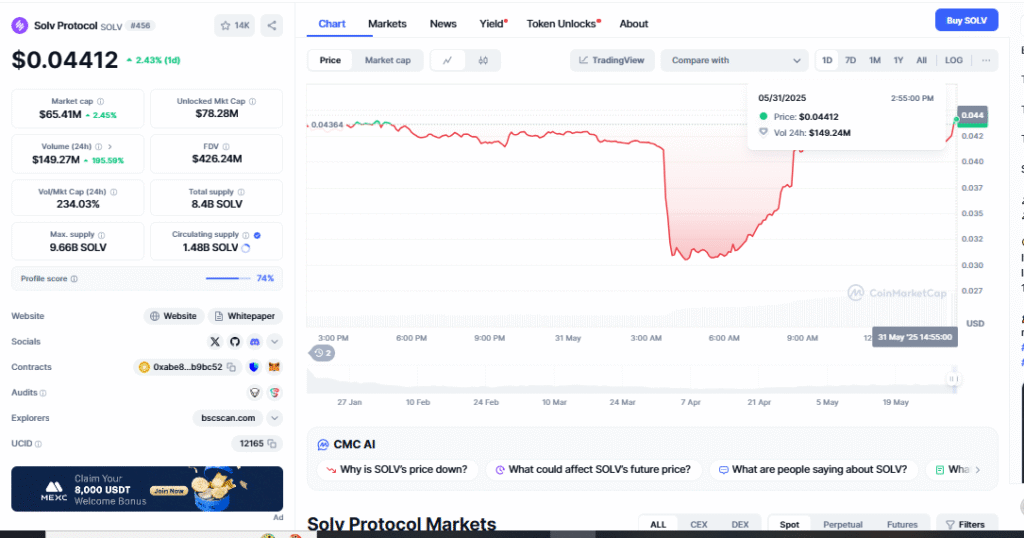

The market for cryptocurrencies is sometimes volatile, and $SOLV has lately shown a perfect V-shaped rebound. Reaching higher levels with little indication of weakness, the token made a wonderful recovery after falling to the $0.028 price zone. $SOLV price analysis, Currently, the asset is trading at $0.04251, which is 0.33% higher, and exhibits indications of consolidation just under a critical resistance point. Investors and traders are now attentively watching to see if this configuration can trigger a fresh breakout and short-term new highs.

V-Shaped Healing and Positive Velocity

There is a noteworthy V-shaped pattern in the price movement of $SOLV. Often seen in assets oversold and subsequently rapidly purchased by investors expecting value, it shows a strong comeback following an equally sharp downturn. Typically, this kind of rebound suggests that market players are confident in the technical catalysts or underlying fundamentals of the asset. ZKJ Token Staking, In the case of $SOLV, the rapid upward movement from $0.028 to the $0.044 mark was carried out with few pullbacks, implying consistent purchasing activity and strong bullish intention.

Although V-shaped recoveries are occasionally ephemeral, the absence of strong declines during $SOLV’s climb supports the notion that the present market mood stays favourable. Now stabilizing close to the $0.044 resistance level, the price is creating a brief phase of consolidation. Often, this pattern is viewed as a beneficial pause, allowing momentum to recharge before the next upward leg.

Entry Zone, Price Targets, Risk Management

From a technical standpoint, the perfect entrance zone falls between $0.04200 and $0.04250. Considered suitable for traders seeking to join with less downside risk, this range exhibits a modest support basis established following the V-shaped recovery. Slightly below the lower limit of the consolidation zone, the stop-loss level is set at $0.04000. This level has often been a logical invalidation point and a source of support should the trade thesis fall apart.

Phases of specified price goals help to control risk and maximise income. The first objective at $0.04400 represents the instantaneous barrier of resistance. A successful breakout above this barrier would result in a secondary target near $0.04650, where the price has recently stalled. Should upward momentum persist, the ultimate goal for this configuration rests close to $0.04900, approaching the psychological $0.05 mark. These objectives fit previous resistance zones and Fibonacci extensions.

Volume’s and Confirmation Signals’ Significance

Any prospective breakout is validated in great part by volume. The action must be accompanied by a notable rise in trading volume for $SOLV to surpass the $0.044 resistance with confidence. On the 1-hour chart, a close above this level would lend weight to the breakout scenario. Such validation guarantees that the movement is not the outcome of temporary manipulation or a fake breakout.

The ideal scenario would be a strong bullish candle with a clear closing above $0.044, followed by sustained trading above $0.046. Momentum traders would seek to augment their positions by targeting the upper resistance zones. Furthermore, it is crucial to track how the price responds to any retests of past resistance, as successful retests typically indicate the strength of the movement.

Greater Context and Market Opinion

The current comeback in $SOLV aligns with the generally positive shift in the altcoin market. Lower-cap tokens like $SOLV are attracting fresh interest from traders seeking more upside even as Bitcoin and Ethereum are consolidating. Common during times of market stabilisation, when investors search for more aggressive returns, is this capital rotation. Tokens with clear technical setups often see fast inflows.

Furthermore, crucial is the reflection of rising awareness of $SOLV in sentiment throughout crypto social media, trading forums, and analytics systems. Often acting as a self-reinforcing trigger, a positive mood motivates additional involvement and advances momentum-driven demonstrations.

$SOLV: Rejecting or Breaking Out?

Whether $SOLV can maintain this increasing trend depends mainly on the next few hours. Supported by past momentum and technical strength, a confirmed breakout above the $0.044 resistance level will likely trigger the continuation of the rise. Conversely, failing to overcome this resistance can cause a retreat toward the $0.04000 support zone, therefore testing the bulls’ will.

The secret to traders’ constant observation of activity is to stay responsive instead of predictive. Reacting to price structure, volume confirmation, and candle closes on shorter timeframes, such as the 1-hour chart, will provide the best insight into near-term direction. Currently one of the most interesting short-term setups in the altcoin industry, $SOLV offers a well-defined structure, great momentum, and rising market attention.

Summary

Considering all factors, $SOLV’s remarkable recovery from its lows has set it up for a potential breakthrough. A strong bullish structure and busy volume zones, combined with the current consolidation below the resistance point, suggest that the token may be preparing for another run higher. Traders should be orderly, observe technical indicators, and manage risk accordingly. POKT Surges 620%, Confirmation is absolutely crucial as always in fast-moving markets. Let the chart dictate the trading. Should momentum keep, $SOLV may soon recover its past highs and venture into unexplored area.