US Bitcoin ETFs marked a defining moment in the evolution of the crypto market. For the first time, traditional investors could gain direct exposure to Bitcoin through a regulated, exchange-traded structure without dealing with wallets, custody risks, or on-chain complexity. This innovation was widely celebrated as a bridge between Wall Street and digital assets. However, markets are rarely one-directional. The recent headline that US Bitcoin ETFs bleed $1.72B in a five-day outflow streak highlights the other side of institutional participation: capital can exit just as quickly as it enters.

This five-day stretch of sustained withdrawals has reignited debate around institutional confidence, Bitcoin’s role in diversified portfolios, and the sensitivity of crypto assets to macroeconomic conditions. While the figure itself is striking, the deeper story lies in what these outflows represent. They are not simply a rejection of Bitcoin as an asset, but rather a reflection of shifting risk sentiment, changing liquidity conditions, and evolving strategies among professional investors.

In this in-depth analysis, we will explore why US Bitcoin ETFs experienced such significant outflows, how these redemptions affect Bitcoin’s price and market psychology, and what investors should watch next. By examining the mechanics, motivations, and broader implications, readers can better understand why ETF flow data matters—and how to interpret it without falling into short-term panic.

Understanding the scale of the five-day outflow streak

When headlines say US Bitcoin ETFs bleed $1.72B, the number alone can sound alarming. But scale needs context. ETF flows are cumulative reflections of investor behavior across multiple trading sessions. A single day of outflows might be dismissed as noise, but a five-day streak signals a more deliberate shift in positioning.

In practical terms, these outflows indicate that more investors redeemed ETF shares than created new ones over the period. This suggests sustained selling pressure rather than isolated profit-taking. For spot Bitcoin ETFs, which hold Bitcoin directly, redemptions can translate into underlying Bitcoin being sold or transferred, depending on how authorized participants manage the process.

It is also important to recognize that ETF flow data aggregates behavior from a wide range of participants. These include long-term asset managers, hedge funds, proprietary trading desks, and even short-term speculators. Each group reacts differently to market signals. When multiple sessions show net outflows, it often means several types of investors are reducing exposure at the same time, amplifying the effect.

Why consecutive outflows matter more than daily fluctuations

Markets routinely digest large numbers. What elevates this event is the consistency of redemptions across consecutive days. A streak implies conviction, not coincidence. For US Bitcoin ETFs, this pattern suggests that buyers were either unwilling or unable to absorb selling pressure during that period.

Consecutive outflows can influence sentiment well beyond the ETF market itself. Traders often view ETF flows as a proxy for institutional demand. When that proxy turns negative for several days in a row, it can dampen confidence and reduce speculative appetite elsewhere in the crypto ecosystem.

Key drivers behind US Bitcoin ETFs outflows

Large outflows rarely stem from a single cause. Instead, they tend to emerge when several pressures converge. In the case of US Bitcoin ETFs, the $1.72B five-day outflow streak reflects a combination of macroeconomic uncertainty, strategic repositioning, and market volatility.

Macro uncertainty and shifting risk appetite

Bitcoin has increasingly behaved like a macro-sensitive asset. While it still retains unique characteristics, it no longer exists in isolation from global financial conditions. Changes in interest rate expectations, inflation data, and economic growth outlooks can all influence investor behavior.

When markets move into a risk-off mode, capital often flows out of volatile assets and into safer alternatives such as cash or government bonds. During such periods, US Bitcoin ETFs can become a convenient vehicle for reducing crypto exposure quickly. Selling ETF shares is operationally simple compared to unwinding direct on-chain positions, making them a preferred exit route during uncertainty.

Hedge fund strategies and tactical positioning

Not all ETF investors are long-term believers. A significant portion of institutional activity in US Bitcoin ETFs comes from hedge funds employing tactical or relative-value strategies. These can include arbitrage between spot and futures markets or short-term positioning based on volatility expectations.

When the profitability of these strategies declines—due to shrinking spreads or rising hedging costs—funds may unwind positions rapidly. This can result in sharp ETF outflows that are more mechanical than emotional. To outside observers, such selling can look like a loss of confidence, even if it is simply a rational adjustment to changing market conditions.

Bitcoin price action and volatility spikes

Price behavior plays a critical role in ETF flows. Sudden drawdowns or increased volatility can trigger risk management protocols within institutional portfolios. Many managers operate under strict volatility or drawdown limits. When those thresholds are breached, exposure must be reduced regardless of long-term outlook.

In such scenarios, US Bitcoin ETFs often bear the brunt of de-risking because they are liquid and easily tradable. This dynamic can create a feedback loop where falling prices lead to outflows, which in turn weigh further on sentiment.

