessarily bringing new money into the ecosystem, because one investor can sell shares to another. Bitcoin ETF inflows, however, represent net new exposure being created. While operational mechanics vary, net inflows generally correspond to additional underlying Bitcoin exposure being acquired or allocated via the ETF structure. That’s why sustained Bitcoin ETF inflows often correlate with firmer price action and improving sentiment.

What a $844M inflow day signals in market language

In market terms, $844 million in Bitcoin ETF inflows is an “institutional-sized print.” It suggests that demand was not merely speculative chatter. It indicates decision-making: committees approving allocations, advisors placing orders, platforms facilitating flows, or macro strategies rotating capital. The size also hints at confidence returning—confidence that the product works, liquidity is sufficient, and the timing makes sense relative to risk.

Why Institutions Resume Accumulation Through Spot Bitcoin ETFs

Institutions rarely behave like retail. They don’t typically chase narratives; they chase frameworks—risk models, portfolio construction rules, and long-term theses. When institutions “resume accumulation,” they often do it through tools that minimize operational friction and maximize reporting clarity. That’s exactly what spot Bitcoin ETFs provide.

The compliance advantage of regulated crypto exposure

For many professional allocators, the problem isn’t interest in Bitcoin—it’s implementation. Direct custody introduces complexity. Exchange accounts create counterparty risk. Internal policies can restrict access to non-traditional rails. Spot ETFs reduce those barriers. When Bitcoin ETF inflows surge, it can reflect a structural preference: “We want exposure, but we want it in the wrapper we already trust.”

Institutional accumulation is often incremental, not dramatic

Even on a day when Bitcoin ETF inflows spike to $844 million, institutional accumulation usually remains a layered process. Many allocators scale in over time, increasing exposure during favorable regimes and trimming when volatility rises. That’s why the term institutional accumulation doesn’t imply a single buy—it implies an evolving position.

The role of liquidity and market depth

Institutions care deeply about liquidity. A regulated ETF structure can provide tighter spreads, deeper order books, and a smoother path for large orders than fragmented exchange venues. Rising Bitcoin ETF inflows can therefore reflect confidence in crypto market liquidity and the ability to transact at size without excessive slippage.

What Could Trigger a One-Day Surge in Bitcoin ETF Inflows

A huge inflow day is rarely caused by one factor. It’s more often a convergence: macro conditions shift, price structure improves, and investor psychology moves from cautious to constructive.

Macro sentiment and risk-on rotations

Bitcoin trades in a global macro landscape. When investors feel less pressure from tightening conditions and more optimism about liquidity, risk assets tend to benefit. In these regimes, Bitcoin ETF inflows can rise as allocators increase exposure to assets perceived as higher-beta opportunities or alternative stores of value.

Price structure and momentum confirmation

Institutions do respond to momentum, but typically through systematic rules rather than emotion. A reclaim of key levels, a breakout from a range, or a sustained higher-low pattern can trigger rebalancing and trend-following allocations. When the market starts to move with strength, Bitcoin ETF inflows can accelerate as confirmation replaces hesitation.

Portfolio rebalancing and allocation cycles

Institutional allocation often follows calendars. Funds rebalance, models update, and advisory platforms adjust portfolios. A surge in Bitcoin ETF inflows can reflect these mechanical flows as much as it reflects narrative. Importantly, mechanical flows can still be meaningful, because they demonstrate that Bitcoin exposure is becoming embedded in standard portfolio processes.

Which Bitcoin ETFs Typically Capture Institutional Demand

When Bitcoin ETF inflows spike, flows often concentrate in the largest funds because institutions prioritize liquidity, stability, and operational ease. The biggest spot Bitcoin ETFs tend to become the default vehicles for many professional buyers.

Why scale matters for institutional buyers

Large funds tend to offer deeper liquidity, potentially tighter spreads, and strong integration across brokerage and custody systems. For a large allocator, execution quality matters. If a fund can absorb a big order with minimal friction, it becomes attractive. This helps explain why major inflow days can show heavy concentration.

Why diversified inflow distribution can be a stronger signal

Even though concentration is normal, it’s also worth watching whether inflows broaden across multiple issuers. If Bitcoin ETF inflows appear across a wider set of funds, it can suggest broader market participation. Breadth often aligns with healthier demand, as it implies multiple channels—wealth platforms, advisors, and different institutional groups—are engaged.

How Bitcoin ETF Inflows Interact With Bitcoin’s Supply and Demand

Bitcoin is a supply-constrained asset with a known issuance schedule. Demand shifts can create outsized price impact, especially when new demand arrives through highly visible vehicles.

The psychological impact of measurable demand

One reason Bitcoin ETF inflows matter is that they are easy to track. Visibility changes behavior. When traders and investors see demand arriving through ETFs, sentiment can improve, leading to increased participation elsewhere. This is a form of reflexivity: flows shape perception, perception shapes positioning, positioning shapes price.

The absorption effect and selling pressure

If new inflows arrive while sellers are active, ETFs can help absorb supply. In periods where there’s profit-taking or risk reduction, strong Bitcoin ETF inflows can act as a stabilizer, reducing the magnitude of pullbacks. Conversely, if inflows fade while selling increases, volatility can rise.

