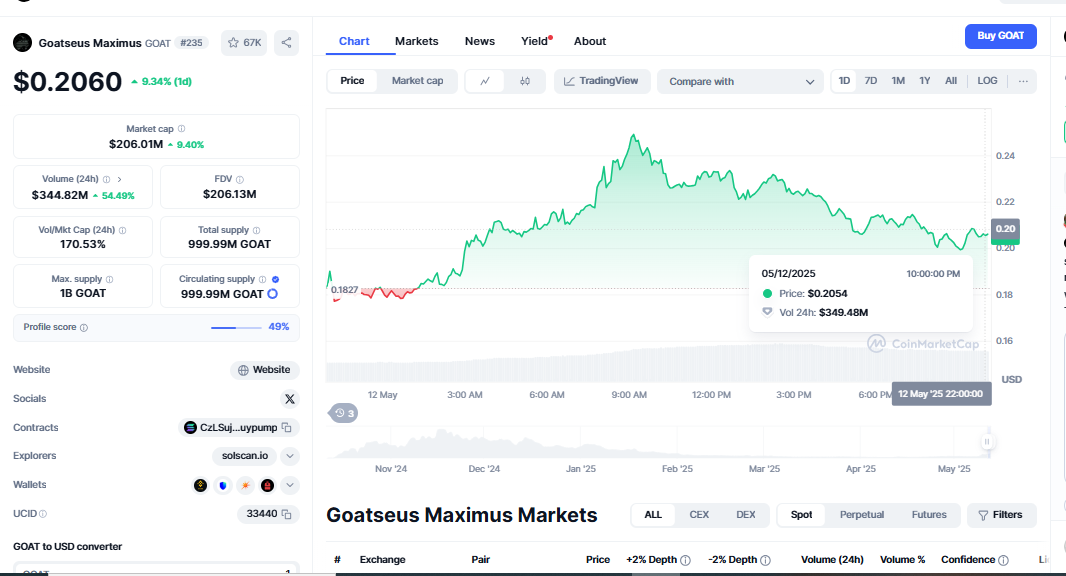

Rising to $0.2325 following both its 7-day and 50-day moving averages, $GOAT has lately shown a notable positive movement. Traders who are monitoring for a continuation of the trend have been paying close attention to this technical breakthrough because it indicates greater market confidence. $GOAT breakout prediction: The asset’s capacity to remain above these important averages points to increasing momentum and the possibility of more gains in the future.

Reflecting a point at which buyers once stepped in with conviction, the recent low near $0.1406 has become a noteworthy support level. Investors evaluating downside risk rely mostly on this basis. Conversely, resistance is evident near the $0.2503 level at the opposite end of the spectrum. As a psychological barrier, this upper limit has begun to prevent sellers from applying downward pressure. The shrinking distance between the current price and this resistance emphasizes the likelihood of a significant movement, through a retreat or a breakout.

Opposition at $0.2503 Might Be a Turning Point.

The price of $GOAT is nearing the $0.2503 level, indicating a significant shift. In the past, similar formations in fast-moving cryptocurrencies have foreshadowed abrupt directional changes. Pi Network Price Surges, A confirmed breakout above this level would imply fresh optimistic strength and could spur momentum-driven purchases. Such an action would probably put $GOAT into price discovery mode, with low overhead to restrict near-term upside potential.

On the other hand, the inability to overcome this resistance may point to fatigue in the current trend. A pullback is probable and healthy from a technical standpoint, considering the sharp increase over the past several days. This would let $GOAT to reset overbought circumstances, consolidate recent gains, and maybe be ready for another move higher. Therefore, traders should not be surprised if the price declines slightly to test lower support levels before any significant upward movement resumes.

Points of Market Behaviour Suggest Overbought Territory

Although this study does not provide the Relative Strength Index (RSI), the aggressive character of the price rise clearly implies that $GOAT is almost overbought. Under such a situation, traders usually expect more volatility as buyers and sellers fight for temporary control. Though they typically indicate a slowing upward momentum or a stop in trend continuance, overbought indications do not always indicate an impending crash.

Interpreting the next actions also depends much on volume. A breakout would be credible if sustained strong volume combined with a movement above resistance suggested institutional investors or significant traders joining the market. Conversely, a breakout effort on low volume could produce a misleading signal and then cause a strong pullback, trapping late arrivals. Monitoring volume dynamics is thus as crucial as observing pricing levels.

Support Zones Offer Traders’ Safety Nets

Should there be a downturn, the first region of interest will be the support zone centred at $0.2000. This level may provide temporary support, stabilising the price before attempting to rise again. Should the downturn extend, the past low of $0.1406 will be more important as an anchor point. $GOAT breakout prediction, Historically, this area drew significant purchase activity, likely the zone for new accumulation.

Waiting for a retreat to one of these support zones could offer a less risky starting place for those wishing to join the market. Conversely, long-term holders can see any decline as a buying chance if the more general positive trend is unbroken.

Keep Shape Price Action in progress.

The performance of $GOAT is not a result of random events. Driven by macroeconomic signals and changes in Bitcoin, the overall crypto market mood will surely affect the short-term behaviour of the asset. Should Bitcoin keep on its ascent, altcoins like $GOAT might gain from more liquidity and investor confidence. On the other hand, a fall in more general market indicators can curtail gains or hasten losses.

Altcoin cycles are also important. During positive times, capital moves from Bitcoin to highly prospective cryptocurrencies. Should $GOAT keep outperforming in the coming days, it could indicate the start of a more robust trend on such assets. Monitoring the relative strength of Ethereum and Bitcoin can help one understand the probability of further increases for $GOAT.

Traders should give strategy top importance.

Under these circumstances, controlling risk takes equal weight as spotting opportunities. Traders carrying $GOAT should think about taking a partial profit near resistance at $0.2503 if momentum wanes. The smarter option for prospective purchasers could be to wait for confirmation of a breakthrough or a pullback toward support instead of following the present surge.

Stop-loss levels, set according to volatility and risk tolerance, are key to avoiding needless losses. KAITO Bull Flag Breakout, Sharp price swings may result in sharp reversals; therefore, traders ready for both situations can remain objective in rapidly changing surroundings.

In essence, eyes are on the pullback or breakthrough.

Currently trading in a limited range between verified support and growing opposition is $GOAT. It’s above important moving averages, and a consistent rising trend points to positive intention. Still, uncertainty is introduced by the proximity to overbought conditions and an increasing resistance. Whether a breakout or a retracement, the next calculated action will probably determine the asset’s short-term course.

Traders should keep educated, monitor market events constantly, and make trades depending on confirmation rather than guesswork. $GOAT breakout prediction, The narrative of $GOAT in the coming days might act as a textbook case study of technical breakout or trend exhaustion.