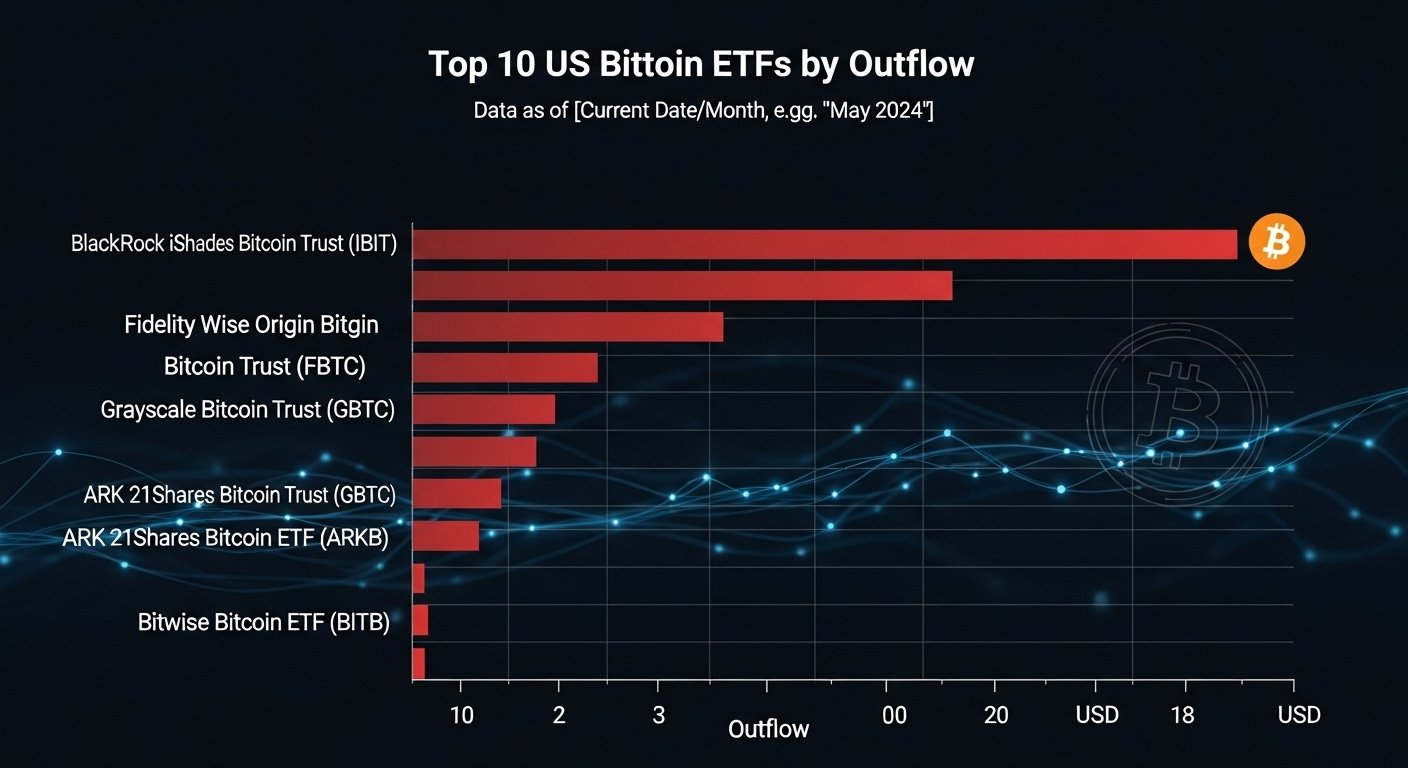

Which US Bitcoin ETFs are most affected during outflows

Although headlines often treat US Bitcoin ETFs as a single category, not all funds experience outflows equally. The distribution of redemptions can provide insight into investor behavior.

Large, high-liquidity ETFs tend to see the biggest absolute outflows during selloffs. This does not necessarily mean investors prefer smaller funds; rather, they are exiting positions where liquidity is deepest. These flagship products often serve as the primary gateway for institutional exposure, so they naturally reflect broader market moves.

At the same time, smaller ETFs may show relatively stable flows simply because they are less actively traded. This can create a misleading impression that investors are rotating between products when, in reality, they are reducing exposure across the board.

Rotation versus category-wide exits

One key question during any outflow streak is whether investors are rotating within the ETF ecosystem or exiting entirely. If outflows in one fund are matched by inflows in another, it suggests preference shifts. But when multiple US Bitcoin ETFs show redemptions simultaneously, it indicates a category-wide reduction.