Why one day is a spark, not a trend

A $844 million day is powerful, but trend durability matters more than a single print. Sustained Bitcoin ETF inflows over multiple days or weeks are more likely to reshape the demand curve. A single day can still be meaningful, but it’s best viewed as the opening chapter of a possible shift—not the entire story.

Are Bitcoin ETF Inflows a Reliable Leading Indicator for Price?

Many investors want a simple answer: do Bitcoin ETF inflows predict Bitcoin’s next move? The reality is nuanced.

When inflows tend to lead

Inflows are most price-relevant when they are persistent and when the broader market is not overloaded with leverage. In that environment, steady demand can lift price in a healthier way. If Bitcoin ETF inflows remain strong while volatility stays controlled, it often supports a constructive trend.

When inflows can lag or mislead

Sometimes inflows follow price rather than lead it. If Bitcoin rallies first, allocators may respond by adding exposure after the move. In those cases, Bitcoin ETF inflows can confirm strength rather than predict it. Additionally, certain strategies can create inflow spikes that later reverse. That’s why it’s important to watch multi-day patterns, not just one number.

A better way to read inflows

Instead of treating inflows as a prediction tool, treat them as a regime indicator. Rising Bitcoin ETF inflows can imply improving institutional appetite for digital asset investment. Falling inflows can suggest caution or profit-taking. The direction and persistence matter more than the absolute daily figure.

How Institutions Use Spot Bitcoin ETFs in Real Portfolios

To understand “institutions resume accumulation,” it helps to see the practical ways these products are used.

Wealth managers and advisory platforms

Many advisors prefer ETFs because they fit neatly into client accounts. Allocations can be small on a per-client basis but massive in aggregate. When Bitcoin ETF inflows climb sharply, it can reflect broad adoption across many accounts, not just a few large players.

Asset managers and multi-asset portfolios

Some managers treat Bitcoin as a small allocation designed to improve portfolio convexity—meaning it may offer a different return profile than traditional assets. In that framework, rising Bitcoin ETF inflows can reflect rebalancing into a diversifying sleeve or an alternative growth component.

Hedge funds and tactical positioning

Some institutional players operate tactically, increasing exposure during strong trends and hedging when risk rises. Even if their motivations differ from long-term believers, their activity can still drive Bitcoin ETF inflows and affect market dynamics.

What to Watch After a $844M Bitcoin ETF Inflow Day

If you want to interpret the signal properly, focus on what happens next.

Follow-through over the next several sessions

Sustained Bitcoin ETF inflows over multiple sessions is more important than a single day. If flows remain strong, it suggests ongoing accumulation. If flows revert quickly, it may have been a short-lived burst tied to a specific catalyst.

Price behavior: holding gains vs. quick reversal

Watch whether Bitcoin consolidates above key levels or gives back the move. Strong Bitcoin ETF inflows paired with stable price action can indicate demand is absorbing supply. A sharp reversal can indicate that sellers used the inflow-driven strength to exit.

Market tone: volatility, leverage, and sentiment

Institutional allocation tends to prefer calmer conditions. If volatility spikes or leverage builds too quickly, inflows may slow. If conditions remain orderly, Bitcoin ETF inflows can continue, reinforcing the accumulation narrative.

Conclusion

A $844 million single-day surge in Bitcoin ETF inflows is not just a flashy statistic—it’s a meaningful sign that institutional channels into Bitcoin remain active and can scale quickly when conditions align. It supports the idea that institutions may be resuming accumulation, using spot Bitcoin ETFs as the preferred bridge between traditional finance and crypto exposure.

Still, the smartest interpretation is balanced. One day can shift sentiment, but sustained flows confirm a true trend. If Bitcoin ETF inflows stay elevated and price action remains constructive, the market may be entering a stronger demand regime driven by institutional accumulation and maturing digital asset investment infrastructure. If inflows fade, the day remains important as a reminder: institutional capital is watching closely—and when it moves, it can move fast.

FAQs

Q: What are Bitcoin ETF inflows in simple terms?

Bitcoin ETF inflows are the net amount of money entering Bitcoin ETFs over a period. Positive inflows mean more investors added exposure than removed it, signaling net demand through ETF products.

Q: Why does a $844 million inflow day matter?

A $844 million day matters because it implies large-scale participation and renewed confidence in ETF-based Bitcoin exposure. It often suggests institutional-sized allocation rather than small retail activity.

Q: Do Bitcoin ETF inflows directly push Bitcoin’s price up?

They can support price by adding demand, but they don’t guarantee immediate upside. Price also depends on broader risk sentiment, selling pressure, volatility, and market positioning.

Q: Is “institutions resume accumulation” always bullish?

Not automatically. Institutional accumulation can be long-term and supportive, but some institutions act tactically. The most bullish signal is persistent Bitcoin ETF inflows combined with stable price action and healthy market structure.

Q: What should I watch next to confirm the trend?

Look for continued Bitcoin ETF inflows over several sessions, improving breadth across funds, and Bitcoin holding key levels without sharp reversals. Persistence and follow-through are stronger indicators than a single day’s headline.

Also More: Strategy Adds 13,627 Bitcoin Elliott Wave Stalemate