The recent five-day streak appears to align more with broad-based selling rather than selective rotation. This reinforces the idea that macro and volatility factors, rather than issuer-specific concerns, are driving behavior.

Impact of ETF outflows on Bitcoin’s price

The relationship between US Bitcoin ETFs flows and Bitcoin’s spot price is complex. While ETF outflows do not automatically dictate price direction, they can influence market dynamics through both liquidity and psychology.

Liquidity effects and spot market pressure

When ETF shares are redeemed, authorized participants may sell Bitcoin to balance their positions. Over several days, this process can add incremental selling pressure to the spot market. While Bitcoin’s global liquidity is substantial, sustained ETF-related selling can still affect short-term price action, particularly during periods of low overall demand.

However, it is important to note that Bitcoin trades around the clock across multiple venues worldwide. ETF flows represent only one segment of the market. Their influence is meaningful but not absolute.

Sentiment and narrative influence

Perhaps more powerful than direct selling is the narrative impact of outflows. Headlines emphasizing that US Bitcoin ETFs bleed $1.72B can shape investor psychology. Retail traders and smaller institutions may interpret such news as a signal that “smart money” is exiting, prompting them to hesitate or sell as well.

This narrative effect can temporarily outweigh fundamentals, especially in sentiment-driven markets like crypto. Conversely, when ETF flows turn positive again, confidence can return quickly, underscoring how perception-driven these dynamics can be.

What investors should watch going forward

Understanding ETF outflows is not about reacting emotionally to headlines. It is about identifying whether conditions that caused the selling are likely to persist or reverse.

Monitoring macro signals and financial conditions

Investors should pay close attention to interest rate expectations, inflation trends, and broader financial conditions. If uncertainty eases and risk appetite improves, US Bitcoin ETFs could see inflows resume just as quickly as they declined.

Observing volatility trends and market structure

Stabilizing volatility often precedes renewed interest. If Bitcoin enters a lower-volatility trading range and holds key technical levels, it may encourage sidelined capital to re-enter through ETFs.

Distinguishing short-term noise from long-term adoption

Short-term outflows do not negate the structural importance of spot Bitcoin ETFs. The infrastructure remains in place, and the investor base continues to expand over time. Periodic drawdowns and flow reversals are a normal part of market maturation.

Long-term significance of US Bitcoin ETFs despite outflows

While the five-day outflow streak is notable, it does not undermine the long-term case for US Bitcoin ETFs. These products have fundamentally changed how Bitcoin fits into traditional portfolios.

They have lowered barriers to entry, improved transparency, and integrated Bitcoin into the same frameworks used for equities and bonds. Over time, this integration is likely to increase resilience, even if short-term flows remain volatile.

As with any emerging asset class, adoption is not linear. Periods of enthusiasm are followed by consolidation and reassessment. The current outflows may represent such a phase rather than a turning point.

Conclusion

The headline “US Bitcoin ETFs bleed $1.72B in five-day outflow streak” captures attention because it reflects a sharp shift in short-term sentiment. Yet beneath the surface, these outflows are best understood as a response to macro uncertainty, volatility, and tactical repositioning rather than a wholesale rejection of Bitcoin.

ETF flow data is a valuable lens into institutional behavior, but it should be interpreted alongside broader market indicators. As conditions evolve, US Bitcoin ETFs may just as easily see renewed inflows, reminding investors that capital in modern markets is highly dynamic.

For long-term observers, the existence and continued use of Bitcoin ETFs remain a milestone. Short-term bleeding does not erase their role—it simply highlights the reality that Bitcoin, like all risk assets, moves in cycles.

FAQs

Q: Why did US Bitcoin ETFs experience such large outflows in five days?

The outflows were driven by a mix of macro uncertainty, rising volatility, and institutional repositioning. Many investors reduced risk exposure rather than abandoning Bitcoin altogether.

Q: Do ETF outflows mean Bitcoin is losing institutional support?

No. Outflows often reflect short-term strategy changes. Institutions may re-enter once market conditions stabilize or become more favorable.

Q: Can US Bitcoin ETFs outflows directly cause Bitcoin prices to fall?

They can contribute to short-term pressure, but Bitcoin’s price is influenced by global liquidity, derivatives markets, and broader sentiment, not ETF flows alone.

Q: Are these outflows unusual for a new asset class?

Volatility in flows is common for newly integrated assets. As spot Bitcoin ETFs mature, such swings may become less dramatic over time.

Q: Should long-term investors be concerned about ETF outflows?

Long-term investors should focus on fundamentals and adoption trends. Short-term ETF outflows are part of normal market cycles and do not necessarily change the long-term outlook.

Also More: Bitcoin ETF Inflows Hit $844M in One Day